How to Use Limit Orders: Buy Limit Order vs Sell Limit Order

Limit order meaning - An entry limit order is an instruction to buy or sell gold at a specific price where the price is predicted to fall back to before continuing its original path. Traders use limit orders to buy or sell at a more favorable price. Buy Limit Order vs Sell Limit Order - These kinds of orders are found on most online trading sites: for our examples, we'll use MT4 software.

Buy Limit vs Sell Limit Orders: These entry order types enable traders to buy below current market levels during an upward retracement or sell above current market levels during a downward retracement.

Buy limit - When buying, your entry buy limit pending order is executed/opened when the price drops to your set price. (retraces down) - buy limit order below market price

Sell limit - When selling, your sell limit order is done when the price goes up to the price you set. (goes back up) - sell limit waiting above the current price

Traders usually place entry orders when they anticipate that the price will rebound after reaching a certain level.

- Buy Limit Order buy at a level below the ruling market level.

- Sell Limit Order sell at a level above current market level.

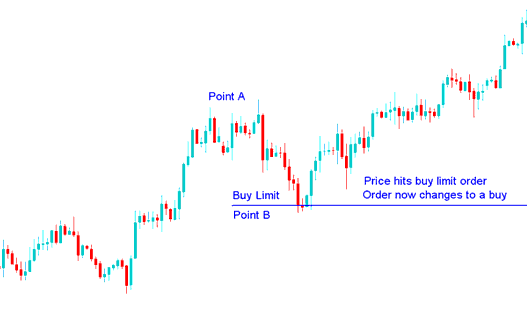

Buy Limit Order Example

The buy limit in the purchase limit order scenario shown and described below was established to initiate a buy at a price lower than the market price. It was placed at point B.

Buy Limit Order Illustration - Guidance on Utilizing Limit Buy Orders - An Example of a Limit Buy Order in Practice - The Limit Order Trading Approach

Subsequently, the price corrected and descended, triggering the buy limit order. Following this, the price resumed its upward trajectory in alignment with the initial uptrend. Once the price activated the limit buy order, it automatically converted into a standard buy order – detailing How to Use Limit Buy Orders.

Price Hits Buy Limit, Limit Buy Order Now Changes to a Buy - How to Use Buy Limit

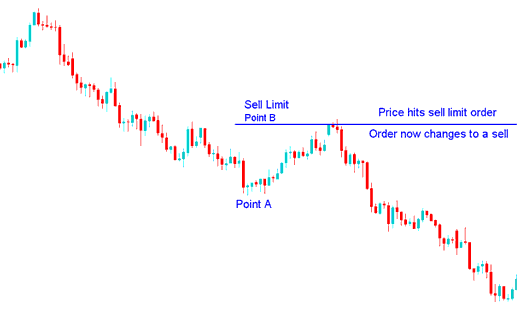

Sell LimitExample

In the example below, the sell limit order gets set above the current market price. That's the price level where you expect a retracement.

Sell Limit Order Example: How to Effectively Use Limit Sell Orders - Methodology for Placing a Limit Sell Order.

The price then rallied, moved up to hit the sell limit order, & afterward price continued to move downwards in the direction of the initial downward trend.

Execution of Sell Limit Order, Which Then Transforms into an Active Sell Position - Utilizing Sell Limit Orders

When price reaches the sell limit level you set, the pending order turns into a sell. This approach lets you sell at a better price after a pullback.

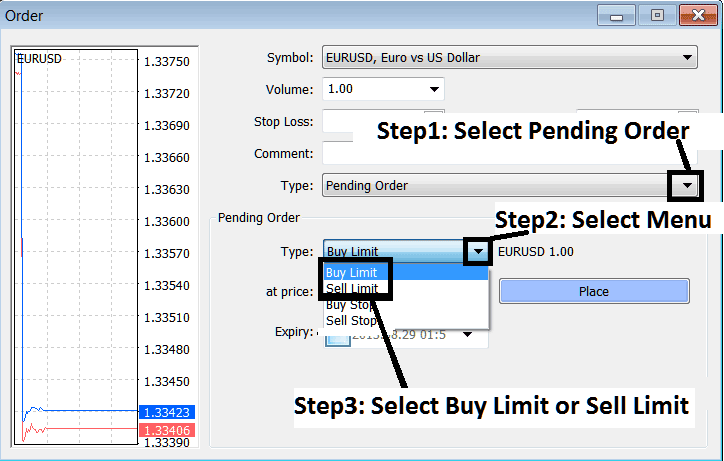

How do you set a limit buy or limit sell order on MT4?

How to Use Limit Orders - to set up these gold limit orders in MT4 platform, Right Click on chart>>> Choose 'Trading'>>> Then Choose 'New'>>> Then on the pop-up panel window that appears (illustrated below), under label 'Type' choose the option of 'pending' instead of the 'market execution'>>> Under the pending order options choose the pending order type: for This example choose either "Buy Limit" or "Sell Limit " depending on whether you as a trader want to place a pending buy limit order or a pending sell limit.

How to use Limit Orders – Creating Limit Order Buy and Limit Order Sell on the MT4 platform.

Sometimes, setting the point value to place your limit pending can be calculated using a number of method, setting a limit order too far may mean your entry limit pending not getting executed, the best tool and gold technique to use is Fibonacci retracement trading indicator and use the 38.2 % Fib retracement levels. This Fib retracement level is used by many traders & entry limit orders tend to crowd at this Fibo retracement level, therefore the best strategy to place a trade would be to use the 38.2% Fib retracement level. Fibonacci Retracement Tutorial Course for Setting Limit Orders - Fibonacci Retracement Course

Get More Lessons & Guides:

- Using MT4 Fibonacci Expansion for Gold Trading

- Standard Tool-bar Menu and Customizing Standard Tool-bar Menu in MetaTrader 4 Software

- How to Execute a Sell Limit Order for XAU USD Assets

- Placing Stop Loss XAU/USD Orders in MT5 Gold App

- Setting Up Automated EAs on the Gold Platform MT5 Meta Editor

- Gold Platform MT4 Gold Software Connection Bars on Status Bar

- Standard Trading Account and Micro XAUUSD Trading Account

- How to Add Moving Average XAU/USD Indicator in Chart in MT4 Software

- Marking Arrows on Gold (XAU/USD) Charts within the MT5 Platform

- How to Trade XAUUSD Mini Lots in Gold