Sell Stop Order Definition

A Sell Stop Order grants permission to sell gold once the price has successfully reached the predetermined sell stop price level.

A sell stop order is always positioned to trigger a sell trade execution at a price lying beneath the current market rate.

Sell Stop

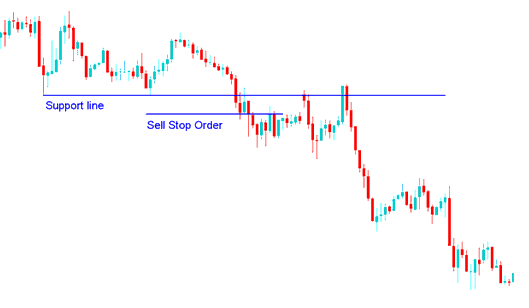

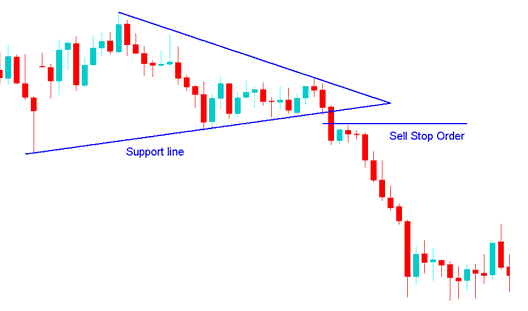

In the subsequent diagrams, a sell stop order was established to initiate a short trade at a price point below the prevailing market price.

The price subsequently declined to hit the sell stop order, later continuing its downward trajectory.

Placing a Sell Stop order beneath the established resistance zone - Clarification of a Sell Stop Order.

A sell stop order sets a pending sell below a consolidation pattern on the chart. As shown in the example, it triggers a sell if prices break down after consolidation. The order opens once the stop price is hit.

Setting a Sell Stop Order During a Price Breakout - Instructions for Placing a Sell Stop Order in Gold Trading.

A Sell trade was opened from the above pending sell stop when the price broke a support level in the first example and when there was a downwards price break-out after a consolidation chart setup on the second sell stop order illustrations.

Examine More Tutorials and Courses:

- How to Analyze/Interpret Ichimoku Indicator

- Can You Start XAU/USD with $5000 for Standard XAUUSD Trading Account?

- How Do I Sign Up XAU/USD Account with a MetaTrader 5 XAU USD Broker?

- Steps to Save a Workspace or Trading Strategy on the XAUUSD Platform

- XAUUSD Buy Long Trades vs XAU USD Sell Short Trades in Gold Charts

- Learn How to Generate Signals using XAUUSD Strategies

- Can You Start XAUUSD with $10 for Nano XAU/USD Account?

- How Can I Learn How to Set a Stop Loss Order in MT5 Platform?

- RSI XAU/USD Strategies for Beginners

- XAU/USD Psychology Principles of Market