How Do I Trade a Double Top Chart Pattern?

To effectively analyze double tops chart patterns, a trader must first familiarize themselves with the specifics of double tops charts, as detailed below.

Double Top Setup

The double top pattern constitutes a reversal setup that typically manifests subsequent to a prolonged upward market movement.

As its name implies, this double tops setup formation is made up of two consecutive peaks on the trading chart which are roughly equal, with a moderate trough in between the two peaks.

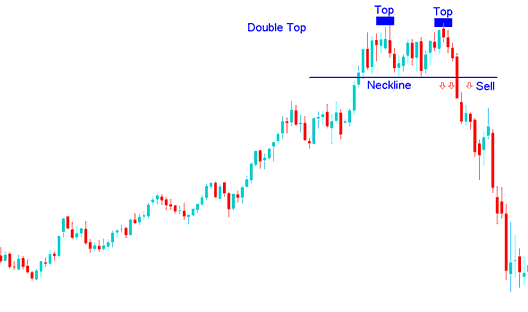

The double top pattern forms fully when gold price hits the second peak and breaks below the neckline. That line is the lowest point between the two highs.

The sell signal generated by this specific Double Top configuration materializes when the market breaks decisively below the established neckline.

In XAU USD, this double top configuration on the chart serves as an early indicator predicting a shift to a bullish trend.

However, double top chart pattern formation is only confirmed once the neck line is broken & the market moves below the neck line.

Neck Line is just another term for the last support level formed on the chart.

Summary:

- Double tops setup forms after an extended move upward - upward gold trend

- This double tops chart pattern signal indicates that there'll be a reversal in market trend

- We sell when price breaks-out below the neckline: as elaborated on the example illustration put to display and explained below.

Trade a Double Top Chart Pattern?

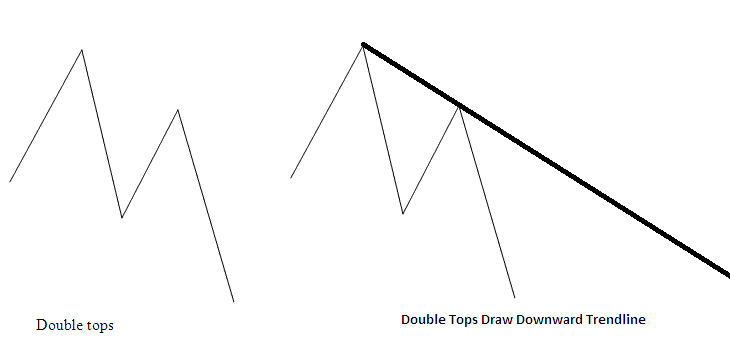

Double tops pattern formation look like an M-Shape pattern, the best reversal signal from the double tops setup is where the second top is lower and lesser than the first top just as is shown:

This configuration signifies that the potential reversal setup is validated by plotting a descending gold trendline, as depicted below. If a trader decides to enter a sell trade based on this double tops reversal formation, the stop-loss order should be positioned just above this downward trend-line.

Guide on Trading the Double Tops Formation - Techniques for Analyzing and Interpreting the Double Tops Pattern in Gold Market Trading

Explore Further Training & Subject Areas:

- How do I trade gold (XAU/USD) with both short-term and long-term moving average strategies?

- Principles of How Do I Draw Trend-lines?

- What Does a Mini XAU USD Account Mean for Trading XAU USD?

- How Do I Register Demo Account in MT4 Trade Platform?

- How to Execute Trades Following an Upward Gold Channel on the MetaTrader 5 System

- How Do I Trade Inverse Head and Shoulders XAUUSD?