Shooting Star Candlesticks Pattern

Shooting Star Candlesticks Pattern

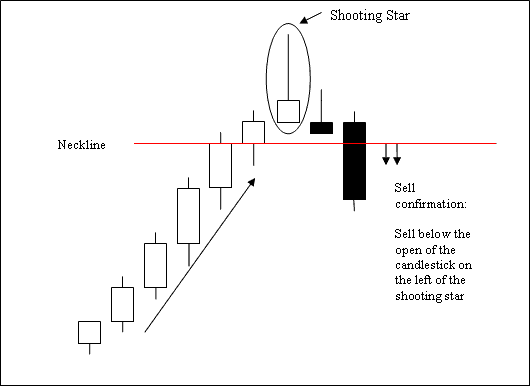

The Shooting Star Candles Pattern is a setup that suggests prices will go down. It happens when the market is going up.

The Shooting Star Candlestick Pattern typically forms at the peak of an upward trend, beginning when the opening price equals the lowest price. The price then rallies before being pushed back down to close near its opening value.

Reversal Candlestick Patterns: Evaluating the Shooting Star Candle Pattern – Setups for Bearish Candlesticks.

Trading Analysis of Shooting Star Candles Patterns

A sell confirmation is achieved when a candlestick concludes beneath the neckline of this Shooting Star pattern: this neckline corresponds to the opening price of the candle immediately to the left of the pattern formation. In this specific context, the neckline functions as a support zone.

Stop Loss placements for sell trades ought to be situated a few pips above the most recent peak price.

The Shooting Star candles is named & called so because at the top of an upwards trend this candlesticks pattern setup formation resembles and looks like a shooting star up high in the sky.

Learn More Lessons & Topics:

- Introduction to MT5 Platform Interface Course Tutorial

- The Best Set of Indicators to Use Together for Gold Analysis.

- What's the best way to trade XAUUSD price consolidation in gold trading?

- Explaining XAU/USD Gold Margin Calls and Their Implications

- Technical Analysis: Using the McClellan Oscillator to Find Buy Signals

- How can I use a buy stop XAUUSD order on the MetaTrader 4 Software or Platform?

- What are the Trading Hours for Gold?

- Strategy for Trading Fibonacci Expansion Levels

- How do you put in place Fibonacci expansion levels in MT4 Software/Platform?

- How to Build a XAUUSD Strategy Using a Gold Plan