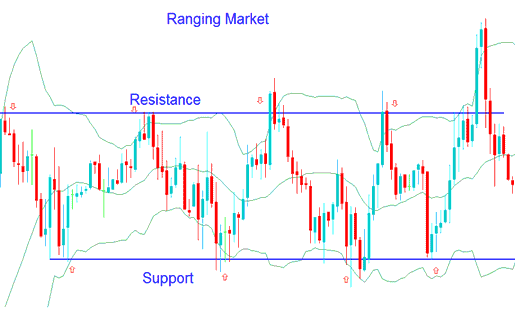

Bollinger Bands Gold Price Action in Ranging Trading Markets

The Bollinger Bands Gold Indicator is utilized to pinpoint times when a market trend may be overextended. Below are the guidelines to consider when using this indicator in a sideways trend.

The Bollinger Bands indicator applied to Gold is significant as it frequently signals the potential for an impending price breakout event.

These analytical methods lose their validity during periods dominated by trends: they are only reliable as long as the Bollinger Bands maintain a horizontal orientation.

- If the price tests/touches the upper band it can be considered overextended on the upside - overbought.

- If the price tests/touches the lower band the price can be considered overextended on the bottom side - over-sold.

One of the uses of Bollinger Bands indicator is to use the above overbought and oversold trading guidelines to establish buy & sell targets during a ranging market.

- If gold trading price has bounced off the lower band crossed the center-line moving average then the upper band can be used a sell level.

- If gold trading price bounces downward off the upper band crosses below center moving average MA the lower band can be used as a buy level.

Trading Bollinger Bands in Range Bound Markets - Bollinger Bands Strategy

In a range-bound market, when the price hits the upper or lower bands, traders can use those moments to set profit targets for long or short trades.

When the market reaches the upper resistance area or the lower support level, trades may be initiated. In case price movement breaks out of the range inside these Bollinger bands, a stop loss order should be placed a few pips higher or lower, depending on the Gold trade that was initiated.

Examine More Topics & Courses:

- How Do I Read MetaTrader 4 Downward Gold Trendline in MT4 Platform Software?

- How Can I Open a Demo MT4 XAU/USD Account on MT4 Platform Software?

- Placing Arrows in Gold Charts in MT4 Platform Software

- What is TP XAU/USD Order on MT4 Software Platform?

- How to Open MetaTrader 4 Chart XAUUSD Tick Chart

- MT4 Charts Objects List on MetaTrader 4 Charts Menu

- XAUUSD Forum Trade XAU USD Forum