MACD Strategy

- MACD Fast Line Versus Signal Line

- Buy and Sell Signals from MACD

- MACD Whip-saws Fake-Out Trading Signals

- Spotting Center-Line Crossover Trade Signals

- Exploring Classic Bullish & Bearish Divergence Via MACD

- How to Spot Hidden Bullish and Bearish Divergence with MACD

- Summary of MACD Indicator

Bullish and Bearish Trading Signals

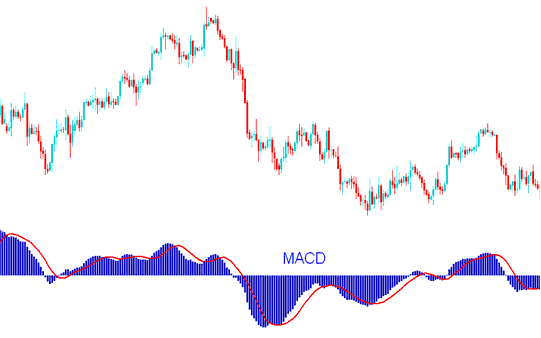

The MACD indicator is one of the most widely used tools in technical analysis. It combines momentum oscillation with trend-following characteristics to guide trading decisions.

MACD technical indicator is one of the most popular indicators used in analysis. MACD indicator is used to generate signals using cross overs.

MACD shows how moving averages(MAs) are coming together or moving apart. The MACD indicator is created using Moving Average calculations. MA Convergence/Divergence is an indicator that helps traders follow trends. The MACD indicator shows the relationship between two moving averages.

One Moving Average is Calculated Using a Shorter Lookback Period, While the Other Uses a Longer Period of Price Data.

MACD - MACD Technical Analysis

MACD indicator has a zero centerline: values above the zero line are bullish while those below the zero are bearish.

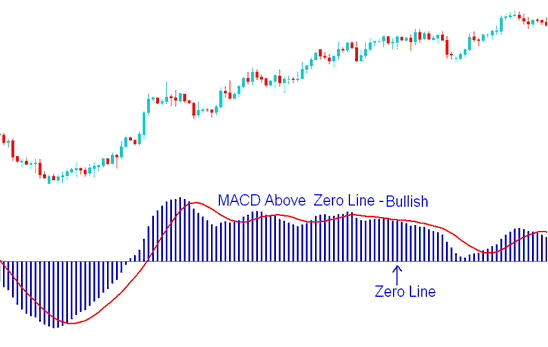

When an uptrend is in progress, the shorter MACD line accelerates its ascent relative to the longer MACD line, resulting in a separation between them. Furthermore, as long as the MACD indicator remains above the central line, the prevailing trend maintains its bullish characteristic, as illustrated below.

Refrain from selling while the MACD remains above the Center Line Mark: this signifies a bullish zone, and its movement is irrelevant as long as it stays above the zero center mark, as illustrated and detailed in the example below.

MACD Above Zero Mark - Bullish Trading Signal

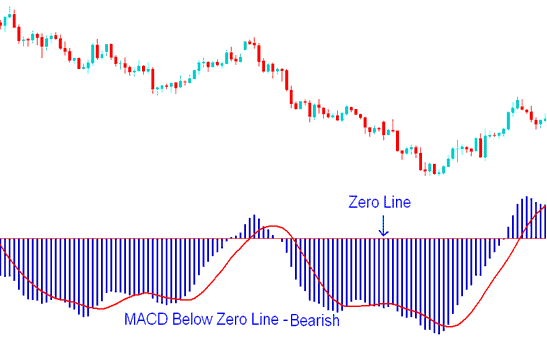

During a bearish trend, the shorter MACD line descends more rapidly than the longer one, creating a visible gap. As long as the indicator stays below its center line, the downward trend remains intact.

Purchasing should be avoided as long as the MACD is located beneath the Center Line Mark: this region is inherently bearish, and its movement is irrelevant so long as it remains below the zero centerline marker, as illustrated and detailed in the example below.

MACD Below Zero Center-Line Mark - Bearish Signal

When a trend reversal is imminent, the MACD lines begin to converge, thus closing the gap between them.

More Tutorials & Topics: