Divergence Trading Setups

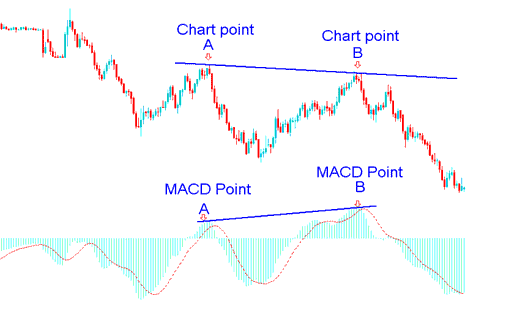

Divergence represents a common trading configuration employed by market participants. It involves scrutinizing a gold chart alongside one additional technical indicator: for demonstration, the MACD indicator will be utilized.

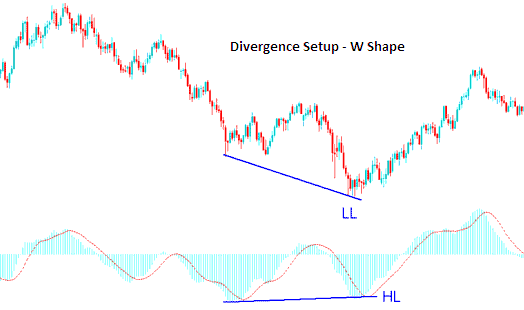

To identify this particular configuration, locate two chart points where the price establishes a new swing high or a new swing low, yet the MACD technical indicator fails to confirm this movement, thus revealing a divergence between price action and momentum readings.

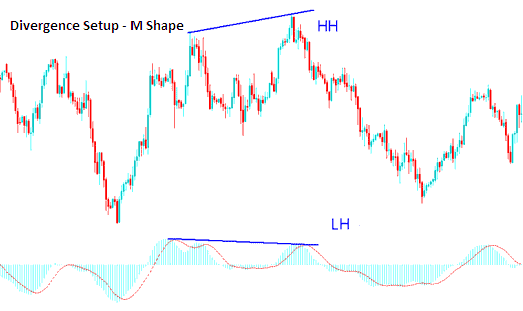

When looking for divergence setups, identify two highs forming an M-shape or two lows forming a W-shape on the chart. Then, find similar shapes in your preferred trading indicator.

Example of a Divergence Trading Setup:

On this chart, points A and B mark swing highs. They create an M shape.

Then using MACD indicator we check highs made by MACD, these are highs which are directly below Chart points A & B.

We then draw one line on the trading chart and another line on MACD.

Drawing Divergence Gold Trading Lines

The graphic above illustrates one of four distinct divergence types: specifically, this is the hidden bearish divergence, recognized as a prime configuration for trading. Further details on divergence types will be explored in the subsequent educational material.

How to spot divergence

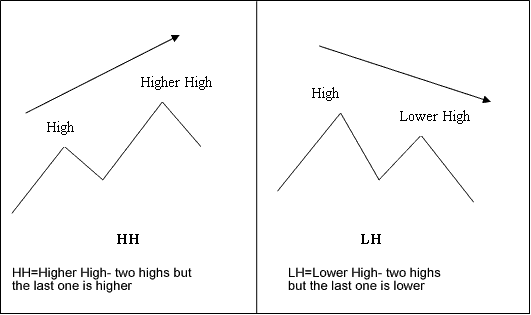

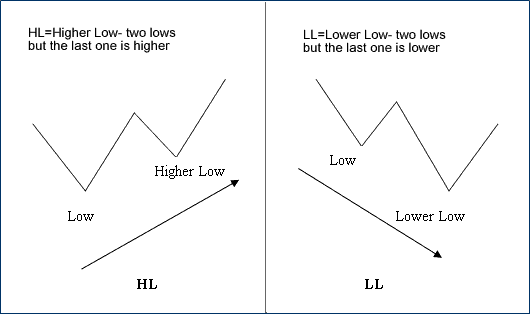

In order to spot Gold divergence setup signal we check for the following:

- HH = Higher High - 2 highs but the last is higher

- LH = Lower High - 2 highs but last one is lower

- HL=Higher Low : 2 lows but last one is higher

- LL = Lower Low - 2 lows but the last one is lower

First let's look at the illustrations of these terms:

M-shapes dealing with price Highs

W Shapes dealing with XAUUSD Gold price lows

Example of M-Shapes

Examples of W-Shapes

Now that you know divergence basics, check the two types. Learn to trade these chart patterns.

The two types are:

- Classic Gold Trading Divergence

- Hidden Gold Trading Divergence

These two setups are described on following tutorial guides below

Study More Tutorials & Topics:

- Fibonacci Expansion Levels on Gold Charts: How to Show Fibonacci Expansion On XAUUSD Trends

- Going Long on XAU/USD: What Does That Actually Mean?

- Gold for Beginner Traders: Setting up Gold Demo Account on MetaTrader 4 Software

- How to Use the Gann HiLo Activator for Buy Signals in Forex

- Setting Up Classic Divergence

- Get price information for MT4 charts using the MT4 data history center in MetaTrader 4's tools.

- Gold Leverage and Margin: Explanations and Examples