Trading Predict Candles Patterns Trend Reversal

Predicting Trend Reversal Signals with XAUUSD Candle Patterns

Trend reversal setups using Candlesticks Setups are used to predict trend reversals using Candlesticks Pattern Setups.

Candle Patterns that show a trend change are used to tell when the current direction of the market might change and start going the other way.

There are different ways traders use Gold Candles Patterns to guess when the price direction might change the other way.

Among the different Gold Candles Pattern Setups - gold reversal setups used to find when trends might change in xau/usd trading are:

Candlesticks Reversal Setups

Reversal candlesticks patterns help create signals that show when a trend might change direction. By using candles, traders try to guess when trends will reverse based on different candlestick patterns.

candles reversal patterns are:

- Hammer Gold Reversal Candle Pattern

- Hanging Man Reversal Candle Pattern

- Inverted Hammer Gold Reversal Candle Pattern

- Shooting Star Gold Reversal Candle Pattern

- Piercing Line Gold Reversal Candle Pattern

- Dark Cloud Cover Gold Reversal Candle Pattern

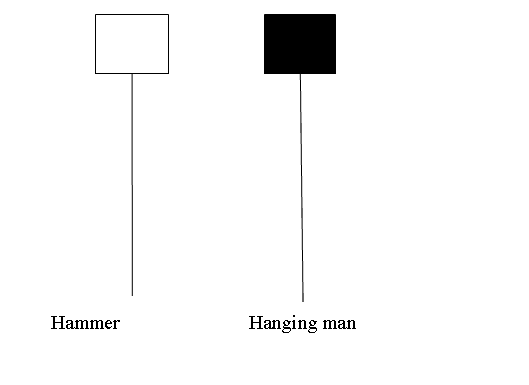

Reversal Pattern Analysis: Comparing the Hammer Candlestick Pattern with the Hanging Man Candlestick Pattern

The Hammer Candle Pattern and Hanging Man Candlestick Pattern exhibit very similar visual structures, but the hammer signals a bullish reversal candlestick formation, whereas the hanging man indicates a bearish reversal candle pattern.

Hammer Candle Pattern and Hanging Man Candle Pattern - Reversal Candle Pattern - Predict Candlesticks Pattern Setups Trend Reversal

Hammer Candlestick Reversal Candle Pattern

Hammer candle-sticks pattern setup formation is a potentially bullish reversal candlestick pattern that forms during a downward trend. It's named and called so because the price is hammering out a market bottom.

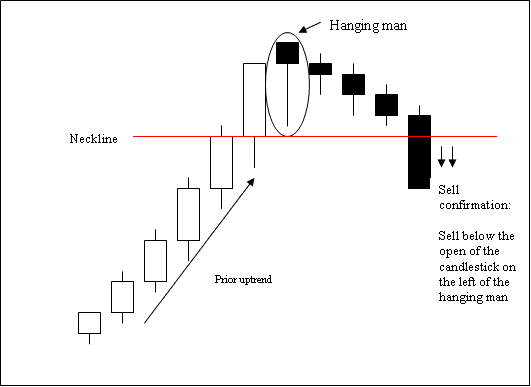

Hanging Man Candle Reversal Candle Pattern

The hanging man candlestick pattern is a potential bearish reversal signal that emerges during an upward trend. Its name stems from its appearance, resembling a man suspended on a noose.

Hanging Man Candle Pattern - Reversal Candle Pattern - Predict Candlesticks Pattern Setups Trend Reversal

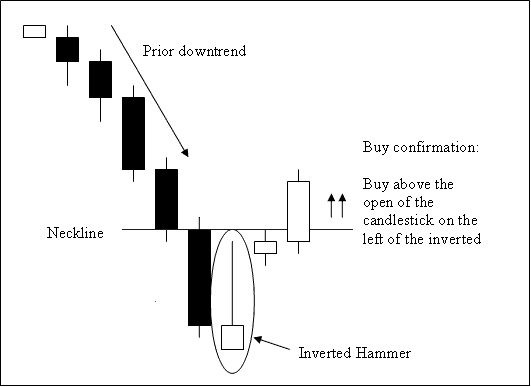

Inverted Hammer Candle-stick Reversal Candle Pattern

This setup forms a bullish reversal candlestick pattern, typically appearing at the lowest points of an XAUUSD trend.

The inverted hammer candle pattern pops up at the bottom of a downtrend and hints that a reversal in gold's downward move could be coming.

Analysis of the Inverted Hammer Candlestick Pattern - A Reversal Candle Pattern used for Predicting Candlestick Setups that Signal Trend Reversal.

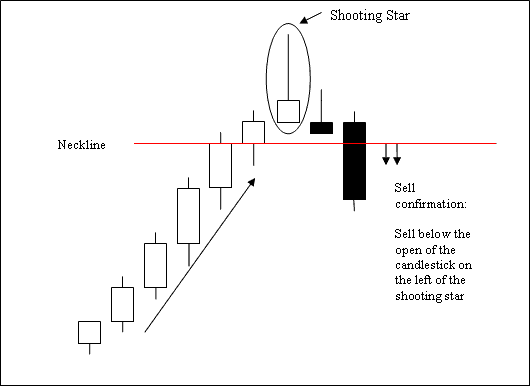

Shooting Star Candle Reversal Candle Pattern

The Shooting Star Candle configuration indicates a bearish reversal pattern, commonly observed forming at the apex of a price trend.

The Shooting Star candlestick pattern typically forms at the peak of an upward price trend when the opening price is similar to the low. Prices rally upward but are eventually pushed back downwards, closing near the opening level.

Shooting Star Candlestick - A Reversal Pattern Used to Forecast Potential Trend Changes via Candlestick Setups.

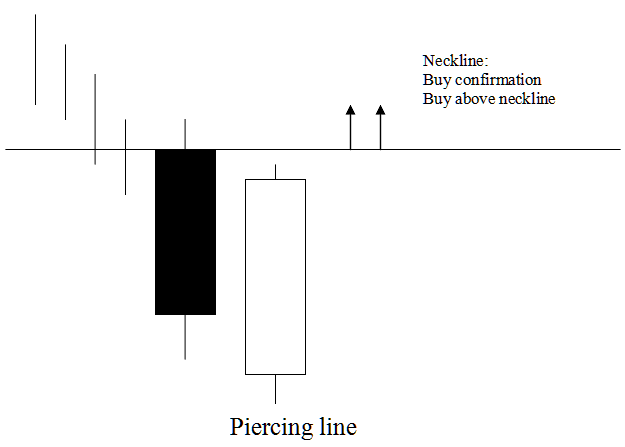

Piercing Line Candle-stick Reversal Candle Pattern

The piercing line candlestick pattern consists of a long black body followed by a long white body candlestick.

The white body pierces the midpoint of the prior black body.

This Piercing Line candlestick formation represents a bullish reversal pattern observed at the nadir of a price downtrend. It signifies that the asset opened at a lower price point but concluded above the center point of the preceding dark candle's body.

The Piercing Line candlestick pattern indicates that the strength of the negative trend is waning or diminishing, and that the trend is about to turn and go upward.

This Piercing Line candles pattern setup formation is shown referred to & known as a piercing line signaling the price is piercing the bottom showing a market floor for price down-ward trend.

Piercing Line Candle-stick Pattern - Reversal Candle Pattern - Predict Candlesticks Pattern Setups Trend Reversal

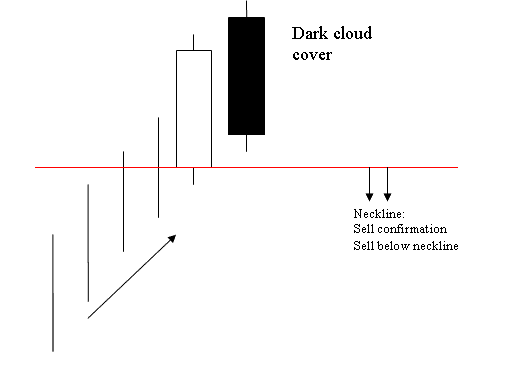

Dark Cloud Cover Candle Reversal Candle Pattern

Opposite of piercing candlestick candlestick.

This candlestick stick is a long white body followed by a long black body.

Black body pierces the mid-point of the prior white body.

This is a bearish reversal pattern that forms at the top of an upward trend.

The Dark Cloud candlestick pattern means the price starts higher but ends lower than the middle of the previous white candlestick.

Dark Cloud candlesticks pattern shows that the power of the upward trend is reducing/decreasing and price trend is likely to reverse and move in a downward xauusd trading direction.

The pattern made by Dark Cloud candles is known as cloud cover, which suggests the cloud acts like a limit for the price going up.

Dark Cloud Cover is a reversal pattern in candlesticks. It signals trend changes.

Guessing Gold Candles Patterns Trend Changes - Guessing Gold Candles Patterns Gold Trend Reversals - How to Spot When Candlesticks Patterns Show a Trend Change

More Guides & Tutorials:

- How Do You Trade the Difference between XAUUSD Stop Entry Gold Order and Stop Loss XAU/USD Order?

- Trading Gold Price Retracements Strategically

- Which XAUUSD Broker is the Best for Starting a Cent Account?

- T3 Moving Average XAU/USD Indicator Technical Study

- Adding instant market execution orders for Gold in MetaTrader 5 explained.

- Risk Management Tactics in Gold Trading