Trade Upward Trend Line Breaks with Double Top Patterns

Strategies Utilizing Double Tops Reversal Patterns Alongside Uptrend Reversal Indicators

Up Trend Reversal

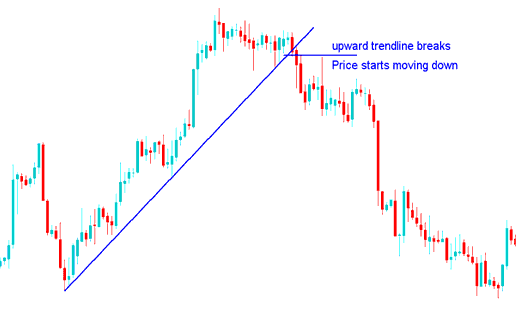

When the price breaks below the upward trend line (support), the market will subsequently decline.

How Does One Trade a Reversal of an Upward Trend? – A Strategy for Executing Trades During an Upward Trend Reversal

Upwards Trend Reversal Strategy

After price has moved in an up-ward direction for an extended period of time within a up trend it reaches a point where it stops moving within the upward trend. When this happens we say the up-wards trendline has been broken & this is interpreted and analyzed as a up trend reversal setup.

An upward trend line acts as support. A break in that support after an uptrend signals a shift. Prices should drop the other way. Traders see this as a reversal setup.

This specific reversal configuration can be effectively integrated with the double top reversal chart patterns detailed further down.

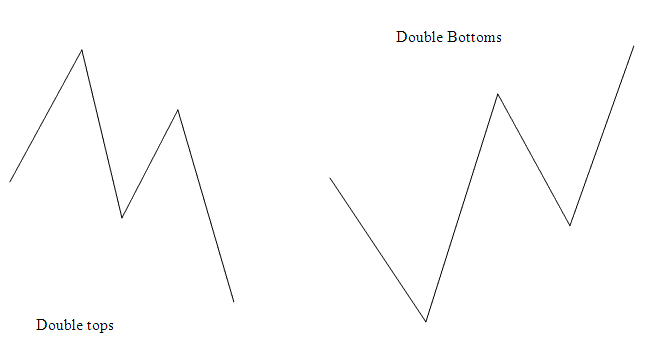

Pair Trendline Reversals with Double Top Patterns

A solid setup is to combine an upward trend reversal with double top patterns - check out the Double Top Reversal Chart Patterns Guide.

Double top reversal chart pattern setups should already be formed before the up trendline break signal. Because these double tops are also reversal setups, combining these two trend reversal setups gives traders a good chance of avoiding a whipsaw.

In the uptrend turnaround described above, these double tops turnaround setups can be verified as having been created even before the trend line turnaround signal showed up.

This shows an upward reversal example. The double tops pattern formed first. Then the uptrend line broke on the chart.

Combining Upward Trendline Reversal Signals with Double Tops Reversal Patterns

Study More Courses & Lessons:

- Analysis of XAUUSD Candlestick Patterns: Dark Cloud Cover Explained

- How to Trade Gold for a Day Using Pivot Points Levels & Reversal XAU/USD Alerts

- Steps for Putting Fibonacci Expansion Lines Directly on the MT5 Platform Screen

- How to Position the Choppiness Index Trade Indicator on Your Trading Chart

- How do you analyze Japanese candlestick charts and patterns?

- Lesson on Using Gold Software in MetaTrader 4

- What's Bid Ask XAU USD Price in XAUUSD Trading?

- Steps to Modify an Existing Take Profit (TP) Order for XAU USD within the MetaTrader 5 Environment

- Process for Opening a Live Gold Trading Account on the MetaTrader 4 Software