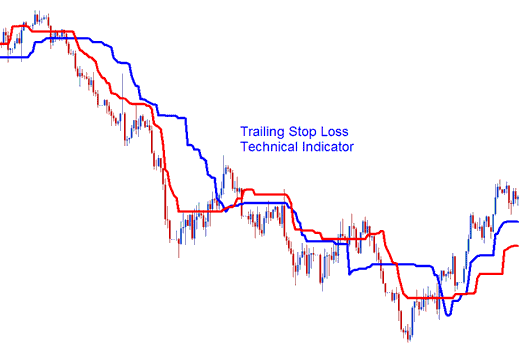

Trailing Stop Loss Levels and Trading Signals

Created by Tushar Chande.

This is a volatility-based trading indicator used to estimate appropriate levels to set stop-loss orders. The distance it calculates for trailing stop levels is determined by price volatility.

Levels of the two lines, these two lines represent:

- Long Stop Level - Blue Line

- Short Stop Level - Red Line

The long stop level line generally has a broader range for trailing stop-loss orders compared to short stop levels, which enforce tighter stop-loss measures.

This measuring tool bases its trailing on price movement observation. Downward market trajectories will see the Trailing Stop Levels follow above the price, while ascending market trends result in these levels tracking beneath the price.

Analysis & Generating Signals

These will be calculated using the volatility to calculate where to draw the technical indicator - this is used to figure out & determine what levels to set stop loss orders.

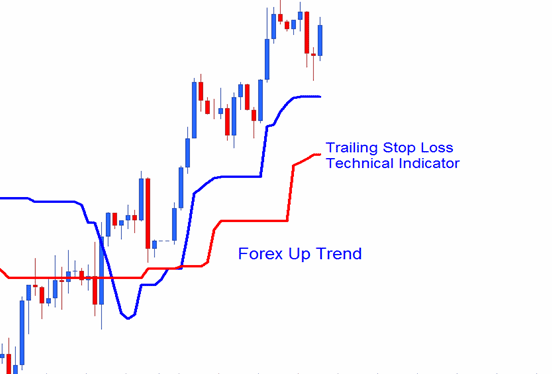

Upward Trend

In an uptrend, these levels trail under the price. Set a tight stop with the short line. Use the long line for a looser stop. As price climbs, the trail rises too. Sell when price drops below.

Gold Uptrend

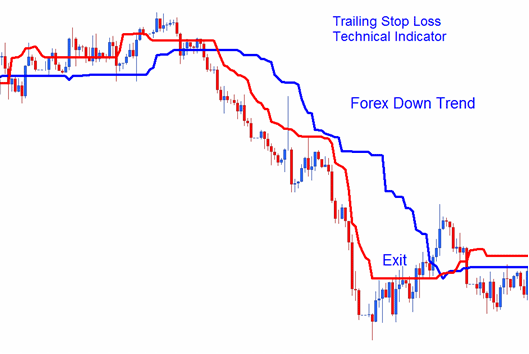

Downward Trend

In a downtrend, stop-loss orders will move above the price: these levels can be used to set the stop-loss. As the price continues to decrease, these levels will also drop and follow the price. An exit signal happens when the price goes above these levels.

Gold Downtrend

When price begins to retrace these technical levels will not retrace but will remain at their levels, this will mean at some point the trade will be stopped out by the trailing stop loss order.

More Topics and Courses available:

- Where Can You Get a Guide?

- Example of a Price Trend for XAU USD on a Chart

- How Do I Trade with Fibonacci Pullback Levels XAUUSD?

- Trading XAUUSD Orders with MT4 on Gold Android App

- How Do I Gold Set Buy Stop XAU/USD Order on MT5 Platform?

- Customizing Gold Line Studies Toolbar Menu in MT4 Software Platform