How Do I Analyze Retracement Trading Indicator Strategy?

How Do I Read Retracement Indicator Strategy?

A good price retracement strategy to use is the fibonacci retracement trading indicator. Fibo retracement indicator is used by many traders as a price retracement strategy trading indicator tool.

The fibonacci retracement indicator is placed on a chart and this Fibonacci Retracement indicator then calculates the price pull-back areas on the trading charts.

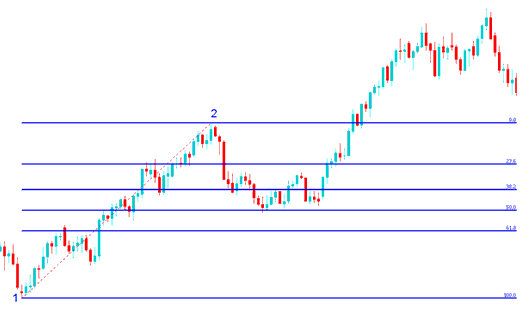

Fibonacci Retracement Method Examples on Upward Trend & Downwards Trend

Gold Retracement Method

In the Retracement Method trading example shown & described below the price is moving up between chart point 1 & chart point 2 then after chart point 2 it retraces down to 50.0% xauusd price retracement level then price continues moving up in the original upwards trend. Note that this price retracement indicator is drawn from point 1 to point 2 in the direction of the trend (Upwards Direction).

Because we recognize that this is just a retracement depending on our chart trend - using this retracement indicator, we put a buy order just between the levels 38.2% and 50.0% and our stoploss just below 61.8 percentage% pull back mark. If you had put a buy at this point in the trade example illustrated and explained below you would have made a lot of pips after the price retracement reached the Fibonacci 50.0% level and then continued moving in the original upward trend.

How Do I Trade Price Retracement on Upwards Trend - Retracement Strategy Method

Explanation for the Above Retracement Strategy Example

Once the price hit the 50.0% xauusd price pull back level, this price retracement level provided a lot of support for the price, & afterwards market then resumed the original upwards trend & continued to move upwards.

23.6% xauusd price retracement level provides minimum support and is not an ideal place to place a trade order.

38.2% xauusd price retracement level provides some support but price in this trading example continued to retrace up to the 50% zone.

50.0% xauusd price retracement level provides a lot of support and in this trading example, this was the ideal place to put a buy xauusd trade order.

For this Retracement Method trading example, the price retracement reached the 50.00% xauusd price pull back level, but most of the time the market will retrace up to 38.2 % xauusd price retracement level and therefore most of the time traders set their buy limit orders at the 38.2% Fibonacci price pull back level, while at the same time placing a stop just below 61.8% Fibonacci price pull back area.

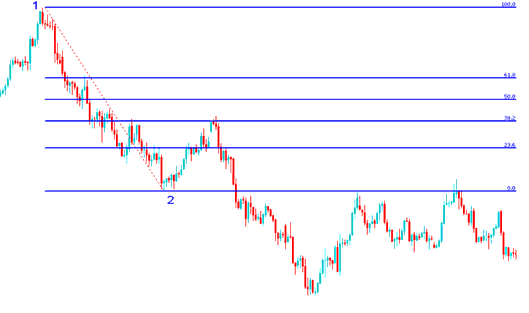

Retracement Method

In the Retracement Gold Strategy xauusd trading example shown & described below the market is moving down-wards between chart point 1 and chart point 2, then after chart point 2 the price then retraces up to 38.2 % xauusd price retracement level then it continues moving downwards in the original downward trend. Note that this price retracement indicator is drawn from chart point 1 to chart point 2 in direction of the trend (Downward Direction).

Because we know this is just a price pull-back depending on the trading chart trend we put a sell order at 38.2% xauusd price retracement level and a stop loss just above 61.8% xauusd price retracement region.

If you had put sell order at the 38.2% xauusd price retracement level as shown on the trade below you would have made a lot of gold pips afterwards after the price reached the 38.2% xauusd price retracement level and then resumed the downward trend.

In this trade the price pull back of price reached 38.2% xauusd price retracement level and did not get to 50.00% xauusd price retracement level. It is always good to use 38.2% xauusd price retracement level because most times the price retracement does not always get to 50.0 % xauusd price pull back area.

Gold Trade Retracement on Downward Trend - Retracement Method

Explanation for the Above Retracement Method Example

The above Retracement Method trading example is a price retracement trading set up where the price retraces immediately after touching the 38.20% Chart Fibo Retracement Level.

This Retracement level provided lots of resistance for the price pull-back, this was the best place for a trader to set a sell limit order as a market quickly went down after hitting this price pull back area.

How Do You Interpret Retracement Trading Indicator Strategy Method?

Study More Courses and Lessons: