Hammer Bullish Candle Patterns

Hammer Bullish Candle Patterns

Reversal candlestick patterns happen after a trend has been going on for a long time. Therefore, a prior trend must exist for a candle pattern to be a reversal setup.

The reversal candlestick patterns are:

- Hammer Candles Setup and Hanging Man Candle Pattern

- Inverted Hammer Candles Setup & Shooting Star Candle Pattern

- Piercing Line Gold Candlestick Pattern & Dark Cloud Cover Candlestick Pattern

- Morning Star Candles and Evening Star Candles

- Engulfing Candlesticks Patterns

Hammer Candlesticks Pattern and Hanging Man Candle Pattern

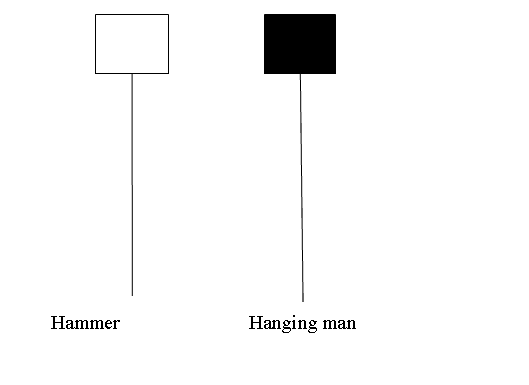

The Hammer Candlestick Pattern and the Hanging Man Candle Setup feature visually similar candles: however, the hammer indicates a bullish reversal, while the hanging man signals a bearish reversal pattern.

Hammer Candlesticks Pattern & Hanging Man Candle Pattern

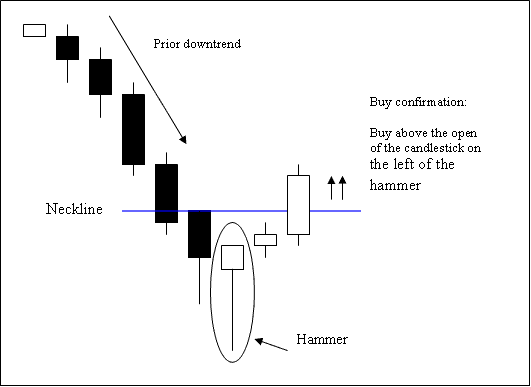

Hammer Candles Setups

Hammer is a potentially bullish pattern which forms during a downward trend. It's named and called so because the market is hammering a bottom.

A hammer has:

- A small body

- The body is at the top

- The lower shadow is 2 or 3 times length of real body.

- Has no upper shadow or very small upper shadow if present.

- The colour of the body is not important

Hammer Candles

Technical Analysis of Hammer Candles Setups

The buy signal is real when a candlestick ends above the first xauusd price of the candle on the left side of the hammer candle design.

Stop orders should be placed a few pips just below low of the hammer candlestick.

Inverted Hammer Bullish Candle Patterns

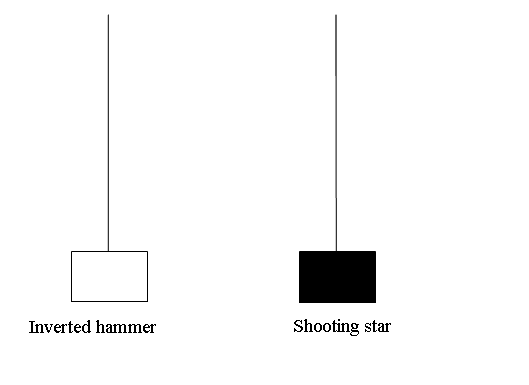

Inverted Hammer and Shooting Star candlesticks look alike. Both show a long upper shadow. They have a small body near the bottom. Color plays no role. Location counts most. A Shooting Star appears at a trend's peak. An Inverted Hammer shows up at a trend's low point.

The inverted hammer is a bullish reversal candle. The shooting star, on the other hand, is a bearish reversal pattern.

Upward Trend Reversal - Shooting Star Candles

Downward Trend Reversal - Inverted Hammer Candlesticks

Inverted Hammer Candlestick Formations & Setups for the Shooting Star Candlestick Pattern Formations

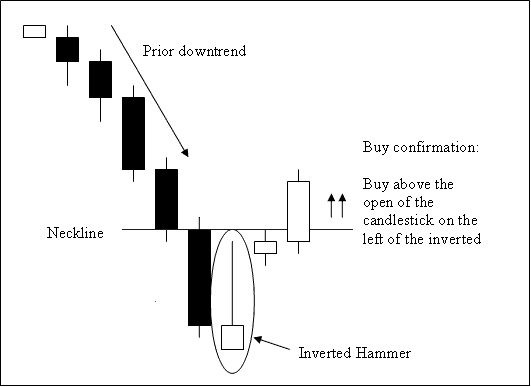

Inverted Hammer Candlestick

This is a bullish reversal candle setup. It occurs at the bottoms of a Gold trend.

Inverted hammer occurs at the bottom of a down trend and reflects possibility of reversal of the downward trend.

Inverted Hammer Candle

Technical Analysis of the Inverted Hammer Candlestick

A buy signal is confirmed when a candlestick closes above the neckline. This point represents the opening of the candle on the left side of the pattern, with the neckline forming a resistance zone.

Stop orders for securing buy positions on XAUUSD trades ought to be placed slightly below the lowest point recorded in the recent price action.

The inverted hammer candle formation earns its name because it visually suggests the market is attempting to establish a bottom.

Learn More Topics and Guides:

- Trading with the Acceleration/Deceleration (AC) Indicator Effectively

- Optimizing Gold Trading with MetaTrader 5 Platform on iPad

- RSI classic bullish XAUUSD divergence compared to RSI classic bearish gold divergence

- Where can I find intraday trading software and online platforms?

- Trading with the MT4 Fibonacci Expansions Indicator in MetaTrader 4

- What is the Difference Between an Inverted Hammer Candle and a Shooting Star Candle?

- What to Expect After a XAUUSD Bull Pennant Pattern

- Looking at Bollinger Band Bulge and Bollinger Band Squeeze