Draw Down & Maximum Draw Down in Gold Trading

In the pursuit of profit within XAUUSD trading, a trader must master risk management. Achieving profitability necessitates understanding the diverse gold risk management techniques detailed within this Gold educational resource on this website.

Effective trading requires managing potential risks and losses. Adhering to money management rules not only protects your account but also helps achieve long-term profitability.

Draw-down

As traders, the main risk is known as drawdown, which is the amount of money lost in your account on a single gold trade.

If you have got $10,000 capital & you accrue a loss in one trade position of $500 dollars, then your draw down is $500 divided by $10,000 dollars which's 5 % draw-down.

Maximum Draw-down

This is the total amount of money you've lost in your account before you start & begin earning profitable trade transactions. For example illustration, if you have $10,000 capital & make five consecutive losing trades with a total of $1,500 loss before making 10 winning trades with a sum total of $4,000 profit. Then draw-down is $1,500 divided by $10,000 dollars, which is 15 % maximum drawdown.

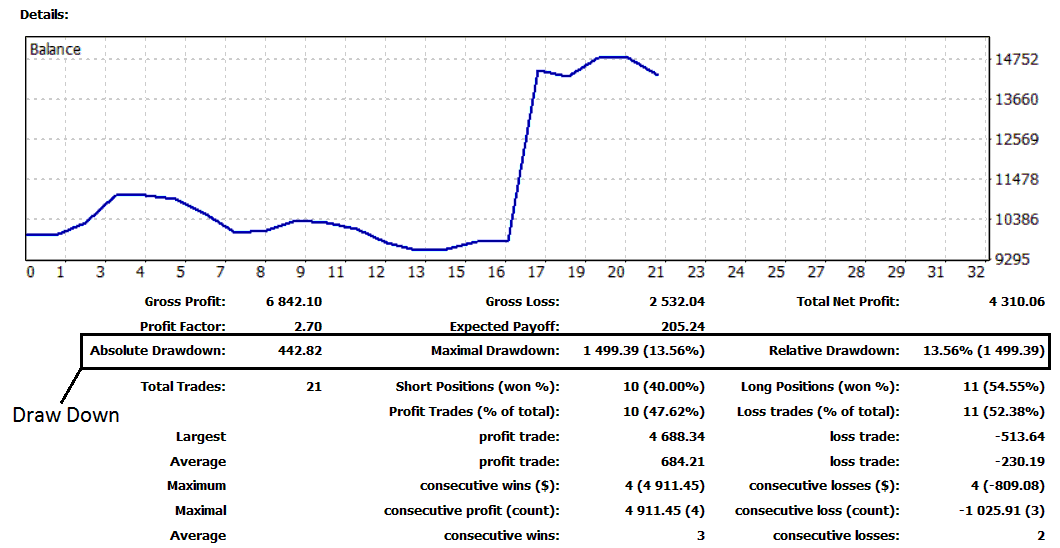

Draw Down is $442.82 (4.4%)

Maximum DrawDown is $1,499.39 (13.56%)

To learn how to generate the above trade reports using MT4 platform: Generate Reports in MT4 Lesson

XAU/USD Capital Management

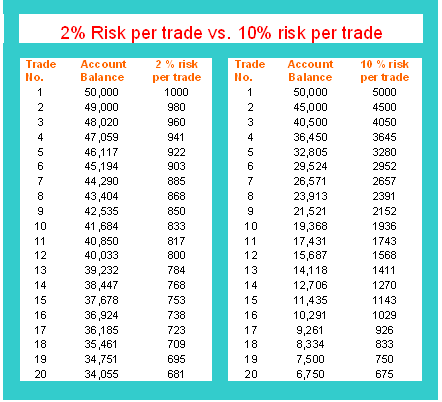

The illustrations illustrated & described below shows the contrast between risking a small % of your trading capital compared to risking a higher Percentage. Good investment principles requires you as a investor not to risk more than 2 percent of your total equity.

Percentage Risk Strategy

2 percent & 10 percentage Risk Rule

There is a big difference between risking 2 percentage of your equity compared to risking 10 % of your equity on a single transaction.

Let's say you hit a rough patch and lost 20 trades in a row, risking 10% of your account each time. If you started with $50,000, you'd end up with just $6,750. That's a loss of over 87.5% of your equity.

A 2% risk would leave you with $34,055. That's just a 32% hit to your account. Stick to the 2% rule for better results.

The difference between risking 2% and 10% is that if you only risked 2%, you would still have $34,055 after 20 trades where you lost money.

Risking 10% of your account leaves you with just $32,805 after five losses. That's less than if you risked only 2% and lost all 20 trades.

The key thing is to create rules so that even if you have times when you lose money, you still have enough money to trade the next time.

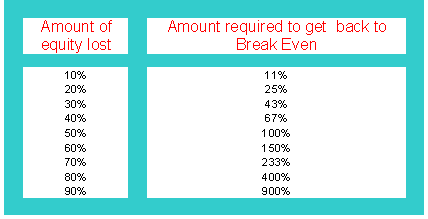

Losing 87.50% of your trading capital requires an overwhelming 640% profit just to recover back to break-even point - a stark reminder of high-risk trading consequences.

As compared and analyzed to when if you lost 32 percentage of your trading capital you'd have to make 47 % profit just to get back to the break even. To compare it with the example illustration 47% is much easier to break-even than 640 % is.

The chart shows the gain needed to break even after losing a percent of your trading funds.

Concept of Break Even

Account Equity & Break-Even

Facing a 50% drawdown, a gold trader would need to achieve a 100% return on their employed trading capital just to regain their initial investment - a feat managed by fewer than 5% of traders globally, when dealing with an account that has sustained a 50% loss.

Facing an 80% drawdown requires quadrupling equity simply to return to baseline values - this is referred to as "breaking even," where the account balance is restored to its initial deposit amount.

The more you lose, the harder it's to make it back to your initial account size.

This underscores the imperative for a gold trader to prioritize the PRESERVATION of capital above all else. Never consent to risk exceeding 2 percent of your total trading equity on any single transaction.

Gold risk management means risking only a small part of your capital per trade. This helps you handle losses and avoid big drops.

When trading XAUUSD, traders use stop losses to limit how much they can lose. Managing risk means putting a stop order in place after making an order.

Effective Money Management in Gold Trading

Effective money management requires controlling all the risks. A trader should come up with a clear gold risk management system & a plan. To be in Gold or in any other biz you must make decisions involving some risk. All aspects should be measured to keep risk to a minimum & use the above tips on this course.

Learn More Lessons and Courses:

- Identifying XAUUSD Trading Signals Triggered by MACD Fast Line and Centerline Crossovers

- Gaining Proficiency in Trading Operations within the MetaTrader 4 Software

- Trading with the Linear Regression Acceleration Indicator

- XAU USD System for 1H Candle Breakouts

- How do you set up the Gold CCI indicator on a trading chart?

- Analyzing the Bollinger Bands Indicator

- Combining Stochastic Indicator with Other Gold Trading Indicators

- MetaTrader 5 Gold Platform: Web Lesson Guide

- Trade Gold with Candlestick