Divergence Gold Indicators

The best divergence indicator is the RSI indicator, traders can use this indicator to check divergence when trading gold.

The two types of divergence -bullish & bearish divergence are explained below.

RSI Hidden Bullish and Bearish Divergence Gold Setups

Hidden divergence pattern is used as a possible sign for a trend continuation. Hidden divergence occurs when price retraces to retest a previous high or low.

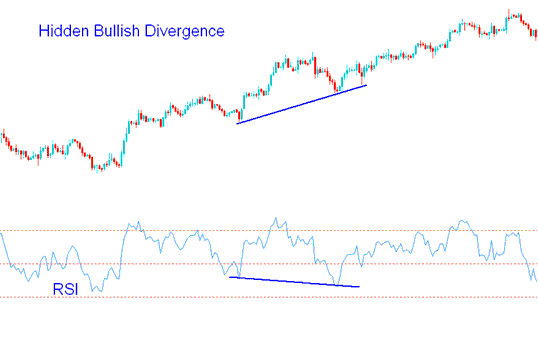

Hidden RSI Bullish Divergence Trade Setup

Forms when price is making/forming a higher low (HL), but the oscillator is showing a lower low (LL).

Hidden bullish divergence in gold trading forms when there is a price retracement in an upwards trend.

Gold Hidden Bullish Divergence - best divergence technical indicator

This setup confirms that a pull-back is over. This divergence shows under-lying momentum of an upward trend.

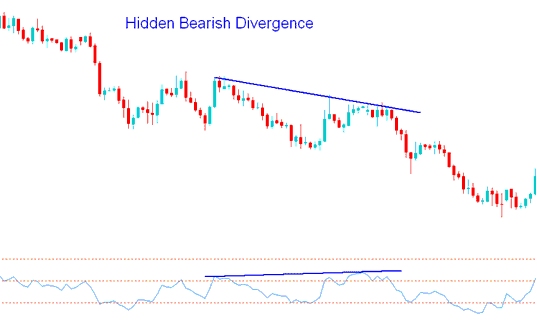

Hidden RSI Bearish XAUUSD Divergence Trading Setup

Forms when price is making/forming a lower high ( LH ), but the RSI is showing a higher high ( HH ).

Hidden bearish divergence in gold trading occurs when there is a retracement in a downwards trend.

Gold Hidden Bearish Divergence - best divergence technical indicator

This divergence confirms that a pull-back is over. This divergence indicates strength of a downward trend.

Study More Lessons & Courses:

- What's the Interpretation of XAU/USD Charts?

- How Do I Place StopLoss XAU USD Order and Take-Profit Order on MT5 Platform Software?

- Gold Key Concepts Explained

- MT4 Gold Technical Indicators Insert Menu on MT4 Insert Menu Options

- Gold TakeProfit Order Setting on Mobile Trading App

- How Can I Open Gold Account with a MT4 Gold Broker?

- How Stochastic Oscillator Works in Trending XAUUSD Markets, Range Gold Markets

- What's Bullish Gold Divergence Trading?

- Which is the Best XAU USD Leverage for $500 XAU USD?

- How Do You Save MetaTrader 4 Profile of MT4 Gold Charts in MetaTrader 4 Software/Platform?