What's Swap in Gold Trading?

In XAUUSD, there is payment of swap fees each day: this is the interest rate of a gold that gold earns per day. This interest for gold like the Australian Dollar is 5%, this means that each day a fraction of this five % is paid to anybody holding this Australian Dollar.

This brings up the problem of giving and taking interest money, which is a problem in the Islamic Religion. The Islamic Religion does not let you give or take interest money, so there is a trading account for Islamic traders that follows their beliefs: It is called Swap Free.

For this account a trader will not pay the overnight rollover interest on any trade & also will net get paid any interest, this also is referred to as Shariah Compliant where there is no paying of RIBA (interest) - also known as Islamic Trading Accounts.

Gold traders wanting a swap-free account should pick an Islamic broker. Choose the "Islamic Trading Account" option in the trade accounts section. Follow the steps to open one.

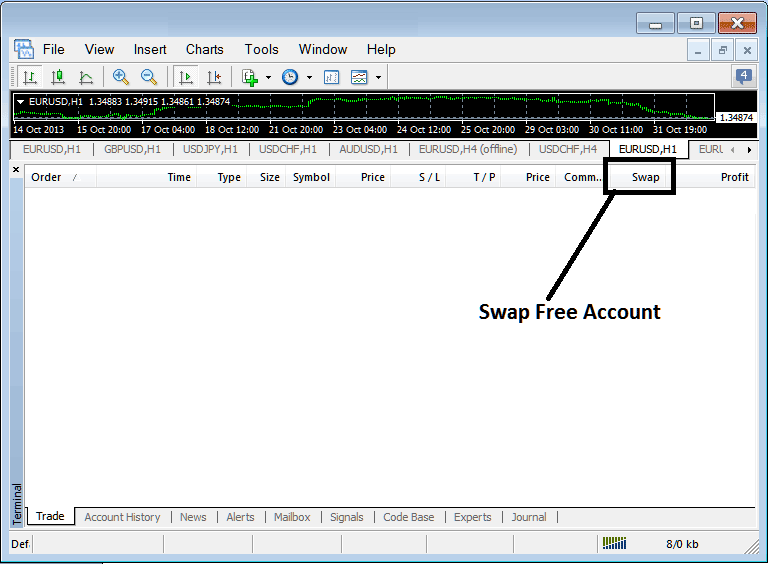

When you open this trading account, gold rollover interest is removed. After setting it so no interest is paid or received, if using software like MetaTrader 4, the rollover interest record will reset to zero.

Rollover fee is charged daily at the end of the trading day for those holding gold for which a swap is to be applied. As a trader if you do not want to pay this roll over you should close your transactions before the end of the day, that way you'll not pay the roll over interest as you're no longer holding open trade position. Because the market does not open on Saturday and Sunday, the swap fee for these two days will be deducted on Wednesdays, meaning on Wednesday one will pay the roll-over for Wednesday, Saturday & Sunday, and thenceforth on Wednesdays this roll-over fee is paid 3 Times.

Traders usually call positions with a roll-over interest Overnight Trades. Day Traders don't usually keep trades open overnight: they close them all by the end of the day. Swing Traders, however, might keep trades open for a few days and leave them overnight to get more movement from the market trend.

Once a trader finds a swap free gold trading broker & opens and Islamic Trading Account, the Gold trader will have the same conditions as those of the other traders, except for the payment of swap fee. This means a gold trader will use the Meta Trader Four Software like all the other traders, the gold trader can trade currencies, all stock indices, all CFDs, all metals & all the other Trading Instruments provided for by the trading Islamic broker.

Pick a swap-free broker with care. Some add fees or extra pips to spreads to replace the swap charge. This should not occur. Gold traders still pay interest in disguise. Top brokers skip commissions and extra costs on spreads.

Furthermore, some intermediaries impose an interest charge on rollovers, also known as a swap fee, if a gold trader's open position is maintained for longer than five to seven days. This practice should not occur: an online broker ought not to levy any form of carry-over interest, even when open positions remain active beyond the five or seven-day threshold. Traders considering opening a swap-free account with an Islamic broker should meticulously review any supplementary account terms before finalizing the opening to ensure the chosen online broker genuinely operates as a no-swap intermediary.

Islamic Gold Account

Online brokers started offering swap free accounts because more Islamic traders wanted accounts without carry-over interest. Regular accounts made people pay interest on rollovers, called rollover interest. This led to the creation of Interest Free Trade Accounts, which Islamic traders could use and still follow their rules about not paying or receiving interest.

Get More Courses & Tutorials at:

- Learn XAU USD for Beginners

- How to Day Trade XAU USD Using MA XAU/USD Technical Indicator Bullish & Bearish Trend Signal

- How to Draw Fibonacci Extension Levels in Upwards XAUUSD Trend

- XAU/USD Basics

- How Stochastic Indicator Works in Trending Gold Markets, Range XAU USD Markets

- Learn Trade Gold Platform MT4 Trade XAUUSD Platform

- Defined Rules for a Sell XAU USD System Signal and a Buy XAU USD System Signal