RSI Commodities Analysis & RSI Trade Signals

Created by J. Welles Wilder, described in the book "New Concepts in Technical Trading Systems".

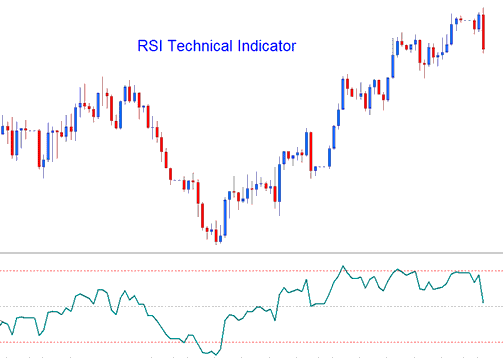

Relative Strength Index is the most popular indicator and it is a momentum oscillator and a trend following indicator. RSI compares a trading commodities price magnitude of the recent commodities price gains against its magnitude of recent losses commodities price losses & plots this data on a scale of values which ranges between 0-100.

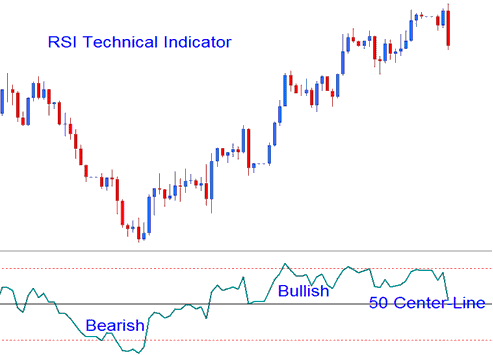

Relative Strength Index measures the momentum of a commodity instrument: values above 50 signify bullish momentum while values below 50 center-line signify bearish momentum.

- RSI is drawn as a green line

- Horizontal dashed lines are plotted to spotting overbought & oversold levels are i.e. 70/30 levels respectively.

Commodities Analysis & Generating Trade Signals

There are several techniques used to trade, these are:

50-level Crossover Signals

- Buy signal - when the indicator crosses above 50 a buy/bullish trading signal is given.

- Sell Trading Signal - when the indicator crosses below 50 a sell/bearish trading signal is given.

RSI Commodities Trading Setups

Traders can draw trend lines and map out patterns on the RSI indicator. The Relative Strength Index often forms chart patterns such as head & shoulders pattern which might not have formed clearly on the price chart.

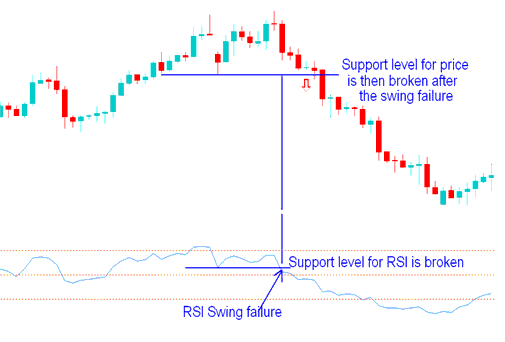

Commodity Trading Support/Resistance Breakouts

RSI is a leading indicator and can be used to predict Support/Resistance Breakouts before price breaks its support/resistance level. RSI uses the swing failure signal to predict when price is about to break support and resistance areas.

Swing Failure - Support & Resistance Breakout

Overbought/Oversold Conditions on Indicator

- Overbought- levels above 80

- Oversold- levels below 20

These levels can be used to generate signals such as when RSI turns up from below 20 after oversold, buy and sell when RSI crosses to below 80 after overbought, sell. These signals are not suitable for trading Commodity Trading because they are prone to a lot of fakeouts.

Divergence Trade Setups

Divergence trading is one of the analysis method used to trade reversals of the price trends. There are four types of divergences that can be traded with this indicator covered in the divergence tutorial on this web site.