Written Example Gold Plan Template

Trading plan checklist - Below is a sample template representing a plan structure:

JUSTIFICATION

1. Trading is a business. Every successful business starts with a plan.

- Businesses which are successful always start with a plan.

- Successful business planning will tutorial you to success, think of trade plan as a map - it is a constant reminder of how you'll consistently pull profits from the market.

- Difference between a successful trader & a losing gold trading one is the trade plan.

2. TO HELP KEEP ME IN THE CORRECT DIRECTION when XAU/USD

Stick to your routine to track your trading success.

Stay focused, review and study the trade plan daily, and adhere to its guidelines.

A trade plan acts as a guide, providing clear instructions to follow. It should outline precise criteria for entering or exiting trades to maintain consistency and strategy.

Your plan needs to fully address all parts of trading: you should read and study it daily until it is second nature, so that when you're trading in the quickly changing market, you'll always know how to handle any situation.

While the complexity of your plan is entirely up to you, possessing one is the most vital element. By having a documented strategy, you gain an advantage over the general market, significantly improving your odds of achieving profitability compared to those without a plan.

This plan checklist guide topic provides with an example plan template which you can use for creating your own trade system. By now you've already written down the justification part of your trade plan template, If not get a pen and paper & writedown the justification part. Next we shall look at how to write the trade system.

The Gold plan is a secret that can help you make more money. A useful training guide like this one should teach you how to make one using a trading plan example that you can use to help create your own plan.

One very common question is, Can you make money trading Gold? One way to increase the odds is to have a well thought out strategy.

A solid gold trading plan with strict rules leads to success if you stay disciplined.

GOALS OF THE TRADING SYSTEM

- Ability to IDENTIFY A TREND AS EARLIEST AS POSSIBLE .

- Ability to AVOID WHIPSAWS .

The trading system should achieve a fair balance between the two objectives.

Develop methods to discern and identify a market trend at the earliest possible stage, while also finding mechanisms to differentiate erroneous whipsaw signals from legitimate ones.

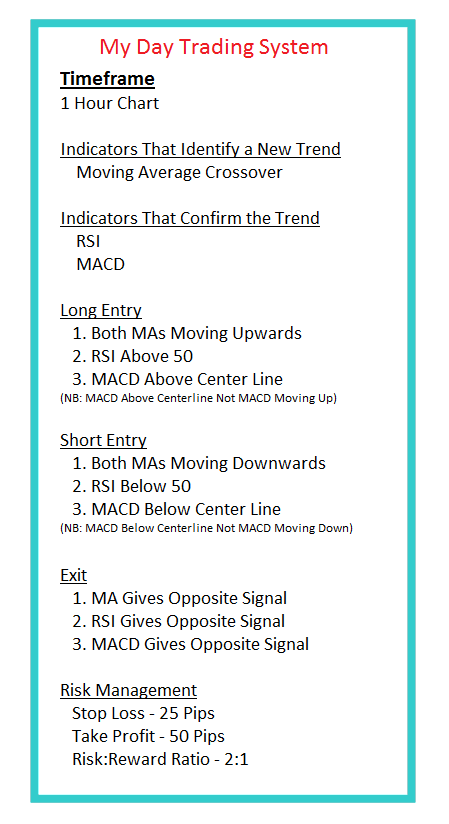

Roles of Each Part in the Indicator

Moving Average - Spot a new market trend as early as possible.

MACD - To ascertain a directional movement as soon as feasible.

Determine force of a continuing trend.

RSI - Swing failure to confirm the begin of a new trend.

Additional confirmation trading tools are available to assess the strength of the trend.

Parabolic SAR Helps Avoid Getting Trapped on the Wrong Trend Side.

Gold Trendlines - Signals a reversal when the line is broken

Gold Price Action Signals - confirm weakening of a market trend.

Bollinger Bands - for watching how prices act

To learn more about each indicator and how these technical indicators can be used and combined together to generate trading signal set-ups you as a gold trader can go to Indicators Section

TRADING CHART TIMEFRAMES

- Main chart timeframe is the 1H.

- Signals are generated/derived on 15 minutes time frame.

15 Min Charts

- Gold Trendlines (Support and Resistance)

- 5 and 7 LWMA

- RSI (14)

- Bollinger Band (20, 2)

RULES

LONG ENTRY

Entry

15 Minute Charts

- Both Moving Averages are moving UP

- MACD Above Zero Centerline (Not MACD moving UP)

- RSI >-> 50

- Parabolic SAR technical indicator is below price ( Support )

When signal is derived & generated on the 1 Hour Chart, use the 15 min chart timeframe to open and close trades.

LONG EXIT

- RSI gives a signal in the opposite market trend signal

- Gold Price breaks Support Trend Line

- Parabolic SAR is hit (Trailing Stop)

RULES

SHORT ENTRY

Entry

15 Min Charts

- Both MAs are heading DOWN

- MACD Below Zero Center Line (Not MACD moving Down)

- RSI <-< 50

- Parabolic SAR technical indicator is above price ( Support )

If a signal is generated on the 1-Hour chart timeframe, the actual execution of opening and closing trade positions should occur on the 15-minute chart timeframe.

SHORT EXIT

- RSI gives a signal in the opposite trend signal

- Gold Price action breaks Support Trend Line

- Parabolic SAR is hit (Trailing Stop)

ROUTINE

- Signals are generated using 1H chart timeframe and executed using the 15 Minute chart timeframe.

- Trading signal to be executed immediately the rules are met and matched.

- Entry alert signals should be executed during the day-time.

TIME OF DAY TO WATCH MARKET - MARKET TRADING HOURS

Monitor market activity during daytime hours when institutions and brokers are most active to plan a suitable strategy effectively.

Example Trade Plan Template

Advice - That way, you may save it as a gold template using the MetaTrader 4 Platform Software, eliminating the need to recreate it every time you create a new trading chart. Read MT4 Software Tutorial Guides if you want to learn how to save a plan template on the MetaTrader 4 software.

Gold Money Management

- Intraday trading - Low risk High return method

- Trade when I have a high risk:reward ratio 3:1 or more

- Stop Loss = Parabolic SAR

- Set TakeProfit Order target 40-60 Pips

- Never transact beyond 3 % of trading equity

- Never risk more than 2% on one trade position

Gold MINDSET/PSYCHOLOGY

- Trade without Emotions (greed, fear, impulse, bias, anticipation, over-excitement)

- I trade what I see on the trading charts not what I feel.

- I will be patient.

My job explanation is not to be the trade system!

It is not to decide which signal looks promising & which does not.

My trading system has clear rules I follow. Stick to them. Avoid chasing price action or making rules on the fly.

MY JOB DESCRIPTION IS

Sit and wait for the strategy to signal entry or exit. Then follow the plan with full focus.

Traders often run into the same problems: ignoring their system's signals, second-guessing, hesitating, getting in too late, or jumping in too early. All of this comes down to not trusting the plan and not having a real drive to follow trade signals accurately.

The goal is simple: have 100% focus on mastering and executing your gold trading rules with precision.

The more you develop your ability to step back from price movements and observe the market calmly while waiting for a trading signal, the easier it becomes to detach emotionally and prevent your feelings from disrupting your trading plan.

WEAKNESS

- I am greedy.

- I over-trade

- Make a list of all your weak-nesses that are interfering with your trading. This is the first step to help you as a trader to overcome these weak-nesses. Use Gold psychology to help you to overcome them.

Important Note: By documenting your shortcomings, you will gradually begin to recognize them as you advance: this realization will then enable you to steer clear of these missteps, leading to better outcomes.

GOALS

- To focus on the exit signals just as much as I do on the entry signals.

- Always protect my account using stop loss order, money management strategies, follow with the trend direction & always following the trading rules of my strategy.

- Never second guess or go against my trading strategy. To always keep up my discipline.

- Follow all the guide-lines of my strategy and never break them.

- Transact fewer times and execute all my signals properly. Trade what I see, what the trade strategy + charts are telling me.

- Sit patiently and wait for signals from my strategy.

- Achieve consistent gold results before signing up a live account.

FOLLOW THIS Gold SYSTEM

This constitutes the most critical element in developing a functional trade system.

Always follow the rules

Adhere strictly to the established trading protocols.

Maintain discipline and exercise patience.

Gold JOURNAL

I log all my trades in a journal to monitor my training progress and refine my gold execution techniques.

This trading strategy uses momentum to identify the trend.

Even if you are new to market and you do not know how a trade system resembles, this strategy template example illustration illustrates to you how a trading strategy should look like, the tutorials explained in other sections of this training website will also explain further different aspects that you need to learn.

The goal here is to share a full strategy if you need one. Take it as is, or tweak it a bit to fit your approach.

The objective is to enhance your trading outcomes by implementing a trading plan. Additionally, this trading plan will provide an opportunity to expand your knowledge and improve your results, allowing you to secure pips when trading gold and retain them, thereby avoiding the tendency to relinquish them back to the market.

Check out this trading plan tutorial to guide you in developing your personalized trade plan. It also covers tutorials and strategies available on the main page of this learning site.

The best part of this gold plan example is risk control. It teaches safe trading to cut losses. Risk rules matter most in markets.

Gold Trading Plan Checklist - Methodology for Formulating a Trading Plan for XAUUSD - Sample Gold Plans - Gold Plan Documentation

Explore More Tutorials and Courses

- XAU/USD Stop Loss Calculator Excel

- How Can I Save a Gold Template in MT4 Platform Software?

- What's an Example illustration of a Upward XAUUSD Trend?

- Classic Divergence XAUUSD Setup

- MT5 XAU USD Platform Software Open New XAUUSD Order in Tools Menu

- How to Add A Sell Stop XAU/USD Order in Gold

- What Occurs After a Reversal Doji Candlestick?

- Recursive Moving Trend Average XAU USD Indicator

- Types of Engulfing Gold Candlestick Indicator Patterns

- Gaining Access to MetaTrader 5 for Live XAU USD Trading on Your XAUUSD Account