How to Generate Trade Signals with Systems

Generating XAU USD MT4 Free Signals

The only method of gold trading is through xauusd signals, It's best to learn how to generate these trading signals for yourself, this way you do not have to rely on other traders to generate them trading signals for you.

Generating signals isn't easy and requires you to have a lot of trading analysis knowledge & experience, but the earlier you begin & start practicing how to generate these trading signals for yourself the better it's for you.

A good technique of how to practice generating signals with systems is to open a free practice practice trading account and test out your signals on the practice account risk free without risking your money, then once you have tested your gold strategies and they are profitable on the demo practice account you then can use these signals on a live account.

The method of how to practice generating these trading signals as well as how to back test the signals on the demo gold account using MT4 platform/software is discussed below:

So, How Can One Generate Signals?

The best method of generating signals is through systems, You can Learn how to come up with systems from the tutorial how to create Systems on the right navigation menu under the tutorials Key Concepts.

A system is a combination of one or two or more indicators with written trading rules of how these technical indicators will generate these trading signals.

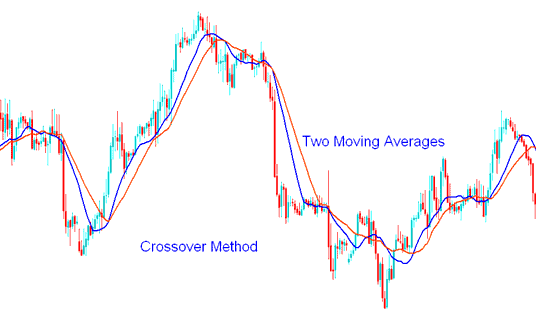

Take an exemplification of the simplest system or strategy referred to as MA cross-over method. A buy signal or sell trading signal gets generated when there is a cross-over of the two moving averages: either a buy signal for an upwards Moving Average MA cross over or a sell signal for downwards trend.

Generating XAU USD MT4 Free Signals - Gold Signals MT4 Indicator Strategy Moving Average Cross over Strategy

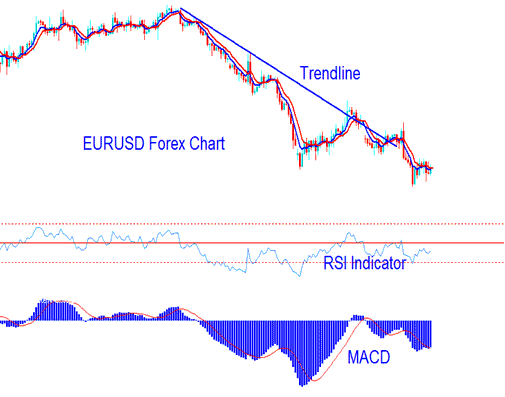

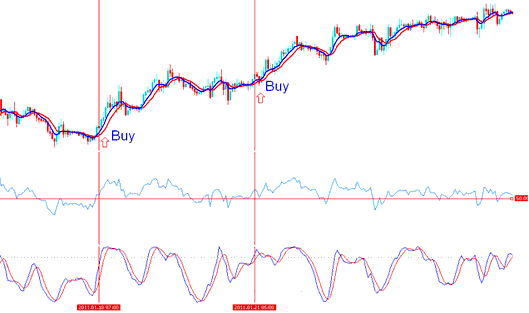

The system example depicted and explained below portrays a trading strategy using the above moving average strategy combined with RSI and MACD indicators to generate buy and sell trades.

Example of Generating XAUUSD MT4 Free Signals - Gold Signals MT4 Indicator Strategy

Example of Generating XAUUSD MT4 Free Signals - Gold Signals MT4 Indicator Strategy

In generating buy & sell signals, traders should use simple systems to generate these signals.

Generating XAU USD MT4 Free Signals - Gold Signals MT4 Technical Indicator Method - Buy and Sell Signals

Generating XAU USD MT4 Free Signals

An illustration of a simple gold system that works, is one that's a combination of:

- Moving average cross over strategy

- RSI

- MACD

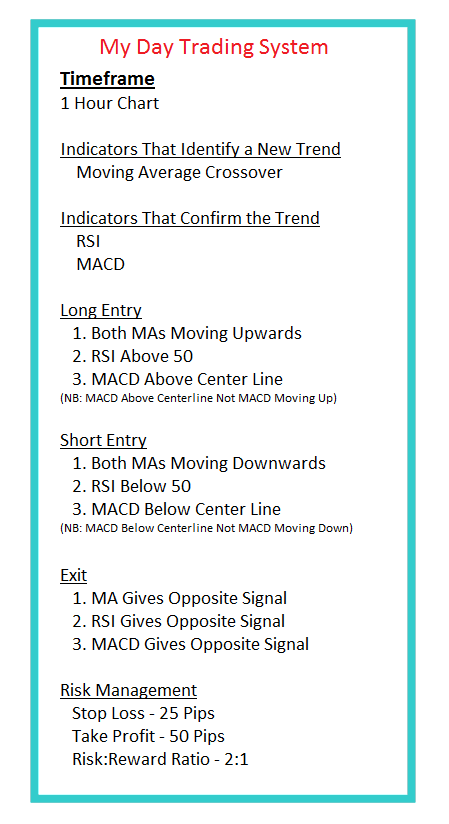

The written gold rules are:

Generating Signals Strategy System Examples

Gold Trade Rules:

Buy Trading Signal is Generated when:

- Both Moving averages going up

- RSI above 50

- MACD above center line

Sell Trading Signal is Generated when:

- Both MAs going down

- RSI value below 50

- MACD below centerline

Generating Buy and Sell Trades - Example of a Trading Strategy

Exit Signal

Exit signal gets generated when Moving Average, RSI & MACD indicator give a signal in the opposite direction.

The chart timeframe to use is 1 hour chart timeframe or 15 minutes chart timeframe based on what type of trader you are.

For a starter trader the above written rules will give good buy & sell signals, the only thing that one requires to do is to have the discipline that's required to follow the written signals rules the exact way they are, and wait for a buy/sell trade position to be indicated by your gold trading strategy & trade after the trading signals have been generated, not before they're generated.

Back Testing

Generating Signals with a trading system is one of the easiest method to trade gold, it's the best way that a beginner can attempt to determine the direction of the price trend with a good level of accuracy, and with a little back testing on practice trade account so that to constantly increase the level of accuracy of this trade signals strategy

The best way to back test a strategy is by following these two steps:

- Paper Trade

- Demo Trade

Gold Paper Trading - This method of testing a system involves setting your trading system on the trading charts, then take the chart back to a particular date, 3 months back for example, & then using this chart history to determine where your trading strategy would have generated buy, sell and exit signals. Write down these points and the profit per trade position on a piece of paper and then calculate the total profit after you've recorded a good No. of trades such as 50 paper trade transactions gold transactions and determine if your method is overall profitable, the win ratio, the loss ratio and the risk:reward.

This is an ancient method of testing trade systems which was used by traditional traders when there was no online markets or PC computers for that matter, the trader would use tools like A3 or A2 paper, graph format paper & draw the charts manually (Imagine drawing the trading charts on your trading software manually every day or each hour, would you as a trader be ready to do that? doubting it!) Those traders were hard-working than most, some were so used to the trading method that they still continue to paper trade the online trading market & draw the trading charts on paper, anyway for our paper trading technique examples, just a sample data of 50 trade transactions is all we need.

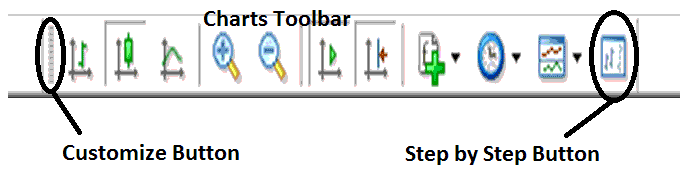

A good tool to use to backtest your system is known as the Meta Trader 4 Trading Step-by-Step Tool. Found in MetaTrader 4 charts tool bar of MT4 platform, If you want to find the trading charts tool-bar on the MT4 it is at the top of MT4 platform. If it's not: Click View (next to file, top left corner of MT4)>>> Toolbar >>> Charts. Then click Customize button >>> Select and Choose Gold Step by Step >>> Click Insert >>> Close.

Meta Trader 4 Software Chart Toolbars - How to Trade Gold for Beginners

Meta Trader 4 Chart ToolBars - Gold Step by Step Button for Back Testing Gold Systems Explained

Once you get this MT4 tool you can move your chart backwards, & use this MT4 tool to move the trading charts step by step while at the same time testing when your system would have generated/derived either a buy or sell transaction, & where you'd have exited the Gold trade, then write-down the amount of profit and loss per trade position & out of a sample number of gold transactions you'd then calculate the over-all profits and losses derived and generated by the trade strategy.

If your gold trading strategy is profitable on paper then, it's time to demo gold trade and testing if the it is profitable on live market as it is on paper method. This is the process of testing or backtesting a trade system.

Maintain a XAUUSD Journal to keep record of profitable trade positions, and determine why these trade positions were profitable. And also maintain a log of all losing trades, determine why these trade positions made a loss & then avoid making the same mistakes the next time you trade using your strategy.

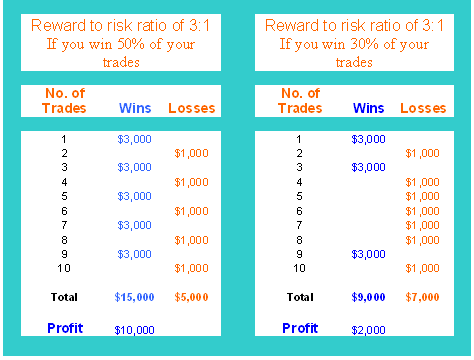

Tweak your xauusd system until you get a good risk : reward ratio, with the trading signals that you generate. Aim for a good risk : reward of 3:1 and a win ratio of above 70% is a good ratio, with good gold money management even a trading strategy with a win ratio of even 30% - Less than half of your gold transactions make profit you can still make a profit. You may & might want to read and study this lesson to know what the illustration below is talking about: Risk : Reward Ratio.

Risk to Reward Ratio Chart of Gold Money Management Strategy - Gold Strategies Described

Read Gold Equity Management Trading Methods Lesson Tutorial

A manual trading system is still the best way to generate signals in-comparison to automated systems, a manual strategy is a better technique and is also much simpler to implement.

However, other traders prefer automatedtrade systems & for those then they can check the information on this page MQL5 EAs and automated systems.

You also can view our extensive list of gold strategies topics that offers you with various methods of buy & sell analysis using a number of diverse technical methods, navigate to the Gold Strategies Section.

More Topics and Lessons:

- How to Add ADX XAU/USD Indicator in Chart in MetaTrader 4 Software

- Gold Market Tops Reversal & Market Bottom Trend Reversal Using Stochastic Indicator

- How Can Use Gold Sell Limit Order on MT4 Software/Platform?

- How Do You Trade DeMark Projected Range Technical Indicator Sell Signal?

- Swing Trading XAU/USD across Chart Timeframes