RSI Divergence Technical Indicator Analysis

Divergence concept is a concept where one will for a difference between the price movement with the movement of a indicator. For our example we shall use the RSI to illustrate divergence trading setups.

RSI is one of the often used divergence technical indicator. This indicator is an oscillator similar to the RSI & it can be used to trade divergence setup just the same way as RSI indicator.

RSI Analysis & RSI Signals

RSI Divergence Technical Indicator

RSI Divergence Technical Indicator

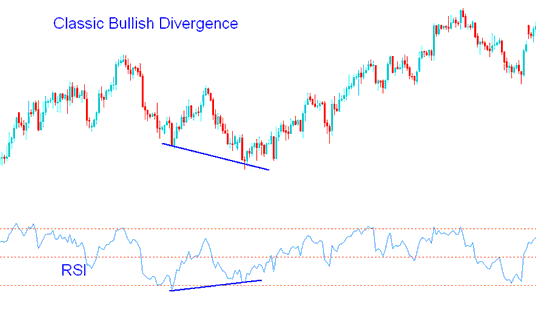

Classic RSI Bullish Divergence Trading Setup

RSI classic bullish divergence forms when the price is making/forming lower lows ( LL ), but RSI is forming/making higher lows (HL).

Gold Classic Bullish Divergence - RSI Divergence Meaning

RSI classic bullish divergence warns of possible shift in the trend from downward to upwards. This is because even though the price moved & headed higher lower the volume of sellers who moved price lower was less as displayed and illustrated by RSI technical indicator. This demonstrates under-lying weakness of the downwards trend.

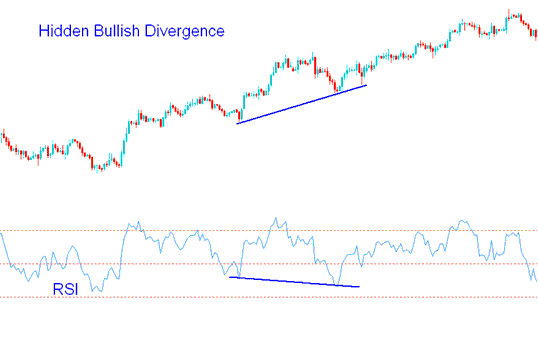

Hidden RSI Bullish Divergence Trading Setup

Forms when price is making/forming higher low ( HL ), but RSI is forming/making lower low (LL).

RSI hidden bullish divergence trade setup forms when there's a retracement in an up trend.

Gold Hidden Bullish Divergence - RSI Divergence Meaning

This set-up confirms that a retracement move is exhausted. This RSI divergence trade setup shows underlying power of an upwards trend.

RSI Divergence Technical Indicator

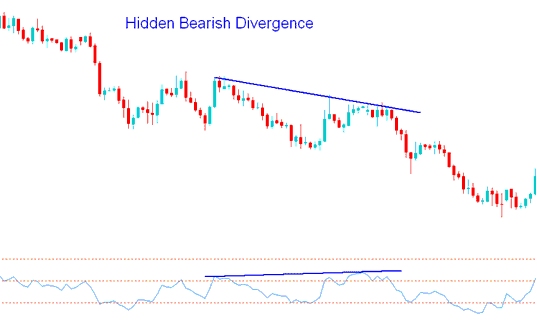

Hidden RSI Bearish Divergence Trade Setup

Occurs when the price is forming lower high ( LH ), but indicator is forming/making a higher high ( HH ).

Hidden bearish divergence trade setup forms when there is a retracement in a downward trend.

Gold Hidden Bearish Divergence - RSI Divergence Meaning

This set-up confirms that a market price retracement move is complete. This divergence shows the underlying momentum of a downwards trend.

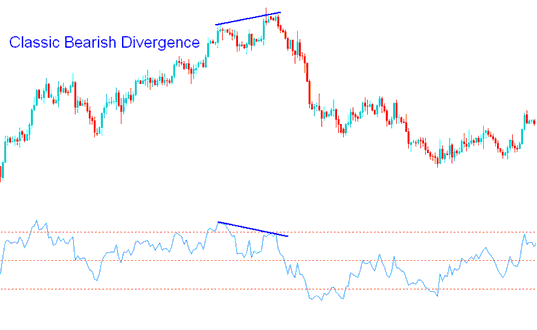

RSI Classic bearish Divergence Trade Setup

RSI classic bearish divergence occurs when the price is showing higher high ( HH ), but the RSI is making/forming lower high (LH).

Gold Classic Bearish Divergence - RSI Divergence Meaning

RSI Classic bearish divergence signals a possible shift in trend from upward to downward. This is because even though price moved & headed higher higher the volume of the buyers(bulls) who moved price higher was less just as displayed and illustrated by RSI technical indicator. This demonstrates under-lying weakness of the upwards trend.

Study More Courses:

- XAUUSD Indicators XAUUSD Strategy

- XAU/USD Key Concepts Described

- List of Beginner Trader Gold Methods for Gold Beginner Traders

- How to Set Average True Range XAUUSD Indicator on Chart in MetaTrader 4 Platform Software

- XAU/USD Long & Short

- XAUUSD Setup Effective XAUUSD Strategies

- Types of Gold Market Brokers