Gold Trend Indicators

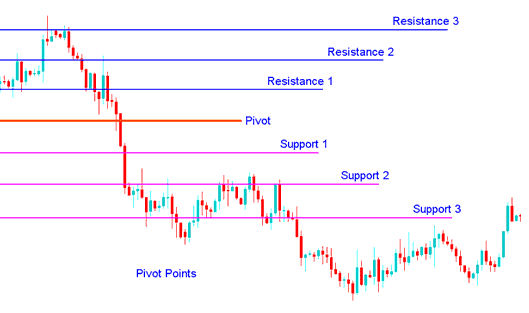

Traders use pivot points to spot support and resistance from the prior day's prices.

This indicator is an effective tool that uses the highs, lows, and closings of previous bars to project future support and resistance zones.

This indicator provides an idea of where the key support and resistance should be. Place the pivot points on your charts & the price will bounce-off of one of these levels. These levels are used by Gold traders to determine market the tops, market bottoms or trend reversals.

- Daily pivot points levels are calculated from the previous day's high, low, close

This indicator is displayed & shown below

Analysis in XAUUSD Trading

The central pivot point serves as the main level for determining market trends.

The other support and resistance zones are also important in calculating levels that can generate substantial market movements.

This technical indicator can be used in 2 ways

The first way is for determining the general trend: if the pivot point is broken in an upwards movement, then the market is bullish, and vice versa. However, pivot levels are short term trend indicators, helpful only for one day until they need to be recalculated.

The second strategy involves using these points to determine market entry and exit. This indicator acts as a beneficial tool for identifying levels likely to influence price changes.

Use these pivot points with other ways to study the market, such as Moving averages, MACD, and the stochastic oscillator trading indicator.

This indicator can be utilized in many various ways. Here are a couple of the most common methods for utilizing them.

Gold Trend Identification: By integrating this analysis with other technical tools, such as oscillators that measure overbought/oversold conditions and volatility gauges, the central pivot point can serve as a valuable reference for discerning the overarching directional bias of the price movement. Trade entries should exclusively be aligned with the prevailing market trend. A buy signal is generated solely when the market price is situated above the central pivot reference points, whereas a sell signal is confirmed only when the market price is located beneath these pivot reference points.

Gold Price Breakouts: You get a bullish signal when price pushes up through the center pivot or one of the resistance zones (usually Resistance Zone 1). A bearish signal comes when price breaks down through the center or a support level (often Support Zone 1).

XAU/USD Trend Reversals:

- A buy signal forms when price moves toward a support level, gets very near to this point, touches this point, or only moves slightly/a little through this level, and then reverses and heads back in the opposite trend market direction.

- A sell signal forms when price moves toward a resistance level, gets very near to this point, touches this point, or only moves slightly/a little through this level, and then reverses and moves back in the opposite market trend market direction.

Stop Loss and/or Limit Profit Values Based on Support/Resistance: This indicator could help you decide where to put stoploss orders and/or limit profit orders. For example, if you're trading a long breakout above Resistance 1, it might make sense to set a stoploss order.

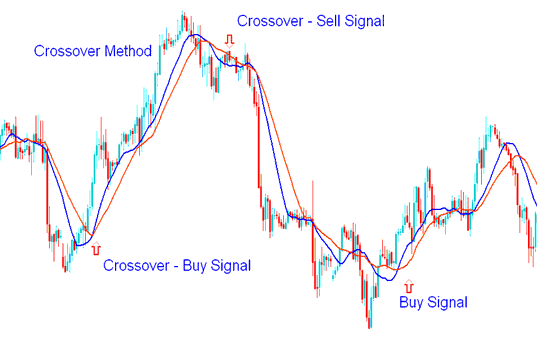

Combining with MA Moving Average Cross Over System

A good tool to pair with reversal signals is the MA crossover. It helps confirm the direction of a reversal.

An investor may then place an order once both indicators generate a signal aligning with the same market direction.

MA Cross over Method and Technique

MA crossover approach pairs well with this tool to build a trading setup that creates buy and sell alerts.

To download this Pivot points Indicator:

https://c.mql5.com/21/9/pro4x_pivot_lines.mq4

After downloading the indicator, open it in MQL4 editor. Hit compile, and it joins your MT4 tools.

Note: Upon adding the indicator to your Meta Trader 4, the trading indicator gains supplementary lines labeled 'Mid Points'. To eliminate these extraneous lines, access the MQL4 Language MetaEditor (use the shortcut F4) and modify line 16 from its current setting to:

Extern bool mid-pivot = true:

To

Extern bool midpivot = false:

Subsequently, click Compile once more, and the technical indicator will then be visible and displayed exactly as it appears on this website.

Get More Guides & Tutorials:

- Software for Gold Trading

- What is the Way to Understand the Ehler MESA Adaptive MA Indicator to Know When to Buy and Sell a Forex Signal?

- Lessons in Gold Trading

- Gold MA Strategy and Gold Indicator Analysis

- Understanding Gold Chart Patterns

- MT4 Platform for Beginners: How to Use It

- Understanding How to Read MetaTrader 4 Trend lines and Channels on MT4 Charts