Candlesticks Setups Patterns

Candlestick Consolidation and Continuation in XAUUSD

By analyzing the size and shape of an XAUUSD candle, traders can gauge buyer or seller strength. Similarly, identifying underlying weaknesses within either group is possible through this analysis.

Long Body XAUUSD Candles

Candlesticks displaying long bodies signify that a significant volume of buying or selling activity took place, dependent upon the candle's color coding.

A big shift from open to close price highlights strong buyer or seller force.

Long Blue Candlesticks - Strength of Buyers

Long Red Candles - Strength of Sellers

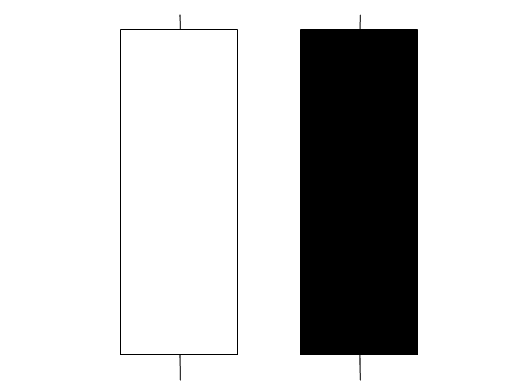

Long Body Candlesticks

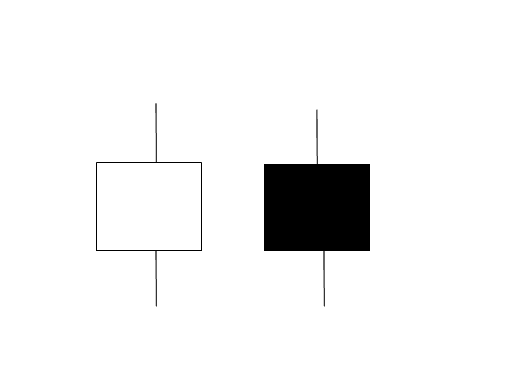

Short Body Candles

Candles that don't have much of a body mean there weren't a lot of buyers or sellers, and the price didn't change much from start to finish.

These show that the buyers/sellers weren't very strong.

Short Body Candlesticks

Marubozu Candlestick

Marubozu are long candlesticks that have no upper or lower shadows, Like shown below.

Marubozu XAUUSD Candles

Marubozu candles signal the price will keep going the same way. They show as white or blue for uptrends, black or red for downtrends.

Marubozu XAUUSD Candlesticks

White marubozu - the open is also the low and the close also is the high.

Marubozu signifies no price changes during that period, displaying complete control of the price by buyers who pushed price direction.

White Marubozu is a sign of continuation, meaning that the next candlestick will likely keep moving in the same upward direction.

Black marubozu - the open is also the high & the close also is low.

Marubozu candlestick patterns indicate strong seller control with no price retracements during formation.

A Black Marubozu is a continuation pattern suggesting that the following candlestick will likely maintain the current downtrend.

Get More Topics and Tutorials:

- Gold Demo Practice Trading Account MetaTrader 5 Free Start a Practice Demo MetaTrader 5 Training Course.

- How to Place a New XAU USD Order on MT5 for iPhone

- Advanced Tutorial on Gold Candlestick Patterns for Traders

- Computer Gold Program, WebTrader XAUUSD System and Mobile Phone Program

- Optimal Sessions for Trading Gold: Timing Matters