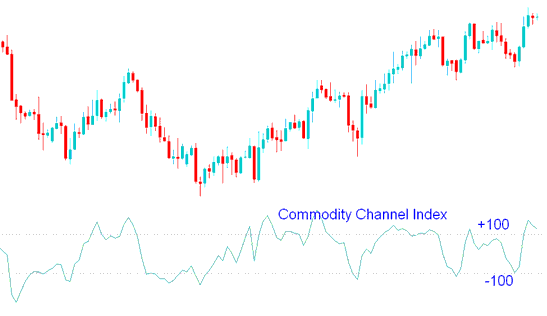

CCI Divergence Indicator

CCI is one of the often used divergence technical indicator. This indicator is an oscillator similar to the RSI and it can be used to trade divergence setup just the same way as RSI indicator.

CCI Gold Trading Analysis and CCI Signals

Commodity Channel Index measures the variation of a commodity price from its statistical mean(statistic average).

CCI is an oscillator that oscillates between high areas and low levels

When the CCI is high it portrays that price is unusually high compared to the average.

When the CCI is low it portrays that price is unusually low compared to the average.

CCI Divergence Indicator

CCI Divergence Technical Indicator

CCI Divergence Indicator

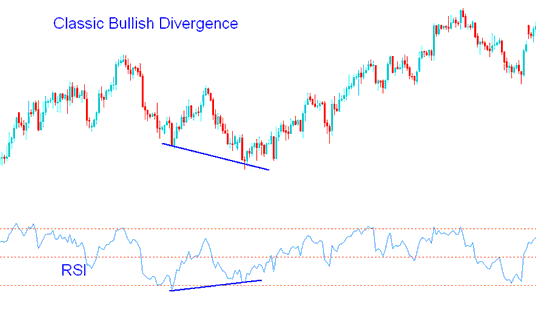

Classic CCI Bullish Trading Divergence

CCI classic bullish divergence setup occurs when price is making/forming lower lows (LL), but Commodity Channel Index CCI trading indicator is making/forming higher lows (HL).

Gold Classic Bullish Divergence - CCI Divergence Indicator

CCI classic bullish divergence warns of possible shift in the trend from downward to upward. This is because even though the price moved lower the volume of sellers that moved price lower was less just as is shown & illustrated by the CCI technical indicator. This signifies underlying weakness of the down-ward trend.

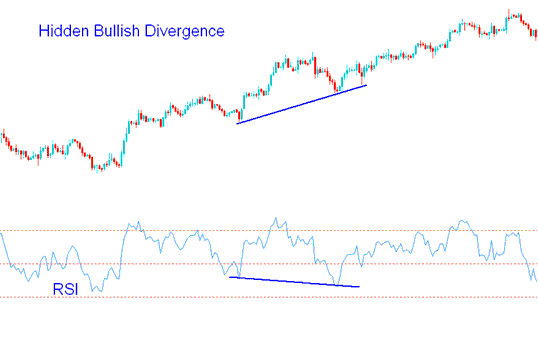

Hidden CCI Bullish Divergence Setup

Forms when price is making/forming a higher low (HL), but Commodity Channel Index is showing a lower low (LL).

CCI hidden bullish divergence occurs when there's a price retracement in an upwards trend.

Gold Trading Hidden Bullish Divergence Setup

This setup confirms that a pull-back is over. This CCI divergence shows underlying momentum of an upward trend.

CCI Divergence Technical Indicator

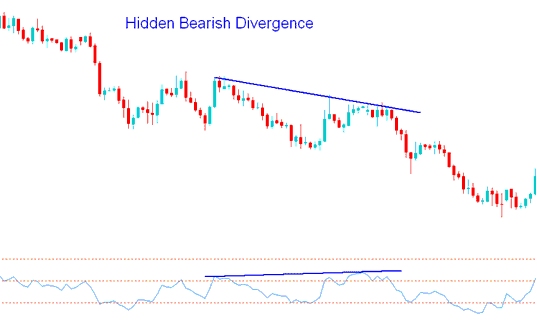

Hidden CCI Bearish Divergence Setup

Occurs when price is forming lower high (LH), but oscillator is showing higher high (HH).

Hidden bearish divergence trade setup occurs when there's a retracement in a downwards trend.

Gold Hidden Bearish Divergence - CCI Divergence Indicator

This setup confirms that a pull-back is over. This divergence shows strength of a downwards trend.

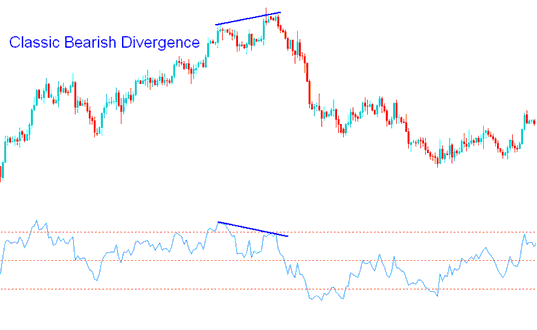

CCI Classic bearish Gold Trading Divergence

CCI classic bearish divergence occurs when price is forming a higher high (HH), but Commodity Channel Index is forming/making a lower high (LH).

Gold Classic Bearish Divergence - CCI Divergence Indicator

CCI classic bearish divergence warns of possible shift in the trend from upward to downward. This is because even though the price moved higher the volume of buyers that moved price higher was less such as shown & illustrated by the CCI technical indicator. This shows underlying weakness of the upward trend.

More Topics and Tutorials:

- Example of How to Generate Trading Signals with This XAU/USD Strategy

- What's Bid Ask XAU USD Price in XAUUSD Trading?

- How Do You Open a Real XAU/USD Account from MetaTrader 4 Trading Software?

- Is Aroon Oscillator Leading or Lagging Indicator

- How to Add Fibonacci Expansion Levels on Charts in MT4 Trading Platform Charts

- Three Steps To Help Improve Your Gold Results

- How Do I Set a StopLoss XAU/USD Order in MetaTrader 5 iPhone Gold App?