The 3 Major Sessions: Asia, Europe and USA

Asian Session

The Asian session sees only 8% of daily trades through Tokyo desks. It ranks as the quietest among the three key sessions. That 8% mostly covers yen-gold deals, with almost no action in other assets. This low volume makes it a poor time to trade. Skipping it helps you save time and cash.

European Session

The London/European market takes the lion's share of the total trade transactions, 34% of all transactions are carried out during this market session. London time zone is also well placed in terms of business hours for both eastern & western economies, this is when there are market overlaps and this results in high No. of trade transactions during the period. This time is most liquid and most volatile market session for all the trading instruments.

The European time zone encompasses all member states of the EU. With 17 nations in the Eurozone, major financial institutions in these countries are active, resulting in considerable liquidity due to the high volume of transactions being processed.

USA Session

The USA market takes up 20% of all transactions. Most active time for trading is approximately from 8 am to 12 pm when both London & New York dealing desks are open. This is the time when there is generally the highest market volatility as it is also the time when majority of the major US financial data announcements are released.

European USA Session Overlap

Certain trading periods are characterized by higher trade volumes, enhancing opportunities for profit.

For day traders, the London and US market sessions' overlap offers optimal trading opportunities. This period sees high transaction volumes and increased market activity due to its significance.

During this time, lots of economic news comes out, making prices change a lot: prices move fast, and there are many chances to trade, giving traders the best chance to make as much money as possible.

The best time to trade is during the market overlap. That's when prices really move, trends are clear, and your chances to make a profit jump.

This explains why Asia traders in Japan wait until the afternoon to start putting in orders, which is when it lines up with trading in Europe and the USA.

Given that Asian investors traditionally refrain from initiating gold trades during Asian market hours, it is advisable for any global trader to avoid transacting during this period. Even major hedge funds and professional traders based in Asia usually abstain, preferring to wait until the afternoon when overlap with US and UK liquidity makes conditions significantly more favorable.

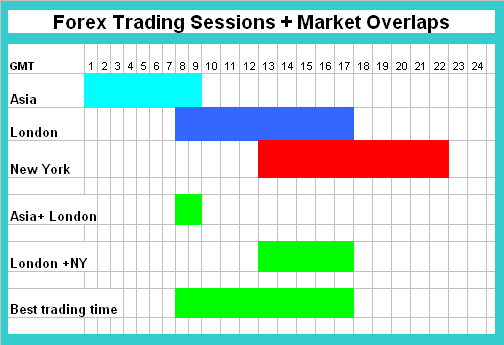

Therefore to come up with the best hours using based on these three markets sessions like shown:

Market Hours & Overlaps

The chart above shows the timetable of when each session starts & when it ends. The chart also displays when there are overlaps and also displays the best hours based on these over-laps.

Summary:

Determine Your Schedule

The type of trader you're determines your schedule. If you don't have a lot of time then a longer-term strategy would suit you best. If on the other hand you've got a lot of time then you might & may make a decision to set a intra-day trading schedule where you open gold transactions during the most active market trading hours. The above chart illustrates and shows the best GMT times to be in the market - from around 800 GMT and 1800 GMT.

Determine your timeframe

To setup a schedule you need to determine your chart timeframe. Try using different chart timeframes until you find the most appropriate and suitable to use in accordance to your schedule.

Test your trading strategy

Test your strategy on a practice demo practice account for a period of time. Keep track of every transaction & monitor the progress of your schedule. Try to analyze and interpret what times are most profitable for your strategy.

Your strategy should be specified on the trading plan which you use.

To learn more about how to specify this in your plan, read the tutorial about Gold plan. This learn gold guide will show you an illustration of a format that you can use to specify your schedule.

Study More Guides & Topics:

- How do you draw XAU/USD trading channels in MetaTrader 4?

- Basics of Gold Trading

- Setting Up Your Gold Trading Platform on MT5

- Types of Traders for XAU USD Pairs

- Strategies for Trading Gold

- Creating a Bull Power indicator system on XAUUSD for trading.

- Gold Trading Guides - Complete List of XAU/USD Indicators

- Learn About the Gold ADX Technical XAU/USD Indicator with this Tutorial