Indicators For Setting Stop losses In Energies

Some indicators are used for setting stop losses taking away the need for traders to perform complex calculations on where to place these stop loss trade orders.

A trading systems trader can also set a stop loss order according to these indicators. Some technical indicators use mathematical equations to calculate where the order stop loss order should be set so as to provide an optimal exit. These indicators can be used as the basis for setting stop loss orders. These indicators follow price action of a energies instrument closely and define the boundaries which the prices should move along in. When the price moves outside these boundaries it is therefore best to close the open trades because price stops moving in that particular direction.

Some of the Technical indicators that can be used to set stop loss orders are:

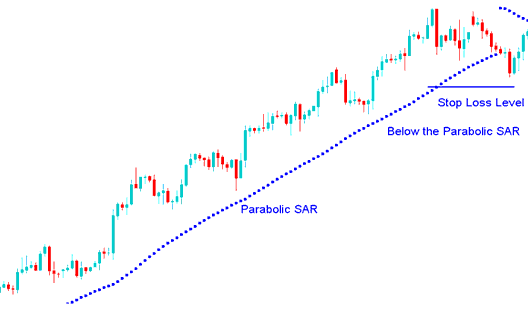

Parabolic SAR Indicator

Parabolic SAR is like an Automatic Stop Loss Energies Trading Order & TakeProfit Energies Trading Order Indicator used to set a trailing price stop loss

The Parabolic SAR provides excellent exit points.

In an upwards trend, you should close long trades when the price falls below the Parabolic SAR technical indicator

In a downwards trend, you should close short trades when the price rises above the Parabolic SAR.

If you are long then the price is above the parabolic SAR, the SAR will move up every day, regardless of the direction in which the price is moving. The amount the Parabolic SAR indicator moves up depends on the amount that prices moves.

Parabolic SAR - Indicator - Automatic Stop Loss Energies Trading Order & TakeProfit Energies Trading Order Indicator

Picture of parabolic SAR and how it is used

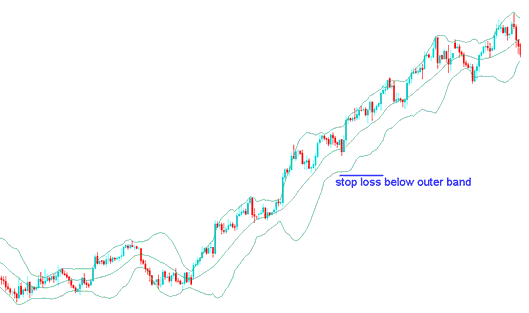

Bollinger Bands Indicator

Bollinger bands indicator use standard deviation as a measure of volatility. Since standard deviation indicator is a measure of volatility, the Bollinger bands are self-adjusting meaning they widen during periods of higher volatility and contract during periods of lower volatility.

Bollinger Bands indicator consist of 3 bands designed to encompass the majority of a energies instruments price action. The middle band is a basis for the intermediate term trend, typically it is 20 period simple moving average, which is also the base for the upper and lower bands. The upper band's distance and lower band's distance from the middle band is determined by volatility of price.

Since these Bollinger bands are used to encompass the price action, the bands can be used by traders to set stop losses outside the area just outside of these bands.

Bollinger Bands Setting Stop Loss Energies Trading Order Level - Bollinger Bands Energies Technical indicator

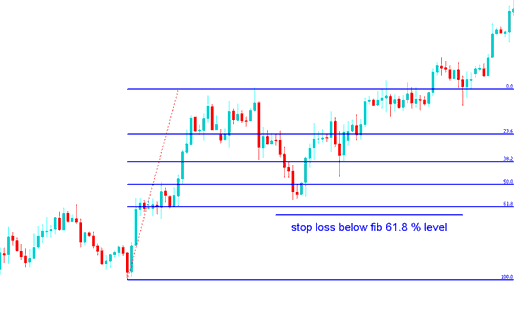

Energies Fibo Retracement Levels Indicator

Fibonacci retracement levels provide areas of support & resistance, these can be used to set stop loss levels.

Energies Trading Fib Retracement level 61.8 % is the most commonly used level for setting stoplosses. A stop loss order should be set just below 61.8 % fibonacci retracement level

The 61.8% Fib retracement level trading indicator is used to set these orders because its rarely hit.

Fibonacci Indicator Stop Loss Energies Order Setting at 61.8 % Retracement Level

Fibonacci retracement level 61.8% - Fibonacci Indicator

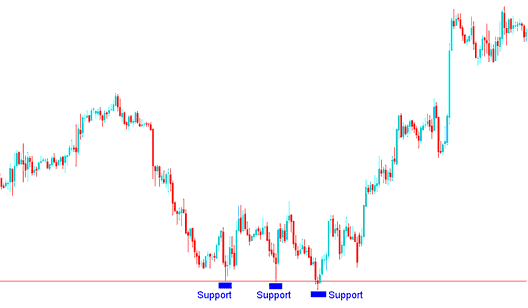

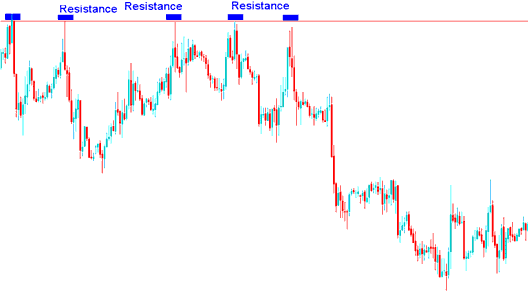

Support and Resistance Levels Lines

Support and resistance levels can be used to set stop loss levels where the stop losses are set just above or below the support or resistance.

- Buy Energies Trade - Stop Loss Energies Trading Order set few pips below the support

Buy Trade - Stop Loss Energies Trading Order set a few pips below the support

- Sell Trade - Stop Loss Energies Trading Order set a few pips above the resistance

Sell Trade - Stop Loss Energies Trading Order set few pips above the resistance