Bilateral/Consolidation Patterns Energies

With bilateral/consolidation trading patterns the market can move in any direction. There are 2 different types of consolidation trading chart patterns that form on trading charts:

- Symmetric Triangles - Consolidation trading chart patterns

- Rectangles - Range market

Symmetrical Triangles Trading Pattern

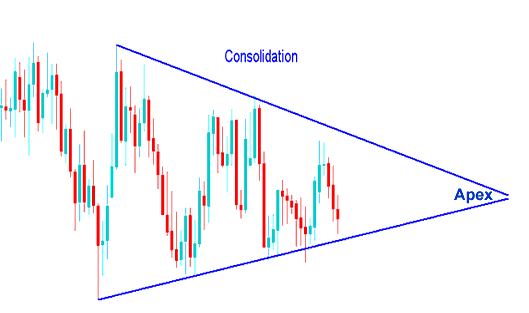

Symmetrical triangles are chart trading patterns with converging trendlines which form a consolidation period. The buy signal from a symmetrical triangle pattern is the up-side break, while a downward break is a technical sell trading signal. Ideally, a market breaks-out from a symmetrical triangle prior to reaching apex of the triangle.

Trend lines can be drawn connecting the lows and highs of the consolidation phase, the trend-lines formed are symmetrical and they converge together to form an apex. A breakout should occur somewhere between 60-80% into the triangle chart pattern. An early or late breakout is more prone to fail, & therefore less reliable. After a price break-out the apex forms support & resistance areas for the price. Price that has broken out of the triangle consolidation chart trading pattern shouldn't retrace past the apex zone. The apex zone is used as a stop loss order setting area for the open trades.

When these consolidation trading chart patternss form we say that the trading market is taking a pause before deciding next direction to take.

These consolidation chart patterns form when there is a tug of war between the buyers & the sellers & the market can't decide which way to continue.

Consolidation Pattern

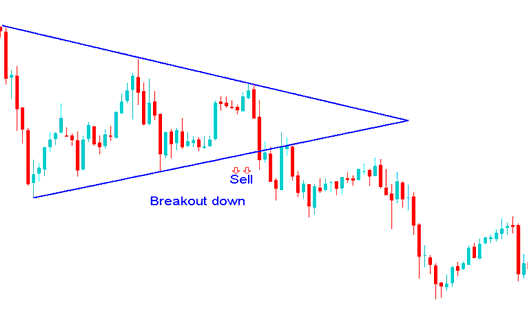

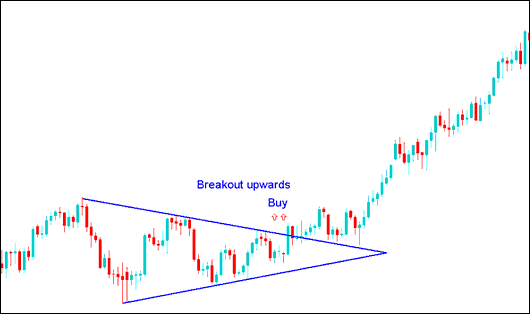

However, this trading chart pattern can't go on forever and just like in a tug of war one side wins eventually, looking at the chart below see how the consolidation eventually had a break out & moved in one direction. Now how do we as traders make sure we are on the winning side?

Breakout Downwards Sell Trade Signal after a Consolidation Pattern

Breakout Upwards Buy Trade Signal after a Consolidation Pattern

Now back to our question, how do we make sure we are on winning side?

Well we wait til price moves past one of the lines & put buy or sell trade orders in that particular direction. After consolidation, If price breaks the upper line open buy, if it breaks-out out the lower line we sell.

Alternatively if you do not want to wait out the consolidation chart pattern, you can use pending orders. If you-wouldyou'd want to learn more about pending orders go to the tutorial: Stop Entry Trading Order Types

The 2 types of stop order types used to trade consolidation chart trading patterns are:

- Buy Entry Stop An order to open buy at a point above price.

- Sell Entry Stop An order to sell at a point below price.

These are orders to open buy above the market or to open sell below the market.

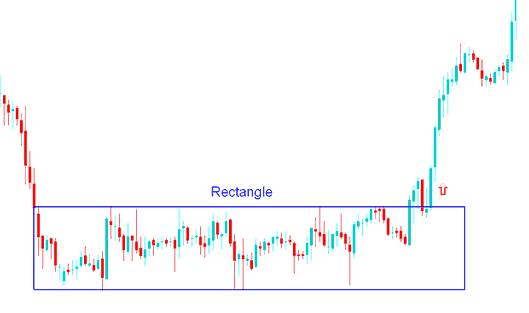

Rectangle Pattern

A rectangle consolidation trading chart pattern is a trading range with a narrow price action which forms a consolidation phase in trading market. The trading range is defined by 2 parallel trendlines which are horizontal & indicate and show the presence of support & resistance. This pattern is plotted on a chart using a rectangle, therefore thus its name rectangle trading pattern.

For this consolidation chart trading pattern setup, energies price forms multiple highs & lows that can be connected with horizontal trend lines that are parallel to each other. This pattern occurs over an extended period of time, giving the chart trading pattern setup its rectangle shape.

A break out of price action from this consolidation chart pattern occurs when either of the horizontal line is penetrated & the trading range of this rectangle pattern is broken. An upward break out is a buy signal. A down-ward break out is a sell trading signal.

Rectangle Pattern Energies Trading - Consolidation Pattern

Price Breaks-out the consolidation trading range after sometime and continues to move upwards after an up-wardsupward market breakout.