Head and Shoulders Patterns: Reversals

Head & shoulders Trading Pattern

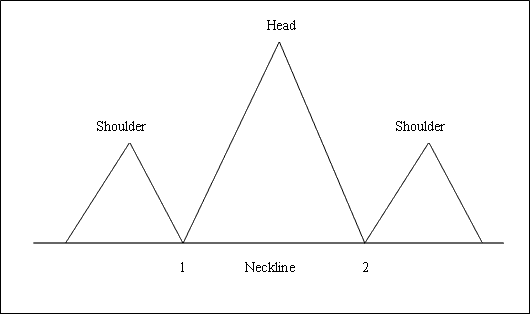

This chart formation signifies a reversal pattern that materializes subsequent to an extended upward trajectory. It is constructed from three successive peaks: the left shoulder, the central head, and the right shoulder, separated by two moderate valleys between the shoulders.

This formation is deemed finalized once the price breaks below and proceeds beneath the neckline, which is established by linking the two valleys found between the shoulders in the pattern.

To go short, traders place their sell stop orders just below neck-line.

Summary:

- This Gold pattern setup formation forms after an extended move upwards

- This setup reflects that there will be a reversal in the market

- This setup resembles and looks like head with shoulders thus its title.

- To draw the neck line we use chart point 1 & point 2 like illustrated below. We also extend the line in both directions.

- We sell when price breaks-out below the neckline point: see the chart below for an explanation.

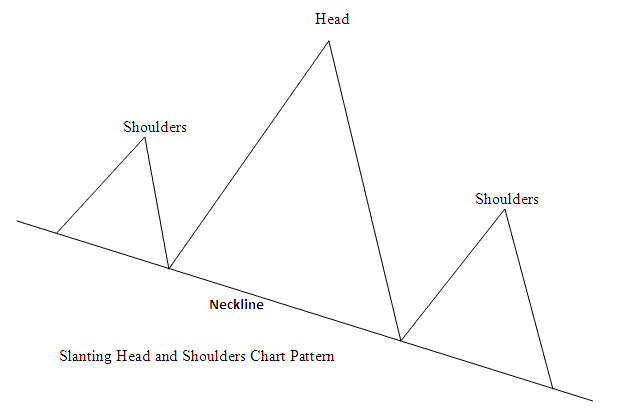

Or the head & shoulders also can form on a sloping neck-line, such as the example shown & described:

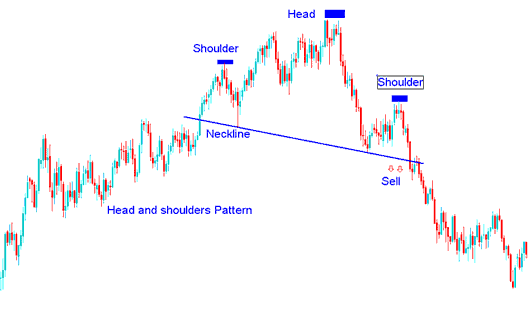

Example of Head & Shoulders Chart Pattern on Chart

Head & Shoulders Chart Pattern

This pattern can also happen with a neck line that's slanted, like the one shown: the neck line doesn't have to be flat.

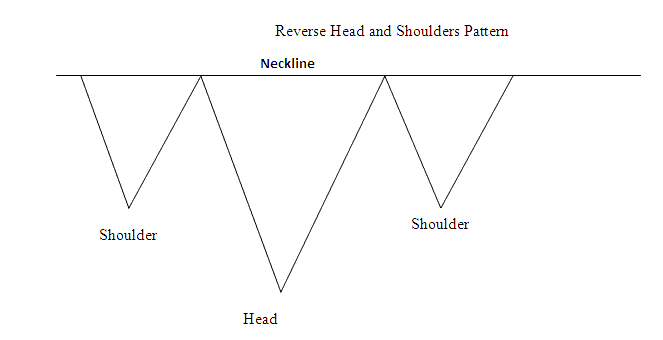

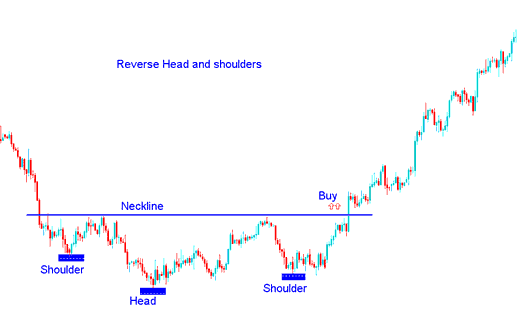

Reverse Head & Shoulders Trading Pattern

This is a reversal head & shoulders pattern which forms after an extended downward trend. It resembles an up-side down head shoulders.

This pattern is done when the price goes above the neck line, which is made by joining the two peaks between the reverse shoulder pattern together.

To go long buyers place their buy stop orders just above neckline.

Summary:

- This Gold setup forms after an extended move downwards

- This pattern reflects that there will be a reversal in the market

- This setup resembles and looks like upside down, thus the title Reverse.

- We buy when the price breaks out above neck line point: see the trading chart below for an explanation.

Example of Reverse Head & Shoulders Chart Pattern on a Chart

Example of Reverse Head & Shoulders Chart Pattern

More Tutorials:

- What's the secret to following gold trends?

- How to understand Fibonacci retracement levels and Fibonacci expansion levels when trading XAUUSD.

- Methodology for Calculating XAUUSD Price Movements.

- Trading an upward channel on MetaTrader 4

- Clarification on Nano Lots within XAUUSD Trading for Nano XAUUSD Accounts

- Learn About the Gold ADX Technical XAU/USD Indicator with this Tutorial

- Step-by-Step Guide to Drawing an Upward Channel on MetaTrader 4 Trading Charts

- Process for Modifying Take-Profit Orders for XAU/USD in MetaTrader 5

- Complete Gold Trading Course: Learn Everything About XAU/USD

- Looking to build an indicator-based trading strategy? Here's how.