Multiple Timeframe Analysis in XAUUSD Trading

Analyzing more than one timeframe means using two timeframes to trade xauusd: one shorter timeframe is used for trading, and a longer timeframe checks the trend.

It's always smart to follow the price trend. In Multiple Time Frame Analysis, the longer timeframe shows you the direction of the long-term trend.

If the long-term market trend supports the price direction on the smaller chart, the chance of making a profit is much greater. This is because the long-term trend will eventually help you even if you make a mistake. Also, trading with the market's direction usually leads to wins: this is what this analysis is about.

Many XAUUSD and stock traders say, "The trend is your friend." Don't fight the market.

There are four different types of traders - all these use different charts to trade just as is shown below.

Examples of Various Trader Types Utilizing Multiple Timeframe Analysis Strategies for Gold:

Scalpers in Gold Trading

This group holds onto their trade transactions for only a few minutes. Scalper never holds onto a trade for more than 10 minutes. With the main aim of earning just small number of pips as profit, 5 - 20 pips.

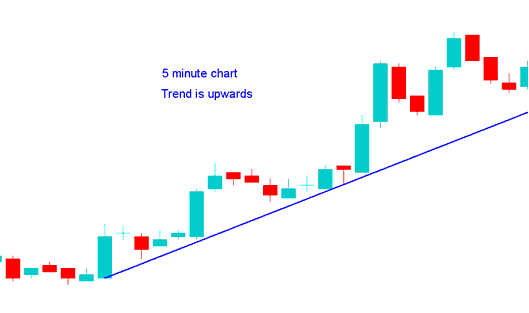

A Scalper using 1 min chart wants to buy long, checks 5 minute trading chart, which look like one below, since 5 minute explain trend is heading up, then decides from the analysis it is okay button to buy.

Day Traders

This group of traders holds on to their trades positions for a period of few hours but not more than a day. With the main objective of making quite a number of pips, 30 to 100 pips.

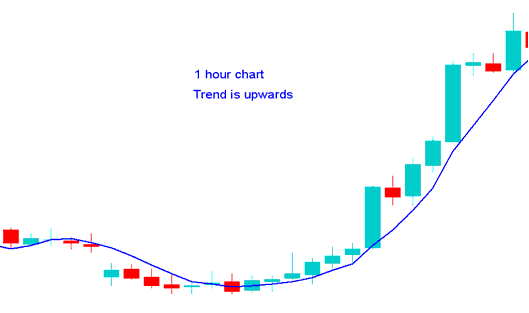

A day trader on a 15-minute chart wants to buy, so they check the 1-hour chart. If the H1 shows an uptrend, they take that as a green light and go for the buy.

Swing Traders

This group of traders keeps positions for days to a week. They aim for 100 to 400 pips in profit.

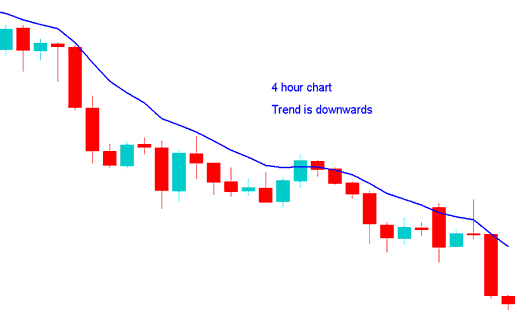

Swing trader using the 1 Hour chart wants to short sell, checks 4 Hour chart, which looks like the trading examples shown & described below, since 4 hour highlights the trend is moving down, then decides from the analysis it is okay button to sell.

Position Traders

These are the gold traders that hold onto their trades transactions for a duration of weeks or months. With main goal of earning a large number of pips in trading profits, 300 to 1000 pips.

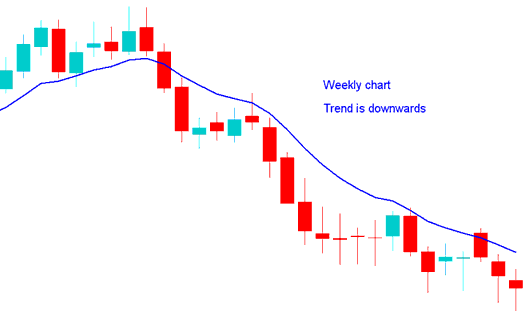

A Position trader who uses a daily chart wants to sell, so they check the weekly chart. The weekly chart looks like the one below, and since it shows the trend is going down, they decide it's a good idea to sell.

How to Define A Gold Trend

This plan uses three technical indicators - a Moving Average Cross Over System, RSI, and MACD - and uses simple rules to understand the trend. These rules are:

Upwards trend

Both MAs Moving Up

RSI Indicator above 50 Mark

MACD Above Centerline

Downward Trend

Both MAs Moving Averages Moving Down

RSI Indicator below 50 Mark

MACD Below Center-Line

Read this for details on the strategy. See how to create trading signals with a plan.

Learn More Guides & Lessons:

- When is the XAU/USD market most active? Here are the top overlaps.

- Explaining XAU/USD Gold Margin Calls and Their Implications

- How to Implement a Stop Loss Order for XAU USD Trades within the MetaTrader 5 Platform.

- Guide to Creating MetaTrader 4 Expert Advisor on MT4 Software

- Analyzing the Chande QStick for XAU/USD

- Opening a Gold Demo Account on MetaTrader 5

- Going Long on XAU/USD: What Does That Actually Mean?

- Gold Strategy: Exploring XAU/USD Price Action Systems

- What is the Best Way to Trade MACD?