What's Double Bottoms Patterns?

Trading Identify a Double Bottoms Pattern in XAU USD Trading

The Best Patterns Training Course for Beginners - How to Identify and Trade Double Bottom Patterns

Patterns for Intraday Trading - Patterns Guide

This Double Bottoms trading patterns charts guide explains and describes how to identify xauusd setups - identifying chart patterns is the first step when it comes to learning how to trade with Double Bottoms chart patterns in Gold.

Double Bottom trading setups frequently appear on XAUUSD charts. This analysis guide explains how to effectively trade and interpret gold charts using these Double Bottom formations.

Double Bottom Pattern

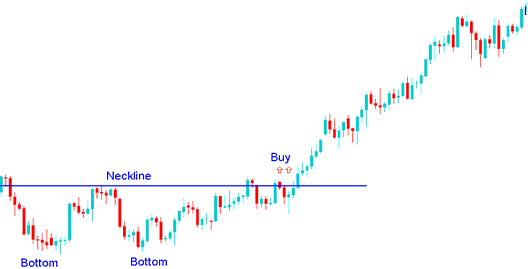

The double bottom pattern acts as a reversal signal in gold trading. It appears after a long downtrend. This chart pattern includes two equal lows with a small high between them.

This double bottoms pattern setup formation is considered complete once price makes the second low & then penetrates highest point between the lows, referred to as the neck line. The buy indication from this bottoming out signal occurs when the market breaks out the neckline to the up side.

In XAU USD, this double bottoms setup formation is an early signal that the bearish Gold trend is about to turn & reverse. It's only considered complete/completed once the neckline is broken. In this double bottoms pattern formation setup formation the neck line is the resistance zone for price. Once this resistance is breached and broken the market will move upwards.

Summary:

- Double bottoms trading setup forms after an extended move downwards

- This Double bottoms chart pattern formation shows that there will be a reversal in the market

- We buy when price breaks-out above the neckline point/level as shown below in the explanation.

Double Bottom Pattern

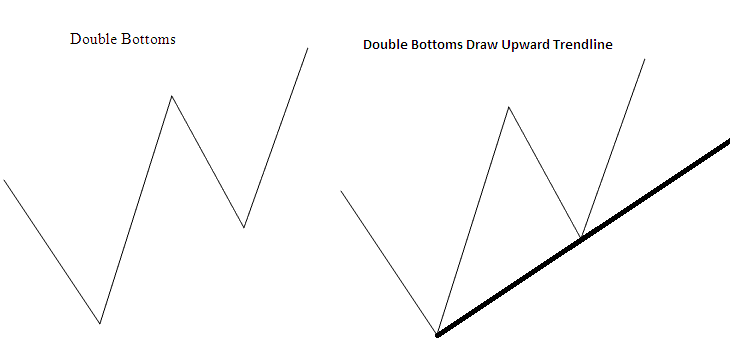

A double bottom looks like a W on the chart. The strongest reversal signal for gold comes when the second bottom sits higher than the first, as shown below. Confirm it by drawing an upward trend line like the illustration. For a buy trade, place the stop loss just below that trend line.

W Shaped Double Bottoms Pattern

Learn more lessons and subjects:

- How to Set Demarker on Gold Chart in MT4 Platform Software

- Signing in to a XAUUSD account - step-by-step.

- MT4 XAU/USD Transactions Tabs Window

- How to Set MACD Technical Indicator on Gold Chart in MT4 Platform Software

- How to Analyze/Interpret Relative Strength Index Indicator

- How to Modify Stop Loss Order on MT4 Trade Charts