Parabolic SAR Analysis & Parabolic SAR Signals

Created by J. Welles Wilder.

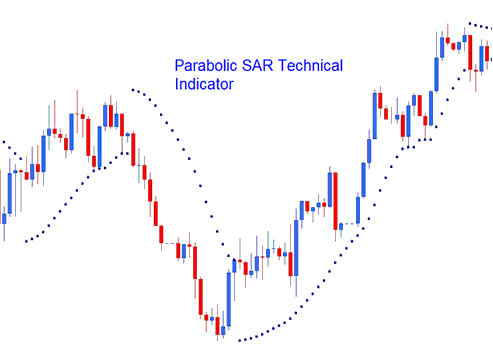

The Parabolic SAR (Stop and Reverse) is a technical indicator used for setting trailing stop losses. This indicator closely follows the price movements.

- In an Uptrend, the stop and reversal will trail below the market trading price

- In a downward trend, the stop and reversal will trail above market price

Analysis and Generating Trade Signals

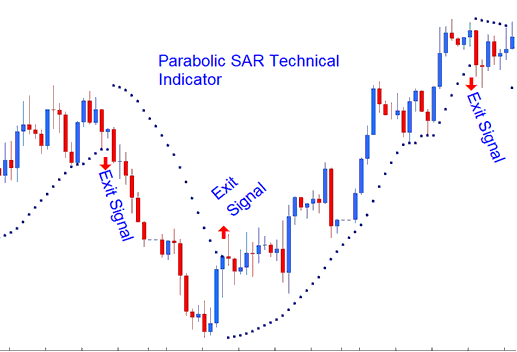

This indicator calculates and provides excellent exit points.

Exit Trading Signal for Buy trade transactions

Traders and Investors should close long trades when the price drops below the technical indicator.

If you're in a long trade and price stays above the stop and reversal, the SAR indicator moves up each day. It ignores price direction. The shift depends on pip moves. When SAR flips down, the trend turns bearish. That signals an exit from the long trade.

Exit Signal for Sell trades

Traders should exit any short positions if the price moves above the reading of this technical indicator.

If you are trading short, meaning the price is below the stop and reversal, the SAR will move downwards every day, no matter what direction the price is moving. How the technical indicator moves depends on how many pips the price changes. When Parabolic SAR switches directions, the price trend also switches to go up. This gives you the signal to close short trades.

Exit Trade Signal for Buy & Sell trades

Obtain Further Programs & Instructional Material:

- Download MetaTrader 5 Mobile App Android -Android MetaTrader 5 App Download

- Trade Fibonacci Extensions Indicator in MetaTrader 4

- Support & Resistance Levels in Gold Trading

- Learn XAU USD for Beginners Tutorial Lesson

- Three Steps To Help Improve Your Gold Results

- How to Set SL XAU/USD Order on MT4 Trade Platform

- Hull Moving Average XAU/USD Indicator

- How to Use TP XAU/USD Orders & Use Stop Loss XAU USD Order on MT4 Software Platform

- Choosing the Best XAU/USD Software to Master Precious Metals Trading

- Guidelines to Draw Fibonacci Pullback Indicator on Gold Charts