Technical Analysis of MA Indicator

Trend Identification

The cfd moving average indicator can be used as an indicator for generating cfd signals. A buy or sell cfd signal is generated when price either moves above or below the moving average, respectively.

If the Moving Average is heading upwards in diagonal manner then the general cfd market cfd trend is up-wards.

If the on the other hand the Moving Average is heading downwards in diagonal manner then the general cfd market cfd trend is down-wards.

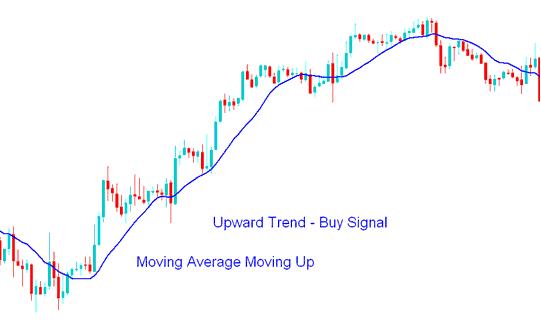

Upward Trend/Bullish Trend

If the Moving Average is moving up, then the cfd trend is upward & the signal generated is a buy/bullish trading signal.

As long as the price is above the moving average then the cfd trend will remain as an upward trend. The moving average will act as a 'support level' and cfds price action of the chart candlesticks should not close below the MA.

Buy Signal

When the price moves above the Moving Average and closes above the moving average, a buy trade signal is generated.

CFD Traders, who want to confirm the cfd trade signal before implementing it, should wait until the Moving Average line turns & starts to move in an upwards trend direction. It is always best to wait for confirmation cfd signal so as to reduce chances of a cfd whipsaw.

Upward Trend - How to Day Trade CFD: A Detailed Tutorial to Day Trade Strategies

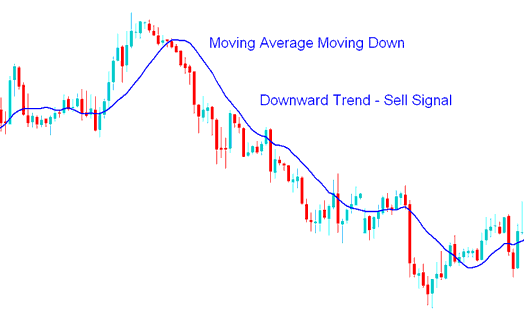

Downward Trend/Bearish Market

If the Moving Average is moving down, then the cfd trend is downward & the signal generated is a sell/short trading signal.

As long as the price is below the Moving Average then the cfd trend will remain as a downward bearish CFD trend. The Moving Average will act as a "resistance level" and cfds price action of candlesticks should not close above the MA.

Sell Signal

When the price moves below the Moving Average and closes below the moving average, a sell trade signal is generated.

Traders who want to confirm the cfd signal should wait until the Moving Average line turns & starts to move in a downwards direction. This will reduce the chance of trading a cfd whipsaw.

Downward Trend - How to Day Trade CFD: A Detailed Tutorial to Day Trade Strategies

CFD Trading Range Market trading signals

Range Market signals can also be identified using the Moving Average Indicator.

Moving Average Crossover Strategy Method CFDs Strategy

The MA cross over method is also another cfd signal generation strategy that is more favored by cfd traders compared to the above cfd signal generation strategy method. Moving average crossover cfd strategy is also the simplest form of a cfd system widely used by online traders. This Moving Average crossover method is combined with other technical indicators to form more complex cfd systems and cfds trading strategies.