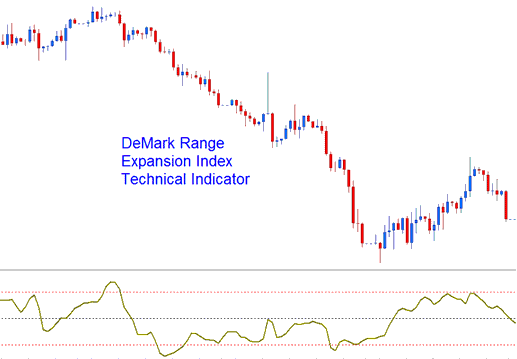

DeMarks Gold Analysis & Range Expansion Index Signals

Created by Tom DeMark.

DeMark used the Range Expansion Index to trade options, in his trading strategy. This trading indicator is an oscillator indicator.

DeMarks Expansion Index for Ranges

This Oscillator Indicator serves as a market timing tool designed to address the limitations of exponentially calculated oscillators. By using arithmetic calculations, it reduces lag compared to traditional technical indicators.

Gold Analysis & Generating Signals

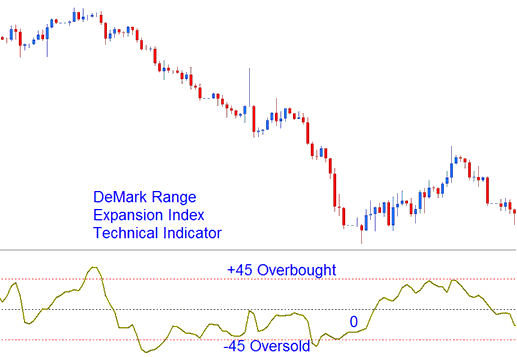

This Oscillator Technical typically oscillates between the values of -100 to +100.

Over-bought Levels - Readings of +45 or higher indicates overbought conditions.

Indicating Deeply Depressed Market Sentiment - Readings at or below -45 signal that the asset is in an oversold condition.

Over-bought & Oversold Levels on Indicator

Regarding exit signals, DeMark advises against trading in extreme overbought conditions marked by six or more bars above +45. A buy signal exit is typically triggered six bars after the price tests or touches +45.

Exit Signals - If the market is extremely oversold, shown by 6 or more bars below -45, it's time to exit or stop short trades.

Study More Lessons: