Relative Strength Index Gold Analysis and RSI Signals

Developed by J. Welles Wilder, as described in the book "New Concepts in Technical Systems."

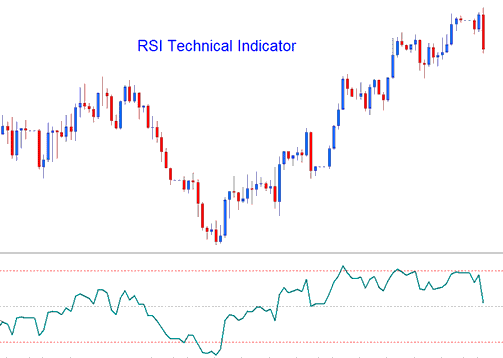

RSI is the most used trading tool, and it is a tool that measures momentum, and a good tool to follow trends. RSI looks at and figures out how big recent price gains are compared to how big recent price losses are, and puts this data on a scale from 0-100.

RSI shows how strong gold is moving: numbers over 50 mean it's going up, while numbers under 50 mean it's going down.

- RSI is drawn as a green-line

- Horizontal dashed lines are drawn to spotting overbought and over-sold levels are - 70/30 levels respectively.

Gold Analysis and How to Generate Signals

There are various methods used to trade, these are:

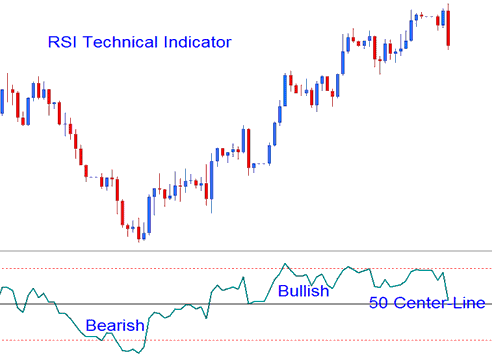

50-level Cross-over Signals

- Buy signal - when the technical indicator crosses above the 50 center line a buy/bullish trading signal is generated.

- Sell Trading Signal - when the technical indicator crosses below the 50 mark a sell/bearish signal is given.

RSI Setups

Traders have the ability to draw trendlines and identify chart patterns on the RSI indicator. Interestingly, the RSI can form patterns like the head and shoulders chart pattern, which may not be as apparent on the price chart itself.

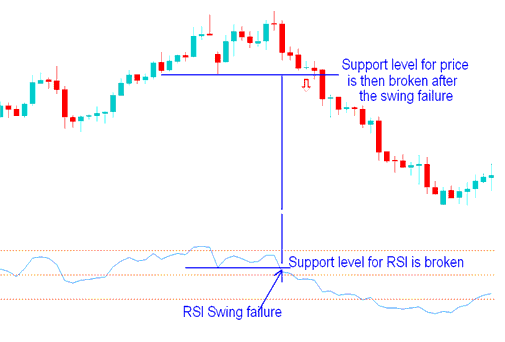

Gold Support/Resistance Break-outs

RSI functions as a leading indicator, capable of anticipating breakouts from Support and Resistance zones before the price actually breaches those boundaries. The RSI gauge employs the swing failure signal concept to forecast impending breaches of support or resistance areas.

Swing Failure - Support and Resistance Break Out

Over-bought/Oversold Conditions in Indicator

- Overbought levels above 80

- Oversold - levels below 20

These reference points can be utilized to generate Gold trading signals, such as initiating a buy when RSI reverses upward from below the 20 mark after an oversold condition, or selling when RSI crosses below 80 after registering overbought status. However, these specific signals are ill-suited for Gold due to their propensity to generate numerous false movements.

Divergence Setups

Divergence trading spots market trend reversals. This method uses four types of divergences. Check the site's tutorial for details on trading them with this indicator.

Get More Lessons & Guides:

- Purchasing and Selling Gold

- How to Load a XAU USD Template in MT4 Platform

- Principles of How Do I Draw XAU/USD Trend-lines?

- Trading with Candle Pattern Strategies: What You Need to Know

- Techniques for Forecasting Trend Reversals Based on XAU USD Candle Formations.

- Applying the 100.0% Fibonacci Expansion Level in Trading Decisions