MA Strategies

- Gold Price Period of MA

- SMA, Exponential MA Moving Average, Linear Weighted Moving Average(MA) and SMMA

- Moving Average Trend Identification

- MA Whipsaws in Range-Bound Markets

- MA Cross over Method

- Moving Average Support & Resistance

- How to Select & Choose a MA

- Short-Term and Long-Term Setups

- 20 XAU USD Pips Price Range Method

About the Moving Average(MA) Strategy

The Gold Moving Average stands out as one of the most frequently employed Gold Indicators due to its inherent simplicity and ease of implementation.

This Gold Indicator is a trend-following tool used by Gold traders for three specific purposes:

- Identify the starting of a new market trend

- Assess the sustainability of the new market trend

- Identify the ending of a trend and signal a reversal signal

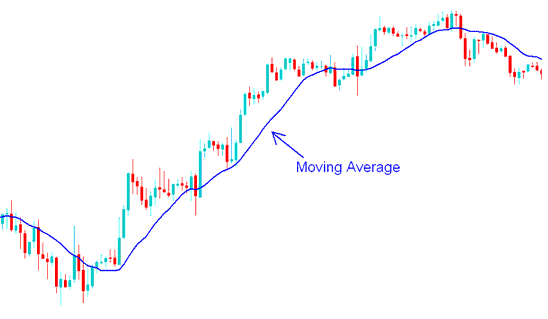

The Moving Average(MA) or MA is used to smooth out the volatility of price action. The Moving Average(MA) is an overlay indicator & it is placed on top or super-imposed on the price chart.

In the chart below, the blue line shows a 15 period MA, which makes the price action's ups and downs less intense.

Gold MA Indicator - MT4 Gold Chart Indicators

Calculation of the Moving Averages(MA)

The Moving Average, also known as MA, is determined by calculating the arithmetic mean of the market price derived from the most recent price figures.

If the Moving Average(MA) uses the 10 period to calculate the average mean of the price then it is known as to as a 10 period gold trading moving average, because most traders use the day as the standard trading price period we shall just refer to it as the 10 day Moving Average.

To calculate the ten-day Moving Average, the prices from the preceding 10 days are averaged: this moving average trading indicator is then perpetually adjusted following the conclusion of each new trading price period. Consequently, after a new pricing period concludes, the moving average is recalculated using the most recent 10 periods of gold trading prices: this constant recalculation based on updated price data is why it is termed a Moving Average (MA).

Explore Further Training & Manuals:

- What is the Way to Mark a Falling XAUUSD Path in MetaTrader 5?

- Pivot Points Technical XAU USD Technical Indicator Analysis

- A Guide to Trading Based on Sell Signals from the DeMark Projected Range Indicator

- Where Do I Study How to Trade in MetaTrader 4 App illustrated?

- How to Analyze/Interpret XAU/USD Analysis Charts Using Gold Trends

- How to Analyze/Interpret XAU/USD Trend Channels in MT4 Platform Software

- How to Draw Downward XAUUSD Trend-line in MT4 Platform Software

- How Do I Trade the Difference between Sell Stop XAU/USD Order & Buy Stop XAU/USD Order?

- How to Draw Trend-line in XAUUSD Chart