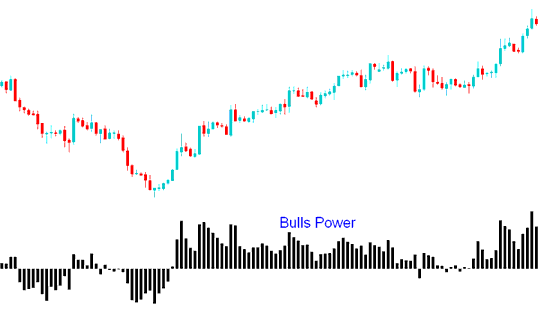

Bulls Power Commodities Analysis and Bulls Power Trading Signals

Developed by Alexander Elder

Bulls Power is used to estimate the power of the Bulls (Buyers). Bulls Power estimates the balance of power between the bulls & bears.

This indicator aims at identifying if a bullish trend will continue or if the price has reached a point where it may reverse.

Calculation

A Commodities Price bar has four parameters: the Opening, Closing, High & Low of the price bar.

Each Price bar either closes higher or lower than the previous price bar.

The highest price will signify and show the maximum power of the Bulls within a price period.

The lowest price will signify and show the maximum power of the Bears within a price period.

This Technical Indicator uses the High of the price and a MA (Exponential MA)

The moving Average represents the middle ground between sellers and buyers for a certain price period.

Therefore:

Bulls Power = High Price - Exponential Moving Average

Bulls Power

Commodity Analysis and How to Generate Trade Signals

Buy Trade Signal

A buy signal is generated when the Bulls Power oscillator moves above Zero.

In an up trend, the HIGH is higher than Exponential Moving Average, so the Bulls Power is above zero & Oscillator is located above the zero line.

Exit Trade Signal

If the HIGH falls under EMA then it means that price are starting to fall, the Bulls Power histogram dropfallsdrops below the zero line.

The Triple Screen method for this indicator suggests identifying the price trend on a higher chart interval (like daily time frame) and applying the bulls power on a lower chart interval (like hourly chart time-frame). trading Signals are traded according to the indicator but only in direction of the long term trend in the higher time frame.