Bollinger Band Analysis & Bollinger Trade Signals

Created by John Bollinger

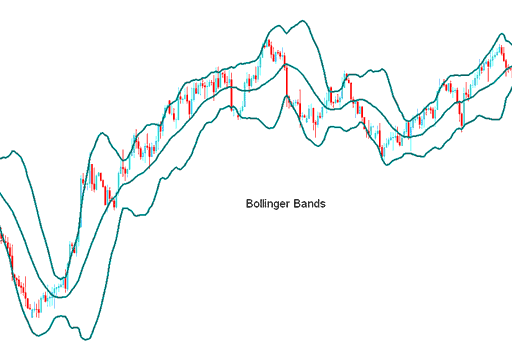

Bollinger Bands consist of three lines. The central line represents a 20-period Simple Moving Average.

The lines are then made at a certain distance from the average movement. These lines are what create the top and bottom boundaries.

The distance where the bands are drawn is decided by another indicator referred to & known as the standard deviations. Standard deviation is a gauge and measure of volatility in the market or that of gold.

Because the price changes all the time, the standard deviations will also change: and because Bollinger bands use standard deviations to be drawn, the distance between the bands will keep changing on its own with the price changes.

Increased market volatility leads to the expansion of the bands, while less volatile times cause them to narrow.

The 3 Bands are designed & intended to encompass/enclose the majority of the price action. Middle band forms the basis for the trend, typically a 20-periods simple moving average MA.

This central band also acts as the foundation for the upper and lower bands. The separation between the upper and lower bands from the middle band is influenced by market volatility. The upper Bollinger Band is positioned at +2 standard deviations above the middle band, while the lower band is situated at -2 standard deviations below it.

XAU/USD Analysis & How to Generate Trading Signals

- Bands provide a relative meaning of high & low

- Used to identify periods of high & low price volatility

- Used to identify periods when prices are at the extreme regions

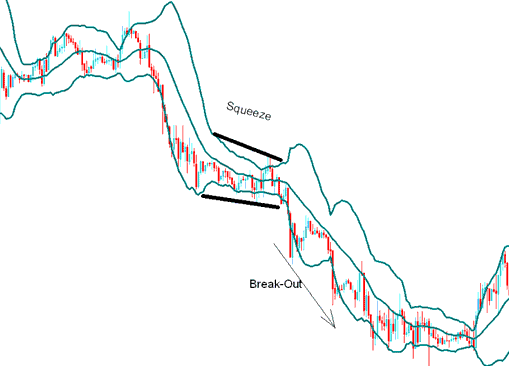

the Squeeze

The bands tighten as the price volatility reduces, this identifies periods of consolidation. Sharp price break outs tend to happen after the bands tighten.

Consolidation Pattern

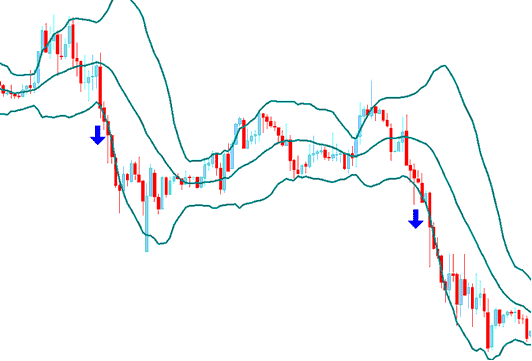

the Bulge

Once gold prices break beyond an upper or lower band, a continuation of the current trend is typically anticipated in the market.

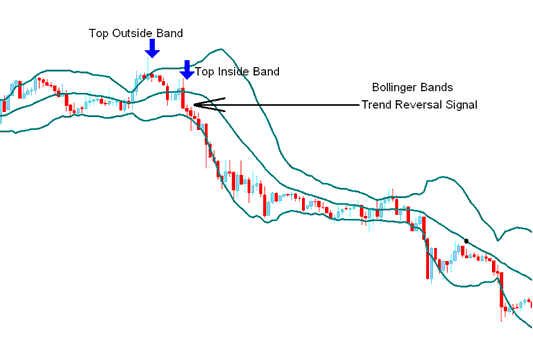

Double Top & Double Bottom

When lows and highs happen outside the bands, followed by lows and highs inside, the market trend is likely to change direction.

The Head Fake - XAUUSD Whipsaw

Traders should be on lookout for false break outs known as whipsaws or head fakes.

Price often breaks out in one direction immediately following the Squeeze setup causing a lot traders to think the break-out will continue in that direction, only to quickly reverse & make the true, more significant breakout in the opposite trend market direction.

Traders acting quickly on this initial break-out often get caught up on the wrong side of the price action, while those traders expecting a "false breakout" can quickly close-out their original position and enter a trade position in direction of reversal. It's always good to combine Bollinger bands with other confirmation Indicators.

Discover More Subject Areas and Instruction Sets:

- XAU USD Technical Indicators Which Are Used To Analyze/Interpret The Market

- XAU/USD Save a Template for Trading Charts in MT5 Software

- Trading Gold Channels on MetaTrader 5

- Technical Analysis Momentum Indicator for FX Buy Signals

- XAU/USD Learning

- MACD Classic Bullish XAU/USD Divergence & MACD Classic Bearish XAU/USD Divergence

- Learn XAU/USD Tutorial Lesson for Beginners

- XAU/USD Trend Indicators Free XAU USD Indicators of Buy & Sell XAU USD Signals

- How to Read Fibonacci Extensions Indicator in MT4

- A Training Tutorial Lesson Learn XAU USD Training Guide Tutorial