McGinley Dynamic Analysis & McGinley Dynamic Trading Signals

Created by John McGinley

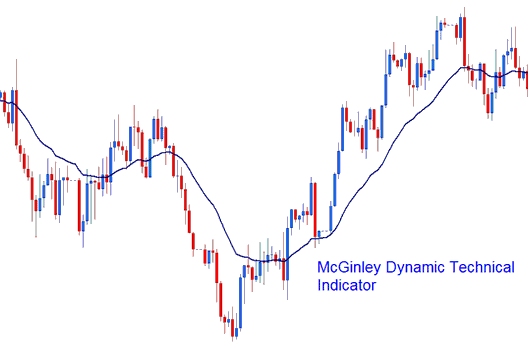

McGinley Dynamic aims to address lag issues found in traditional simple or exponential moving averages by adjusting automatically to market speed, making it a more dynamic technical indicator.

This indicator closely tracks price movements in both fast and slow markets.

Trading Analysis and Generating Signals

This specific indicator designed for gold tends to be more effective at mitigating false signals (whipsaws) in comparison to the standard Moving Average (MA).

Determined by applying the formula:

Dynamic = D1 + (Price - D1) / (N (Price/D1)4) if is dynamic.

D1 Equals the Prior Dynamic Indicator Value

N = smoothing value (for price periods)

^ = Power of

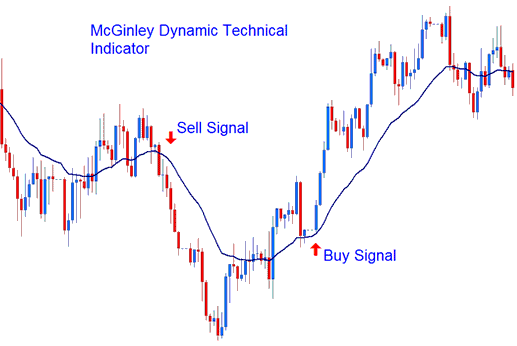

Bullish, Buy Signals & Bearish, Sell Trading Signals

The McGinley Dynamic should be integrated with Moving Averages to construct a robust trading system. The McGinley Dynamic indicator functions best as a smoothing mechanism when a standard Moving Average (MA) exhibits choppiness or sideways movement.

- Bullish, Buy Signal - A buy signal is generated when the price is crosses above the technical indicator.

- Bearish, Sell Signal - A sell signal is derived & generated when price is crosses below the technical indicator.

Analysis in XAU USD

Explore Further Programs and Programs:

- How Can I Trade MetaTrader 4 XAUUSD Platform MT4 User Guide Tutorial?

- XAUUSD Patterns Candlestick Definition Explained and Illustrated

- XAUUSD Patterns Analysis & Gold Technical Charts Analysis

- When Not to Trade XAUUSD

- How to Add XAU USD Stop Loss Order

- How to Set On Balance Volume XAUUSD Indicator on Chart in MT4 Platform Software

- Principles of How Do I Draw Trend-lines?