Continuation Setups

When these patterns that show a trend continuing are formed, they confirm that the current trend will keep going in the same direction.

These patterns are used by traders to spot half-way points of the trend, this is because they form at the half-way point of a trend.

There are 4 types:

- Ascending triangle

- Descending triangle

- Bull flag/pennant

- Bear flag/pennant

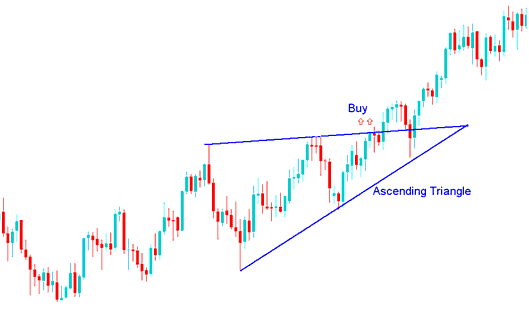

Ascending Triangle

The ascending triangle appears during an uptrend, showing that the market will probably keep moving in the same upward direction.

It shows a resistance area that buyers push higher each time. When it breaks, the price keeps going up.

Overhead resistance temporarily halts market progression higher, whereas the ascending trend line beneath the pattern formation suggests that the buyers remain active. An upward penetration of the upper line constitutes a trading buy signal for a market breaking-out from an ascending triangle formation.

In an uptrend, the ascending triangle shows up as a consolidation phase and usually means the rally will keep going.

During an uptrend, the market presented an ascending triangle pattern that continued upwards upon breaking out. The ideal buy point occurs when the price surpasses the upper sloping line and momentum carries it further.

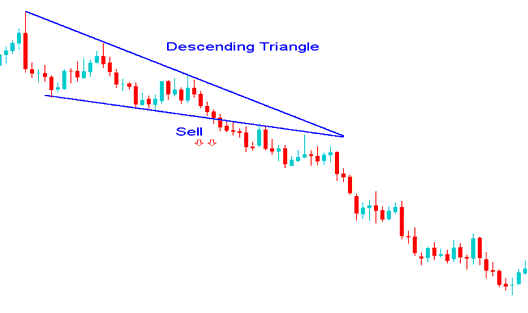

Descending Triangle

The descending triangle looks like a downtrend and shows that the price will likely keep going down.

It illustrates that there is a support area that the sellers keep pushing every time moving it lower, and once it breaks, the price will continue to move downwards.

Support temporarily stops the market from declining, while the descending sloping line above the pattern formation signals that the sellers are still present. A down-side penetration of the lower line is a trading sell signal for a market breaking out down from a descending triangle, and this shows selling will follow.

In a downward trend, a descending triangle pattern emerges as a consolidation phase within the decline. This typically indicates further downside continuation.

The market formed and assumed the shape of a descending triangle during its overall bearish phase, leading directly into further selling pressure and a continuation of the downtrend. A definitive technical sell signal is generated when the price breaks decisively below the lower horizontal boundary line, signaling a resumption of downward momentum.

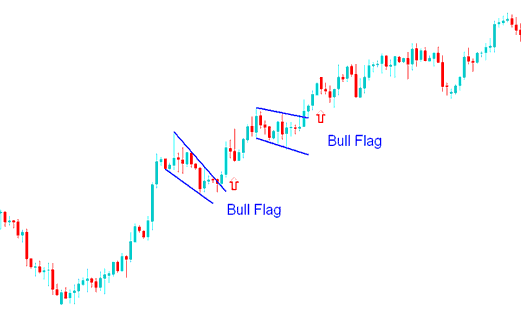

Bull Flag/Pennant

This setup looks like a box shape. Two even lines form it, serving as support and resistance until breakout. Flags often slope a bit, not stay flat.

The bull flag is found within a upwards trend. In this continuation pattern where the market price retraces a little, it is thence a slight retracement with narrow price action that has a modest downward tilt. The buy point is when price penetrates upper line of the flag. The flag portion has highs & lows that can be linked by small lines which are parallel, giving it what looks like a small channel.

The pennant shows up in the middle of an uptrend, and after it breaks, a similar move as high as the flag pole is expected.

The bull pennant observed earlier was merely a consolidation phase, allowing the market to gather enough momentum for an upward breakout. The continuation trading signal was confirmed once the upper boundary was breached.

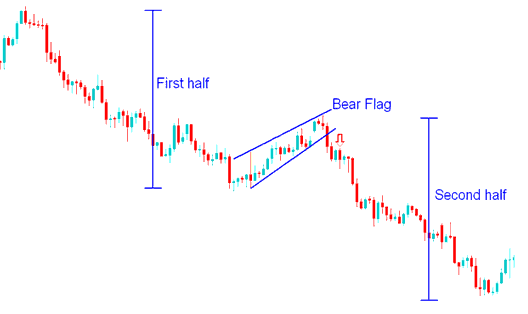

Bear Flag/Pennant

Bear flags appear in downtrends. This pattern continues the drop. Price pulls back a bit with tight action. It tilts up slightly. Sell when it breaks the lower flag line. The pennant links highs and lows with parallel lines. It forms a small channel.

The bear pennant above represented a period of rest for the market prior to further selling. The continuation trading signal was confirmed once the lower line was breached to the downside.

More Online Classes and How-Tos:

- Review of Options and Settings Available for MT4 XAU/USD Charts via the Tools Menu in MT4

- Defining the Concept of a Gold Practice Account

- How to Add Trading Bollinger Bands Indicator in Trading Chart

- Types of Leverage Ratio Course Tutorial

- How Can I Use Fibo Pullback Levels on the MT5?

- XAUUSD Price Action Patterns Using Moving Averages Indicator

- Setting Up Fibonacci Extension Levels on MT4 Platform

- How do you interpret the Linear Regression Acceleration indicator?

- XAU/USD Trend Indicators Free XAU USD Indicators of Buy & Sell XAU USD Signals

- Examination of Various Gold Bar Chart Types and General Bar Chart Formats in Gold Trading