MA Commodity Analysis & MA Trading Signals

An technical indicator that calculates the average value of prices (or any specified price data series) over a predetermined period of time.

The only significant difference between the various types of MAs is the weight assigned to the most recent data. Simple moving averages apply equal weight to the prices. Exponential and weighted averages apply more weight to recent prices.

Explanation

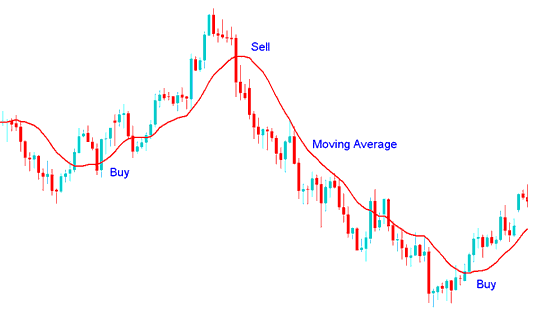

The most popular method of interpreting the MA is to compare the relationship between the MA of the price with the price itself. A buy signal is generated when the price rises above its MA and a sell signal is generated when the price falls below its Moving Average.

MA Technical Indicator

Buy & Sell Trading Signals generated by MA crossing above or below the price action.

MA Cross-over Commodities Strategies

Also popular are various types of moving average cross over systems. Such systems often include 2 or more moving averages crossing above/below each other & perhaps even utilizing other technical indicators as additional entry & exit confirmation signals. The combinations of conditions for these types of systems are almost limitless.

MA Cross-over System