How to Trade a Down trend Reversal

How to Identify a Downwards Trend Reversal: Recognizing Downward Trend Reversal Trading Signals.

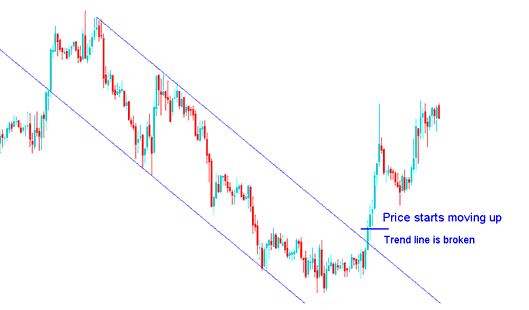

Down trend Gold Reversal

Should the trading price breach above a downward trend line (acting as resistance), an upward price movement is anticipated.

Trade Downward Trend Turns: Spot Reversal Signals in Down Trends

Down Trendline Break

After a long downtrend, price stops falling. It breaks the downtrend line. Traders see this as a reversal from the downtrend.

Because the downward trendline stops the price from going higher and it has been broken, we think the price will go up in the opposite direction, which means the downtrend is likely to reverse.

When this situation arises, traders will finalize the open gold sell positions they previously established. This action is termed profit realization.

A higher low confirms this downtrend flip signal. The setup lets traders buy once the downtrend line breaks. That break signals the trend reversal.

Note that when an asset breaks its downtrend, it might consolidate briefly before moving in the opposite direction. It's advisable to place take-profit orders during such reversals.

As a trader, when engaging with this downtrend reversal setup, it is essential that upon initiating a new trade aligned with the market trend reversal, the price should promptly move upward in that specific direction, exhibiting a breakout pattern. This indicates that prices should rise immediately in the direction of the reversal setup with minimal resistance.

If prices do not rise right after a breakout, close the buy trade. This shows the downtrend still controls the market.

Another helpful hint is to wait for the line that shows the downward trend to break and for the market to close above it, confirming the trend is changing.

Often, traders open positions hoping for a turnaround even before the downtrend breaks, only for the price to hit the downtrend line. Then, the downtrend continues, and gold keeps going in the same direction it was already going.

When you're trading a downtrend reversal, it's best to wait until you see confirmation - a price close above the trend line - before jumping in.

- Downward Price Trend Direction Reversal - this down trend reversal is confirmed once the price closes above the downward trendline, this should be the right time to open a buy trade, so as to avoid a trade fake out.

More Guides & Tutorials:

- How do you start XAU/USD trading with a micro account?

- Gold Trading Lessons for Beginners

- Trading Techniques Using XAUUSD Analysis

- Identifying When an MA Indicator Causes XAU/USD Chart Support to Become Resistance and Vice Versa

- Establishing Principles: Developing Effective XAUUSD Risk Management Guidelines

- What are the 6 Different Types of Candlestick Patterns Seen When Trading Gold?

- Setting Stop-Loss Orders for XAU/USD in MetaTrader 5 Platform

- Gold MACD Centre Line Cross-over Signals Best XAU USD Strategy

- Top XAU/USD Indicators – Intraday Gold Trading Picks