Morning Star Bearish Candle Pattern

Morning Star Candle Pattern

The Morning Star candlestick formation exhibits characteristics opposite to those of the Evening Star candle pattern.

The Morning Star candle pattern analysis details how to trade and interpret Morning Star candlestick formations.

Morning Star Candle Pattern

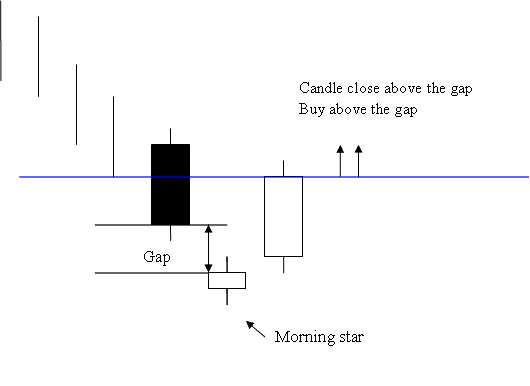

Morning star candles pattern is a 3 day bullish reversal pattern.

First day is a long black candlestick.

Second day is a morning star which gaps away from the long black candle-stick.

Third day is a long white candle that fills the market gap.

When the trading gap is filled and the white candle closes above that gap, it signals a strong bullish opportunity for XAUUSD gold trades.

Traders and investors are advised to open buy positions once market prices close above a gap setup formed by the Morning Star candlestick pattern. This acts as a confirmation signal for initiating a buy trade.

Study More Guides & Topics:

- Placing Pending XAU/USD Orders in MetaTrader 4 Software

- Utilizing Moving Averages for Both Short-Term and Long-Term XAUUSD Views

- Beginner's Guide to Gold Software

- Placing Fibonacci Lines On Gold Charts in MT4 Software

- Explanation of Gold Analysis

- Applying MACD Analysis for XAU/USD Buy and Sell Signals

- Examples of Upward and Downward Trendline Bounces Explained

- How to Put in MT5 OBV Tech Indicator on MT5 Gold Chart

- MT4 Margin Level: Explanation of How to Figure Out XAUUSD Leverage on MetaTrader 4 Software