MACD Hidden Bullish & Bearish Divergence

Gold traders often incorporate MACD hidden divergence as a potential harbinger of continued trend movement.

This trade using MACD hidden divergence happens when the price goes back to test a high or low from before. These are the 2 MACD hidden divergence setups:

1. XAU/USD Hidden Bullish Divergence Trade Setup

2. XAU/USD Hidden Bearish Divergence Setup

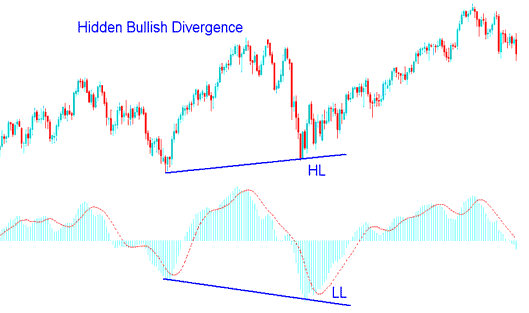

Trade Hidden Bullish Divergence in XAUUSD Trading

The MACD Hidden Bullish Divergence setup materializes when price action establishes a higher low (HL), while the MACD oscillator concurrently registers a lower low (LL).

A hidden bullish divergence setup occurs during a retracement in an upward trend.

MACD Bullish Divergence Strategy - MACD Bullish Divergence Trade Setup

This MACD setup for buying confirms that a price drop is now over. This difference shows there is strength supporting an upward movement.

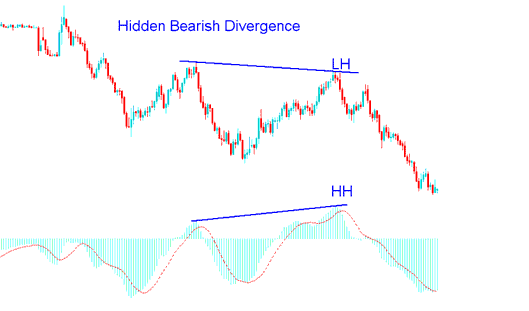

Trade Hidden Bearish Divergence in XAUUSD Trading

A MACD Trade Hidden Bearish Divergence setup occurs when the price is creating a lower high (LH), but the MACD oscillator trading shows a higher high (HH).

Hidden bearish divergence set up forms when there's a retracement in a down-wards trend.

MACD Bearish Divergence Trade Method - MACD Bearish Divergence Trade Setup

This MACD hidden bearish divergence setup confirms that a market price retracement move is complete. This divergence indicates underlying momentum of a downwards trend.

Please note: Hidden divergence presents an optimal trading setup as it signals an alignment with the prevailing market trend, offering better entry points and increased accuracy compared to traditional divergence setups.

Study More Topics and Lessons:

- Technique for Drawing Downward Trend-lines and Channels on Gold Charts

- Reversal Patterns: Head & Shoulders Pattern in Charts and Reverse Head & Shoulders Pattern in XAUUSD Charts

- How to Trade Using the MT4 Platform: A MetaTrader 4 User Tutorial

- Gold Buy Long Trades vs XAU/USD Sell Short Trades in Charts

- Step-by-Step Guide on Opening a Real Gold Account (XAU/USD) and Account Registration?

- Guidance on Integrating a Custom Trading Indicator into the MetaTrader 4 System