Short Term MAs Strategies

Moving Averages Systems

For short-term gold trading, quick price periods such as the 10 and 20 moving average periods are utilized.

In the example below, we use the 10 and 20 Simple Moving Averages to spot signals. These help you catch the trend as early as possible.

Short-term Gold with MAs Moving Averages - How to Trade XAUUSD with MAs Example

Using Moving Averages

One of the most widely used methods of trading analysis that is used to analyze chart trends in scalping is the use of Moving Average.

The core intent of this moving average technical instrument is to improve the quality of trading analysis before executing a market entry signal. Setting short-term gold targets grounded in moving averages assists a scalper in discerning prevailing market trends, enabling them to place orders in alignment with that trend.

Many signals rely on a set time frame for the Moving Average indicator. The gold moving average decides if trades go short-term or long-term. Price above or below this MA shows the day's trend direction.

If much of the gold price sits below the moving average line, the daily trend points down. Traders treat the MA as support or resistance. They watch for price to touch it in line with the trend. That's when they enter a trade.

The gold trading moving averages are drawn and the intersection point with the price can be used to determine the appropriate entry & exit times in the market. Since there is always oscillation in price trends & the market will repeat this process of oscillating and bouncing off the Moving Average and this can be used to generate buy or sell trading signals.

The calculation of simple moving averages is based on examining the price over a designated time frame, utilizing enough data to derive the average. This method has provided gold trading scalpers with numerous insights regarding the optimal times to execute gold scalping trades.

Medium Term Strategy

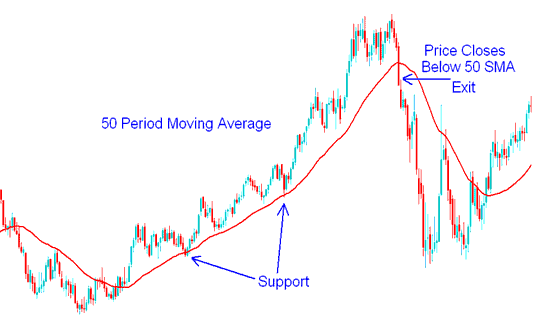

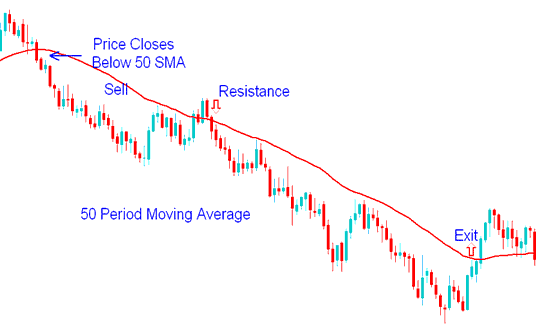

Medium term gold trading MA strategy will use the 50 period Moving Average.

The 50 period MA acts as support or resistance zone for the price.

In a rising market, the 50-period moving average serves as support. Prices usually rebound after hitting it. A close below this line signals an exit from the trade.

50 Moving Average Period Support - Trading Strategy Examples

In a downtrend, the 50-period MA acts as resistance. Price drops after hitting it. A close above signals an exit.

50 Moving Average Period Resistance - Strategies Examples

50 Day Moving Average(MA) Trade Analysis

As the market trend moves upward, there's a key line you want to watch - this is the 50 intraday trading Moving Average. If the market stays above this 50 day trading MA, that is a good trading signal. If the market drops below the 50 intra-day trading moving average in heavy volume, watch out, there could be trend reversal signal ahead.

A 50-day Moving Average (MA) indicator calculates the average of gold market data over ten weeks and updates daily. This trendline reveals whether the market is moving upward, downward, or sideways.

Buy only when prices sit above the 50-period moving average for intraday trades. This shows the trend points up. Trade along with it, never fight it. Most folks enter orders that match the trend.

Xauusd prices normally will find support over and over again at this 50 day trading Moving Average. Big and Large investment institutions watch and monitor this technical level closely. When these big volume entities spot a market trend moving down to its 50 day line, they see it as an opportunity, to add to their position, or begin a new trade at a reasonable level.

What does it mean when the price goes down and breaks through its 50-day average line? If it happens with a lot of trading, it's a strong signal to sell. This means big companies are selling their shares, which can cause a big drop, even if the company seems to be doing well. But, if the price only drops a little below the 50-day line with not much trading, watch what happens in the next few days and do what you need to do.

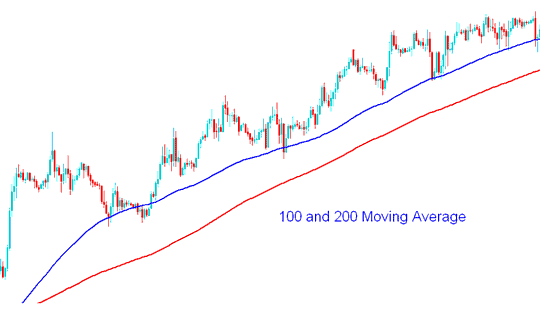

LongTerm Strategy

A strategy for the long run will use long periods like the 100 & 200 MAs, which act as support and resistance over time for the price. Because many traders use these 100 and 200 gold trading moving averages, the price often reacts to these support and resistance areas.

100 and 200 MAs - How to Trade Gold Using Moving Average Strategies

In XAUUSD, traders may use both basic and analysis to help figure out if gold is a smart thing to buy or sell.

Traders check gold's supply and demand with the 200-day moving average. They look at data in various ways.

Traders are generally most familiar with the fundamental technical assessment involving the 200-day Moving Average, which is employed to map out long-range support or resistance boundaries. If the price trades above the 200-day MA, the market exhibits a positive (bullish) trend: conversely, a price below indicates a negative (bearish) trend.

One way to see how much gold is being bought and sold is to figure out the average closing price over the last 200 trading days. This trading moving average(MA) takes into account each day in the past and shows you how this 200-day average has changed.

The rationale behind the significant popularity accorded to the 200-day Moving Average in analytical processes stems from its established historical efficacy, consistently yielding favorable outcomes in market trading. A widely adopted timing strategy involves entering a buy position when the market valuation resides above its 200-day moving average and executing a sell order when the valuation drops below it.

This moving average trading indicator alerts traders when the price breaks above or below its 200-day moving average, allowing them to use their technical analysis to determine whether the trading signal represents an opportunity to go long or short.

More Guides & Lessons:

- Explanation of NDD XAU/USD Accounts

- Shifting Your Psychological Mindset to Achieve Improved XAUUSD Trading Outcomes

- Getting going with XAUUSD using MetaTrader 4 Brokers and Learning XAUUSD Program

- How do I use the Bears Power indicator as a buy signal in forex trading?

- Steps for Setting Stop Loss and Take-Profit Orders for Gold Trades within the MT5 Software

- How to Trade a Double Tops Pattern in Gold Trading

- How do you tell when a new XAU/USD trend is kicking off?

- Online Brokers for Gold

- What Is Free Gold Margin in XAUUSD Trading?

- How to Use Candlestick Charts in the MT4 Platform