Analysis of Bollinger Band Width Variations and Associated Trading Signals

Developed & Created by John Bollinger.

This technical indicator is derived from the initial Bollinger technical indicator.

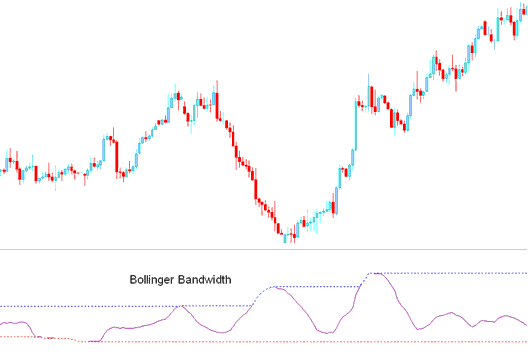

Bandwidth is a measure of width of Bollinger Bands.

Calculation

Bandwidth = Upper Band - Lower Band

Middle Band

This specific oscillator trading indicator is predicated on the principle that price and volatility exhibit cyclical behaviors.

Periods of high volatility are followed by the periods of low price volatility.

When volatility is high, bands are far apart, the band width will also be wide apart.

When volatility is low, Bands are narrow and the band-width technical indicator also will be narrow.

The blue line shows the top bandwidth from past periods.

This line also identifies periods of high price volatility

The red line represents the lowest Bandwidth value reading for a previous number of specified periods.

This line also identifies the periods of low price volatility

XAU/USD Analysis and Generating Signals

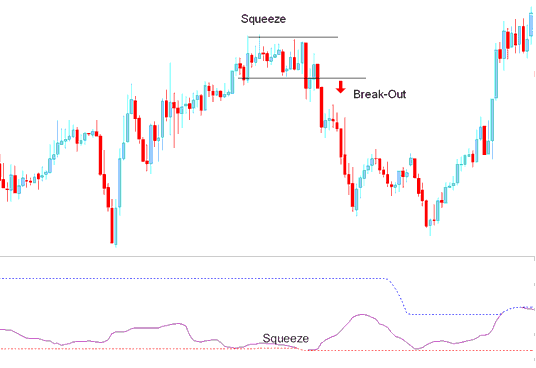

Consolidation - Bollinger Squeeze

Bollinger Bandwidth identifies periods of price consolidation (squeeze), signaling potential breakouts in specific directions afterward.

Signals are generated/derived when there is a price break-out - signal is generated by indicator starting to go up after touching the red line. When bandwidth line begins to move up it signifies that price volatility is rising as price is breaking out.

Squeeze

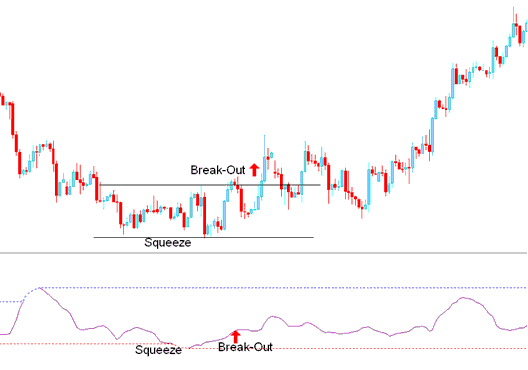

Break Out Signal After Band-width Squeeze

However, this is a directionless technical indicator and needs to be combined with another technical indicator like the Moving Average to figure out the direction of the price trend/ Break Out.

Learn More Topics and Guides: