Best Indicator Combination of Indicators PDF Gold Trading

Best combination of indicators Guide - Stochastic Oscillator Indicator, MAs, RSI & MACD

Stochastic indicator can be combined together with other indicators to form a gold system - Buy Sell Signal Indicator MT4 Indicators. For our illustrations we will combine it together with:

- RSI

- MACD

- MAs Gold Indicator

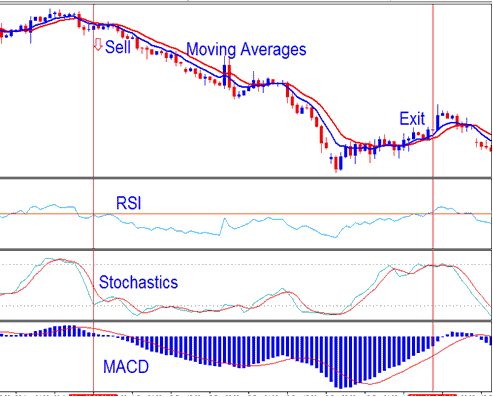

Example 1:

Sell Signal - Best Combination of Gold Indicators

From our system the sell trading signal gets derived & generated when:

- Both Moving Averages are heading downward

- RSI is below 50

- Stochastic heading downwards

- MACD indicator heading downwards below centerline

Sell signal was derived & generated when all these gold rules were met. The exit trade signal is generated when a signal in the opposite trend direction is generated ie. When indicators reverse.

The good thing about using such a trading system is that we are using various types of indicators to confirm trade signals and avoid as many whip saws as possible in the process.

- Stochastic - is a momentum oscillator

- RSI - is a momentum oscillator

- MAs Technical Indicator- is a market trend following trading indicator

- MACD- is a market trend following xauusd indicator

It's very helpful and useful to combine more than one technical indicator, as a combination of signals is better than relying on a single indicator. The technical indicator combinations reinforce each other, & cancel out false whip saw fake-out trade signals.

A trend following indicator helps a trader to see the over-all picture, while using more than 1 momentum indicator gives and generates better & more reliable entry & points for exit trading.

Best combination of indicators & their trading signals help to interpret a lot of the market activity.

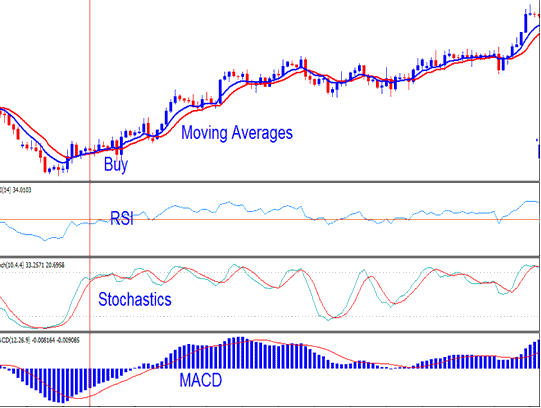

Example 2:

Buy Signal - Best Combination of Gold Indicators in Gold Trading

For this example the market trend is clearly upwards, but at some point there were a few whipsaws generated by the stochastic oscillator indicator, can you spot them? - So the question is how can one avoid trading these gold trading fake outs?

Well, the answer is that by looking at the other indicators like MACD a xauusd trader could have avoided the whip saw, even the MACD technical indicator had not given a gold cross-over signal although it was very close to the zero centerline level, at the same time slope at which the moving averages MAs turned wasn't so sharp as to signal a decisive trend reversal. The thing is that it’s not so obvious when it comes to recognizing fake outs: it is a skill that takes some time to master but after a period of time you can identify whipsaw fake-outs after some practice.

One tip is that as long as MACD indicator is above zero centerline even if the MACD lines are heading downward then the trend is still upwards. As you can see from the above example MACD indicator never went below zero line and afterwards the upward trend continued with the MACD maintaining above Zero-line & continuing to move upwards.

Duringrange-bound sideways market trends Stochastic Indicator will give the fastest trading signals which are prone to whipsaws. This is why stochastic oscillator indicator is best combined with other indicators and signals traded and transacted are confirmed by other 1 or 2 other indicators to form - Best Combination of Indicators - Top 10 MT4 Indicators - Best Combination of Technical Analysis Indicators for Gold Trading.

More Guides:

- How to Trade Successfully with Gold Indicators

- How to Set MetaTrader 5 Gold Custom Trading Indicators on the MetaTrader 5 Platform

- Gold Trend Channel Indicator MetaTrader 4 Trading Software

- What is the Best Leverage for $2000 Account?

- How to Identify Bullish Hidden Divergence and Gold Bearish Hidden Divergence

- How Do You Trade a XAU/USD Pull Back?

- MetaTrader 5 Bar Charts in MT5 Charts Menu

- How to Change Gold Leverage on MT4 Software

- How to Read XAUUSD Chart Data from MT4 Gold Chart Data Window

- How Can I Draw Channels in MetaTrader 5 Trading Software?