MT4 Margin Level : Example of How to Calculate Leverage on MT4 Software Platform

The necessary margin in this specific instance amounts to $1,000 (your own capital), especially when this figure is expressed as a percentage of the $100,000 total you currently command:

If leverage = 100:1

1,000 / 100,000 * 100= 1 %

Margin required = 1%

(1/100 *100= 1 %)

"Forex Trading: Could you simplify the explanations, as I am currently a novice trader?"

Your funds are $1,000. With leverage, you control $100,000. That makes $1,000 just 1% of the total. It sets your margin need.

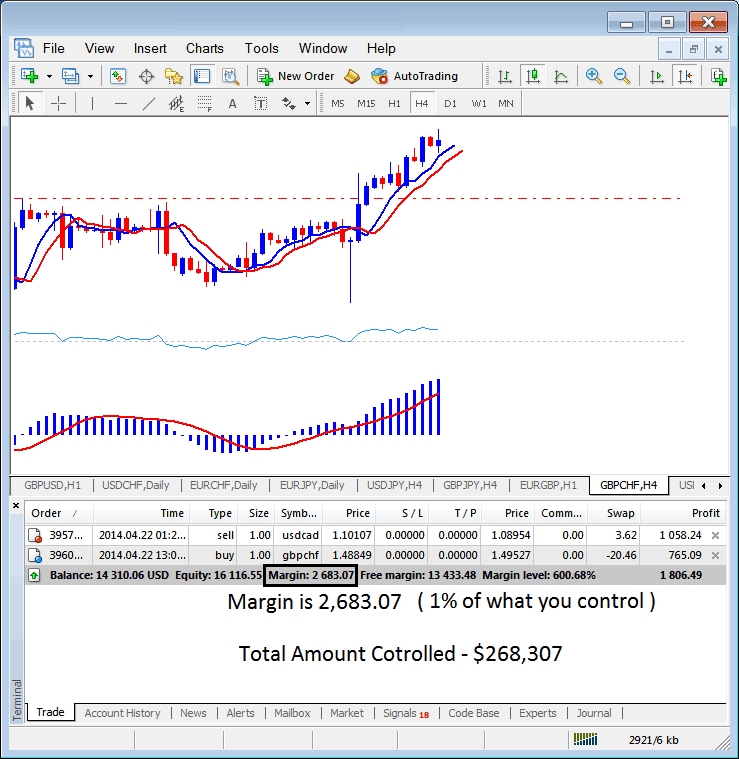

Considering the trading margin example detailed below, where the established leverage ratio is 100:1, the required margin, calculated at 1%, amounts to $2683.07. Consequently, the total value under the Gold trader's control is $268,307. This is a direct result of utilizing leverage, whereby the trader commits only a small fraction of their personal capital while borrowing the remainder. With a 100:1 leverage setting, the Gold trader is effectively deploying 1% of their capital, which equates to $2683.07: if 1% corresponds to $2683.07, then the full 100% controlled amount is $268,307.

MT4 margin level: How to figure out leverage on the platform.

- If = 50:1 Leverage - Used Leverage Option

Then xauusd margin needed = 1/50 100= 2 percentage

If you as a gold trader have $1,000,

1,000* 50 = $50,000.

1,000 divided by 50,000 times 100 equals 2 percent

Keep it simple: $1,000 turns into $50,000 with borrowed power. $1,000 is 2% of that. So that's your margin need.

- If = 20:1 Leverage Option - Used Leverage Option

Consequently, the margin requirement for gold trading equates to 1/20 or 5% of the trade value.

As a Gold Trader in XAUUSD with $1,000

1,000* 20 = $20,000.

1,000 / 20,000 * 100= 5 %

(Simplify - your funds is $1,000 after leverage you now control $20,000 - $1,000 is what % of $20,000 - it is 5 %) that's your margin requirement

- If = 10:1 Gold Leverage - Used Leverage Option

Consequently, the required margin for gold calculates as 1/10 multiplied by 100, resulting in 10%.

As a Gold Trader in XAUUSD with $1,000

1,000* 10 = $10,000.

1,000 / 10,000 * 100= 10 %

Your trading margin requirement is that you now manage $10,000 worth of your funds after leverage option, which is 10% of $10,000. (Simplify - your funds is $1,000 after leverage option you now control $10,000 - $1,000 is what percentage of $10,000 - it's 10 %)

The Distinction Between the Maximum Leverage Limit and the Leverage Currently in Use

Note the gap between max trading leverage and used XAUUSD leverage. Max leverage comes from your broker. It's the top amount you can pick. Used leverage ties to your open lot sizes. One is the broker's limit. The other is your actual use. We'll explain with the example from before.

If your online broker has given you the choice of 100:1 Maximum Leverage, but you start a trade position of just $10,000, then the Leverage Used is:

Ten thousand: One thousand (your funds)

10:1

You used a 10:1 borrowed funds ratio, but your max gold option is 100:1. Even with 100:1 or 400:1 max, you don't need to use it all. Stick to 10:1 max for your XAUUSD trades, but pick 100:1 for the account. Extra gives free margin. With free margin, your open trades stay safe. The broker won't close them if margin stays above the need.

One rule you should stick to in trading, especially with gold: keep leverage under 5:1 as part of your money management.

In the picture above from the MT4 trading platform, the gold trader is using $2683.07 dollars, and the total amount controlled is $268,307 dollars, but the account's equity is $16,116.55, so the leverage used is ( $268,307 divided by $16,116.55 ) = 16.64 : 1

Leverage Option Utilized: 16.64 : 1

Gold Margin accounts let traders handle huge amounts of trading units by using borrowed money, so they only need a little of their own money.

Acquiring this specific account type grants you the privilege of borrowing capital from the broker to execute larger lot trades.

Amount of borrowing power your account gives you what is known as " gold leverage", & is generally denoted as a ratio - a ratio of 100:1 leverage means you can control resources worth 100 times your deposited amount.

For XAUUSD trading, a 1% margin allows traders to manage transactions worth $100,000 with only a $1,000 deposit.

However, Trading this margin trading account increases both the potential for profits and also losses. In you can never lose more than you deposit, losses are limited to your deposits & usually and generally online brokers will closeout a trade position which extends beyond your deposited amount by executing a margin call. Traders must therefore try and keep their margin requirement level that is above that which is required. By using equity management rules & keeping your used leverage below 5:1.

Additional tutorials plus courses

- XAU/USD Demo Trading Account MT5 Free XAU USD Account

- How Do I Read XAU USD Fib Pullback Levels Settings in MT5?

- New Gold Indicators & Modern Gold Indicators

- List of the Learn XAU/USD Topics Required by a Trader

- MACD Classic Bullish XAU/USD Divergence & MACD Classic Bearish XAU/USD Divergence

- Steps for Setting Up and Placing a Buy Limit Pending Order on the MT5 Platform

- How Can I Trade XAU USD in the MT5 App?

- How to Analyze/Interpret Relative Strength Index Indicator

- 3 Types of Stochastic Oscillator, Fast, Slow and Full Stochastic XAU USD Oscillators