How Can I Interpret Chart Pattern Break-out?

A breakout setup is triggered upon the conclusion of a consolidation phase, when the price decisively moves beyond that range, commencing a directional journey that establishes a pronounced trend.

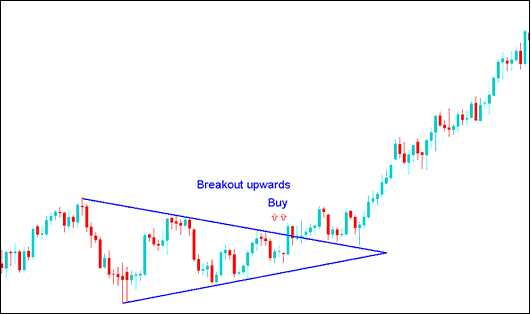

Trading Interpret Bullish Pattern Break-out

The price can go above a certain point and start moving upwards, which creates a bullish upward price trend. After the market goes above this point, it will usually keep moving in that direction for a while. Once it's clear that the price has broken out of the consolidation pattern on the upward side, the prices will likely stay bullish.

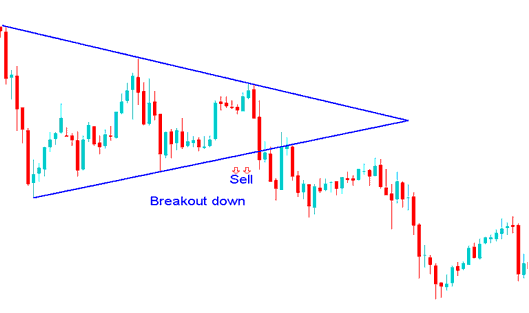

Interpret Bearish Pattern Break-out

The price can breakout to the down side & starts heading in the downward direction thence forming a bearish downwards price trend. After the market breaksout in the downward direction the market will continue moving in that given direction for quite a period of time. Once consolidation pattern downward side break out is confirmed the prices will remain bearish.

It's advisable to wait for price confirmations that break out of a consolidation pattern and move decisively in one direction before initiating any trades - whether buying or selling.

Reading Bullish Pattern Breakouts

Reading Bullish Pattern Breakouts

Discover More Subject Areas & Instructional Material:

- How Do I Identify XAUUSD Upward Trend in XAUUSD Charts?

- Bearish Reversal Candlestick Patterns: A Detailed XAU/USD Course

- How to Analyze/Interpret Fibo Extension Levels Trade XAU USD Strategy

- Triple Exponential Average TRIX XAU/USD Indicator Analysis

- MT4 XAUUSD Platform Download and MT4 XAUUSD Software Installation Guide Tutorial

- How Can I Read Bollinger Bands Indicator?

- How to Place Gold CCI in Your Chart?

- Day XAU USD Strategies Guide

- How to Set Pending Gold Order on MT4 Software Platform

- Learn XAU/USD Tutorial Lesson for Beginners