Spinning Tops Candles Pattern and Dojis Candlestick Patterns

Doji Consolidation Candles Pattern & Doji Continuation Candle Setups

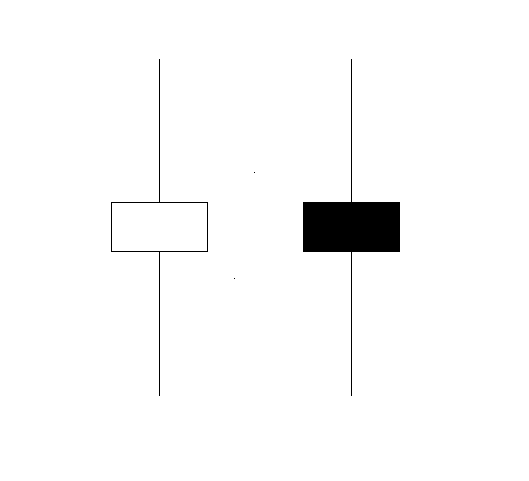

Spinning tops candles setup have a small body with long upper & lower shadows. These spinning tops are referred to by this name of spinning tops because they are similar to spinning tops on a matchstick.

The upper and lower shadows of the spinning tops are longer than the body. The example illustrated and explained below highlights the spinning top pattern. You can look for the setup in your MetaTrader 4 Energies Trading Platform charts. The example illustrated and explained below highlights a screen-shot to help traders when it comes to learning and understanding these formations.

How to read candlestick charts - Spinning Tops

Color of spinning tops candlestick is not very important, this formation show the indecision between the buyers and sellers in the energies trading market. When these energies setups appear at the top of a trend or at the bottom of the energies trend it may signify that the energies trend is coming to an end and it may soon reverse and start going the other direction. However, it is better to wait for confirmation signals that the direction of a trend has reversed before trading the signal from this chart formation.

Candlestick Reversal Patterns Formations on Trading Charts

At the top of an upward energies trend a black/red spinning tops shows that a reversal is more likely than when color of the candlestick is white/blue.

At the bottom of a Energies Trading downwards trend a white/blue spinning top shows that a reversal is more likely than when the color is black/red.

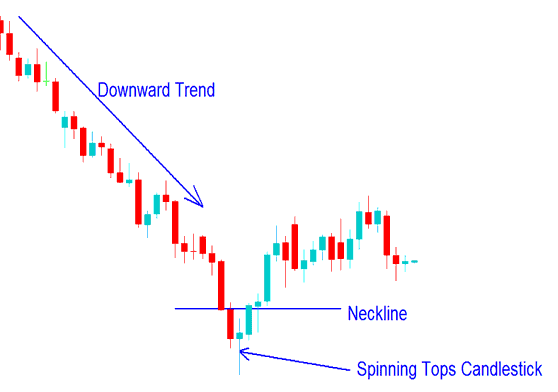

This reversal signal is confirmed when the next candlestick pattern that forms after the spinning tops closes below the neckline for a downward energies trend reversal signal confirmation, and closes above the neckline for a reversal signal in a down ward trend.

The neckline is:

- For an Upwards Trend - The open of the previous candlestick that was drawn just before the spinning top.

- For a Downward Trend - The open of the previous candlestick that was drawn just before the spinning top

Below is example of this Japanese charting techniques where this pattern has formed and how to trade it. On the chart below when the price moved above the neckline the reversal signal given by the spinning top candlestick was confirmed and this was a good point to exit the short sell trade.

Spinning Top Pattern on a Chart

The color of the spinning top formed is blue therefore meaning that a reversal was more likely as opposed to if the color had been red.

Doji Candlesticks Pattern

This is a pattern with same opening and closing price. There are various types of doji candle stick patterns that form on charts.

The following examples explain various patterns of the doji candle:

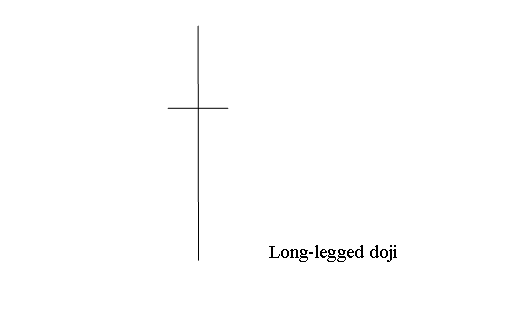

Long-legged doji candlestick has long upper and lower shadows with opening and closing energies price at the middle. When the Long-legged doji appears on a chart it shows indecision between energies traders, the buyer and the sellers.

Below is example screen shot image of the Long Legged

- Doji energies chart pattern

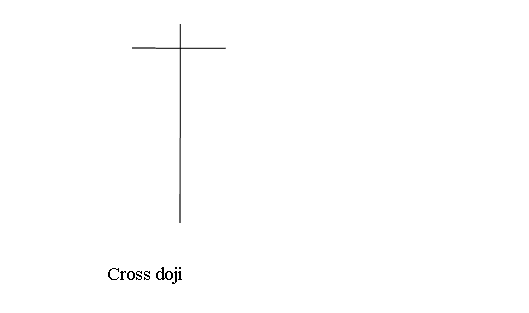

Cross Doji Energy Candlestick

Cross doji has a long lower shadow and a short upper shadow and the open and close of the day is the same.

This energies pattern appears at market turning points and warns of a possible energies trend reversal in the Energies. Below is as example of this chart formation

- Cross Doji Pattern

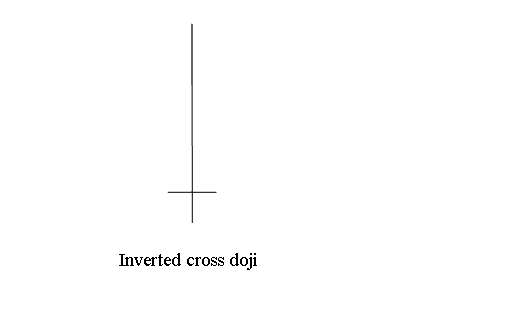

Inverted Cross Doji Energy Trading Candle

Inverted cross doji candlesticks have a long upper shadow and a short lower shadow and the open and close is the same.

This reversal pattern appears at market turning points and warns of a possible energies trend reversal in the Energies. Below is an example

- Inverted Cross doji

Analysis in Energies Trading - All doji candlesticks setup show indecision in the energies market this is because at the top of the buyers were in control, at the bottom the sellers were in control but none of them could gain control and at the close of the energies market the energies price closed unchanged at the same energies price as the opening energies price. This doji shows that the overall price movement for that day was zero pips or just a minimum range of 1-3 pips. Reading these charts patterns require very small pip movement between the opening energies price & closing energies price.