Meta Trader 4 Margin Calculator

Examples of How to Calculate Margin in the MT4

If leverage = 100:1

1,000 / 100,000 * 100= 1%

Margin required = 1 %

(1/100 *100= 1%)

"Forex Trading Explained: Please simplify, as I am new to this."

Simplified: If your gold equity is $1,000 and with leverage you control $100,000, the margin requirement is 1%. This equals your XAU/USD margin requirement based on the account balance.

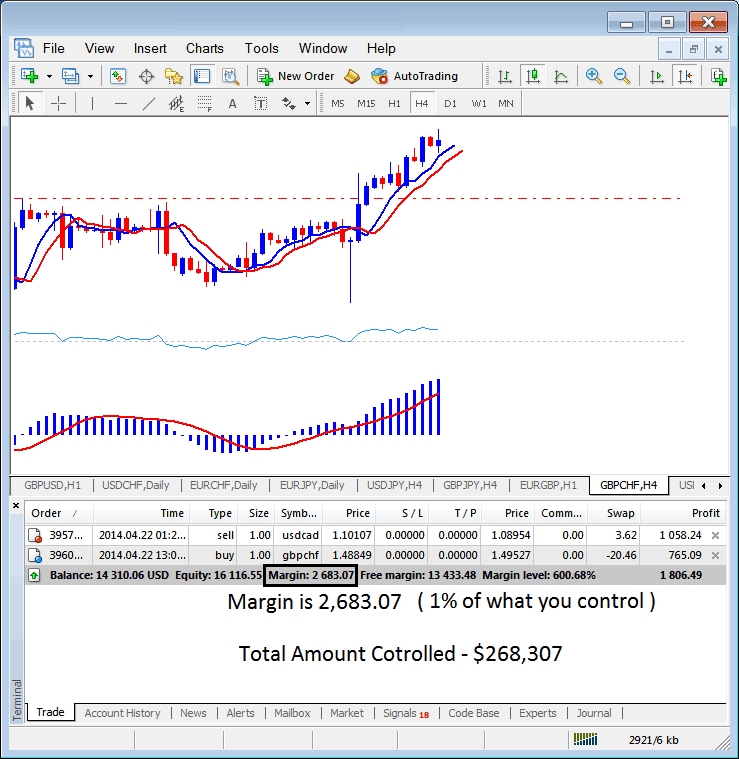

Considering the margin calculation example for XAU/USD on the MT4 Platform below, with a leverage setting of 100:1, the required Gold margin, which equates to 1 percent, is $2,683.07. Therefore, the complete investment size controlled by the Gold trader amounts to $268,307. This is because, thanks to the leverage option, the trader utilized only a small portion of their personal funds and borrowed the remainder. With the leverage set at 100:1, the Gold trader is effectively controlling 1% of their capital, where this 1% equals $2,683.07: consequently, if 1% equals $2,683.07, then 100% equals $268,307.

Meta Trader 4 Margin Calculator

- If = 50:1 Leverage - Used Leverage and MT4 Margin Calculation

The margin requirement for xauusd on the MT4 Software Platform is calculated as 1/50 * 100 = 2%.

Should your available capital be $1,000,

1,000* 50 = $50,000.

1,000 / 50,000 * 100= 2 %

(To put it simply: your $1,000 in gold equity, amplified by leverage, means you now control $50,000. $1,000 is what percentage of $50,000? It's 2%.) This figure represents your required gold margin within the MT4 Platform Software.

- If = 20:1 Leverage Option - Used Leverage & Meta Trader 4 Margin Calculation

Consequently, the margin requirement for Gold trading on the MT4 Software Platform calculates as 1/20 * 100, equaling 5%.

If you have one thousand dollars,

1,000* 20 = $20,000.

1,000 / 20,000 * 100 = 5 percent

(To simplify: your $1,000 in gold equity, leveraged to control $20,000. $1,000 is what percentage of $20,000? It's 5%.) This figure is your required gold margin within the MT4 Platform Software.

- If = 10:1 Leverage - Used Leverage and MT4 Margin Calculation

Then the xauusd margin on MT4 Platform Software requirement is = 1/10 *100= 10%

Should your available capital be $1,000,

1,000* 10 = $10,000.

1,000 / 10,000 * 100= 10 %

(Simplify - your gold equity is $1,000 dollars after leverage you now control $10,000 - $1,000 is what % of $10,000 - it is 10%) that's your gold margin requirement in MT4 Platform Software

Clarification of XAUUSD Leverage: Differences Between Maximum and Currently Used Leverage

Keep in mind the gap between top borrowing power from your gold broker and what you actually use based on open trades in MT4. The first comes from the broker's limit. The second depends on your position sizes. Here's how it works with our gold example.

If your online broker gives you the option of 100:1 Maximum Leverage, but you only make a trade of $10,000 on the MT4 Platform, here is the Leverage Used:

$10,000 dollars: $1,000 (your money)

10:1

you may have used 10:1 Leverage in MT4 software Platform, but your max leverage is still one hundred:1 Leverage. which means that even in case you are given a hundred:1 maximum Leverage option or four hundred:1 maximum Leverage alternative, you don't need to use it all. it is fine to hold your used buying and selling leverage to a most of 10:1 whilst trading on MT4 software program Platform but you'll nonetheless pick out 100:1 most leverage ratio on your account. The extra buying and selling leverage will come up with as a dealer what we name unfastened Gold Margin at the in MT4 Platform software, as long as you as a dealer have loose margin in your MetaTrader four account then your open trade transactions might not get closed with the aid of your xauusd broker because this margin requirement will remain above the specified level on the MetaTrader four software Platform.

In gold trading, one important rule: keep your leverage below a 5:1 ratio as part of your money management plan.

In the above MT4 trading screen shot example, the gold trader is using $2683.07 dollars, total controlled amount is $268,307 dollars, but account equity is $16,116.55, therefore used leverage is ( $268,307 divided by $16,116.55 ) = 16.64 : 1

Leverage Option Utilized: 16.64 : 1

With leverage, traders can manage a large number of trading units with just a small portion of their own funds and the remainder borrowed through Gold Margin accounts.

Securing this MetaTrader 4 account will grant you the ability to access borrowed funds from the online brokerage for trading xauusd volumes.

The term "leverage" indicates the borrowing capacity granted by your account, usually defined as a ratio. A leverage ratio of 100:1 means you can manage assets worth 100 times your deposited amount.

In the case of gold trading, a 1% margin in your trading account allows you to control a position valued at $100,000 with just a $1,000 deposit.

A margin account boosts both gains and risks in gold trading. You can't lose more than your deposit. Brokers close positions via margin call if they go too far. Keep your margin above the minimum. Follow equity rules and stay under 5:1 leverage.

More Help Guides and Online Classes:

- XAU/USD Trend Indicators Free XAU USD Indicators of Buy & Sell XAU USD Signals

- Scalp Gold Tips, Day Trade XAUUSD, Swing Trade, and Hold Positions

- What's the Difference between Sell Limit XAUUSD Order & Buy Stop XAU/USD Order?

- MT4 Draw Trend-line & Channel Tool

- How to Analyze/Interpret the Many XAUUSD Patterns which are Used in Gold Trading

- MT5 XAU USD Platform/Software Introduction