Ultimate Oscillator Analysis and Signals

Originally developed & used to trade stocks & commodities markets.

This oscillator tries to find a middle ground between early signals and late signals given by common technical indicators.

- Leading - some indicators lead the market & give signals earlier than the ideal optimum time

- Lagging - some indicators lag the market so far that half of the move is over before a trade signal is generated.

This is the balance which this oscillator aims to strike, not to lead the market too much or lag the market too much - this way the oscillator trading will always give a signal at the ultimate time, thus its title.

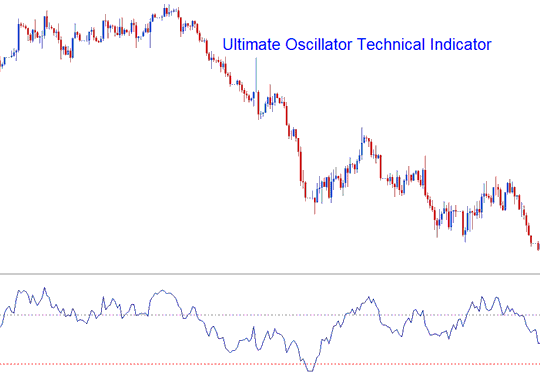

This indicator uses three different n-number of candlesticks and calculates the combined weighted sums of price action from these candles and draws these values on a scale ranging from 0 to 100. Values of above 70 are considered and regarded to be over-bought levels while values of below 30 are considered and regarded to be oversold levels.

The ultimate oscillator trade is calculated using time frames of seven periods (short term trend), fourteen periods (intermediate term trend), and twenty-eight periods (long-term trend).

Analysis and How to Generate Signals

This specific technical indicator offers the capability to generate both buy and sell signals through the application of several distinct methods.

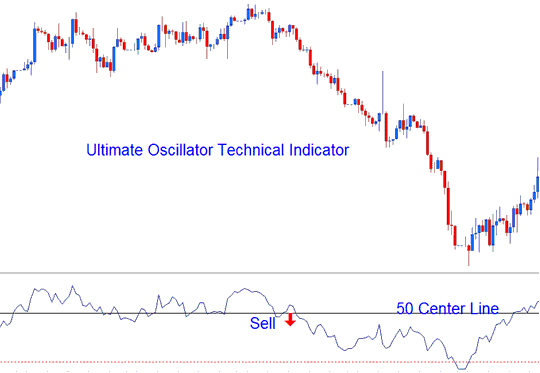

Center line Trading Cross-over Signal

Buy Trading Signal - values/readings above 50 center-line level

Sell Trading Signal - values/readings below 50 centerline level

Center line Trading Cross-over Signal

Over-bought/Oversold Levels in Indicator

Overbought - levels above 70 - sell trading signal

Over-sold - levels below 30 - buy signal

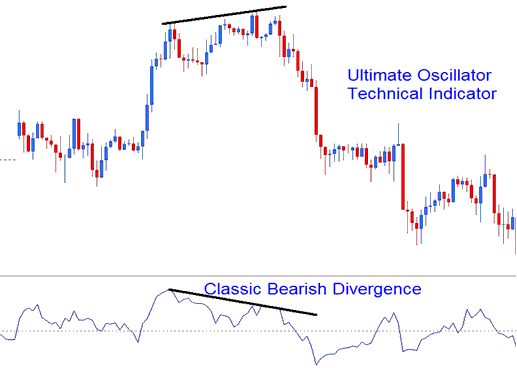

Divergence Trade

The oscillator trading also can be used to trade divergence setups, below is an illustration of a classic bearish divergence trade setup.

Technical Analysis

Learn More Topics and Guides:

- Want to day trade gold? Here's how to use the moving average XAU/USD indicator to spot bullish and bearish trends.

- Methodology for Plotting Fibonacci Expansion Levels on an Ascending Trend.

- Auto Stop Loss & Take Profit EA Bot

- Your Go-To Guide for Learning XAU/USD Trading

- True Strength Indicator TSI MetaTrader 4 Platform

- How to Include the MetaTrader 5 Volumes Indicator on a Gold Chart