Trading Do Swing Trade with Different Chart Time Frames?

15 Minute Swing Strategy Guide

Swing Traders

This swing trading group holds on to their trades for a few days to a week. With the aim of making a large number of pips, 100 to 400 pips.

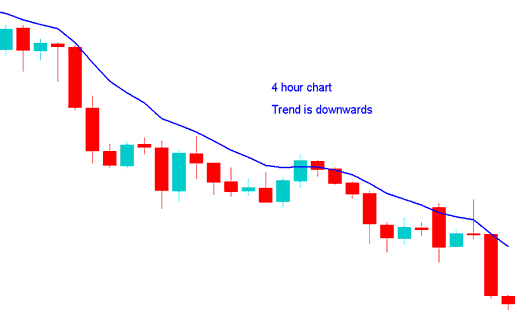

Swing trader using 1H chart chart time frame wants to go short, checks 4H chart chart time frame, which looks like the example illustrated & explained below, since 4 hour highlights the trend is moving down, then decides from the technical analysis it is okay to sell.

Gold Swing Trading on Multiple Charts - Chart Time Frames - 15 Minute Swing Strategy PDF - 1 H Swing Strategy - Gold 4 H Swing Trading Method

Gold Swing Trader traders using analysis use charts to try and attempt to predict the movement of price on the charts.

Gold Swing traders will sometimes use two or more chart time frames so as to determine the longterm gold trend and short term trend.

How to Define A Gold Price Trend for Swing Trading

Using a system that has Three indicators - MA Cross Over System, RSI and MACD and using simple trading rules to define the trend. The trading rules are:

Upwards Gold Trend

Both MAs Moving Up

RSI above 50

MACD Above Centerline

Down-wards Trend

Both MAs Moving Down

RSI below 50

MACD Below Centerline

Multiple charts time frames analysis equals using 2 chart time frames to trade xauusd - a shorter chart time frame used for trading and a longer chart time frame to check the trend - chart time frames that you choose for trading price action with will depend on the type of trader you're: for Swing Traders the chart time frames used for trading will be example of 1 hour chart time frame and 4 Hour chart time frame.

Since it is always good to follow the trend when Swing Trading, in Multiple Chart Timeframe Analysis, the longer 4 H chart time frame gives us the direction of the longterm gold trend when Swing trading using the 1 H Gold Chart Timeframe.